National Grid 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

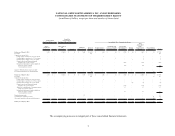

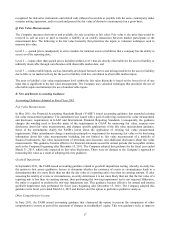

NATIONAL GRID NORTH AMERICA INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDER’S EQUITY

(in millions of dollars, except per share and number of shares data)

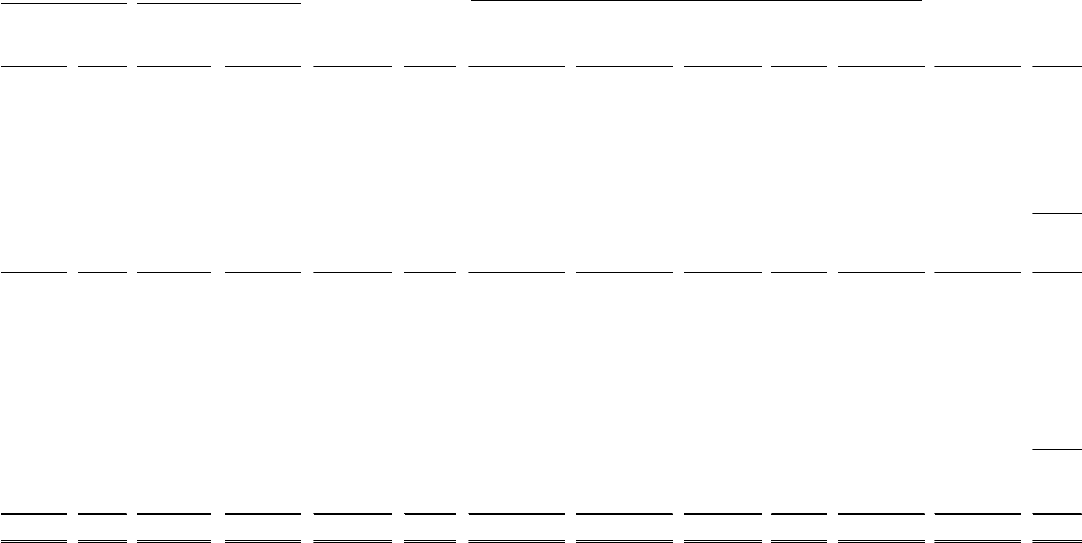

Shares

Issued an d

O u tsta ndi ng Amoun t

Shares Issu ed

an d

O u tsta ndi ng Amoun t

Additi onal

Paid-in C apital

Re tai ne d

Earni ngs

Fore i gn C urre n cy

Trans lation

Unreal iz e d Gain

(Los s) on Avai lable

fo r Sal e Se cu rit ie s

Pe nsion and

Po stre ti re me n t

Bene fi t Pl an s

He dgin g

Acti vity

Total

Accum ula te d

O th e r

C om pre he n si ve

Income

Non-con trol ling

in te re st Total

Balance as of March 31, 2011 1,353 -$ 372,638 35$ 7,098$ 1,422$ (141)$ (9)$ (702)$ (5)$ (857)$ 10$ 7,708$

Net income - - - - - 408 - - - - - - 408

Comprehensive income (loss):

Foreign currency translation, net of $1 t ax expense - - - - - - 1 - - - 1 - 1

Unrealized gains on securities, net of $1 tax expense - - - - - - - 6 - - 6 - 6

Unrealized gains on hedges, net of $3 t ax expense - - - - - - - - - 7 7 - 7

Changes in pension and other postretirement

obligations, net of $124 t ax benefit - - - - - - - - (186) - (186) - (186)

Reclassification adjustment for gains included in net

income, net of $23 t ax benefit - - - - - - - - (34) - (34) - (34)

Tot al comprehensive income 202

-

Issuance of Golden Shares (par value $1 per share) - - 3 - - - - - - - - - -

Net earnings att ributable t o non-controlling interest - - - - - (2) - - - - - (1) (3)

-

-

Balance as of March 31, 2012 1,353 -$ 372,641 35$ 7,098$ 1,828$ (140)$ (3)$ (922)$ 2$ (1,063)$ 9$ 7,907$

Net income - - - - - 464 - - - - - (1) 463

Comprehensive income (loss):

Foreign currency translation, net of $1 t ax benefit - - - - - - 1 - - - 1 - 1

Unrealized gains on securities, net of $0 tax expense - - - - - - - 1 - - 1 - 1

Unrealized losses on hedges, net of $1 tax benefit - - - - - - - - - (4) (4) - (4)

Changes in pension and other postretirement

obligations, net of $73 tax benefit - - - - - - - - (118) - (118) - (118)

Adjustment for establishment of Narragansett pension - - - - - - - - 91 - 91 - 91

tracker, net of $54 tax expense

Reclassification adjustment for gains included in net

income, net of $61 t ax expense - - - - - - - - 87 - 87 - 87

Tot al comprehensive income 521

-

Share based compensation - - - 63 - - - - - - - 63

Consolidation of variable interest ent ity - - - - - - - - - - 22 22

Other equity transactions with non-cont rolling interest - - - - - - - - - - - (4) (4)

-

-

Balance as of March 31, 2013 1,353 -$ 372,641 35$ 7,161$ 2,292$ (139)$ (2)$ (862)$ (2)$ (1,005)$ 26$ 8,509$

Par Valu e $0.10 pe r share Par Valu e $100 an d $50 pe r share

Cumul ati ve

C om mo n S to ck Pre fe rre d S tock

Accu mu lat ed O th e r C om pre he n sive In com e

The accompanying notes are an integral part of these consolidated financial statements.