National Grid 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

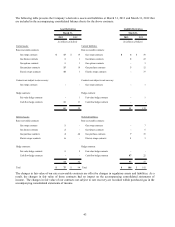

A transfer into Level 3 represents existing assets or liabilities that were previously categorized at a higher level for which

the inputs became unobservable. A transfer out of Level 3 represents assets and liabilities that were previously classified

as Level 3 for which the inputs became observable based on the criteria discussed previously for classification in

Level 2. These transfers, which are recognized at the end of each period, result from changes in the observability of

forward curves from the beginning to the end of each reporting period. There were no transfers between Level 1 and

Level 2 during the years ended March 31, 2013 and March 31, 2012, respectively.

Additional Information Regarding Level 3 Measurements

For valuations that include both observable and unobservable inputs, if the unobservable input is determined to be

significant to the overall inputs, the entire valuation is categorized in Level 3. This includes derivatives valued using

indicative price quotations whose contract tenure extends into unobservable periods. In instances where observable data

is unavailable, consideration is given to the assumptions that market participants would use in valuing the asset or

liability. This includes assumptions about market risks such as liquidity, volatility and contract duration. Such

instruments are categorized in Level 3 as the model inputs generally are not observable. The EPRMC approves risk

management policies and objectives for risk assessment, control and valuation, counterparty credit approval, and the

monitoring and reporting of risk exposures. The EPRMC is responsible for approving risk policies, transaction strategies,

and annual supply plans, as well as all valuation and control procedures. The EPRMC is chaired by the Global Tax and

Treasury Director and includes the Global Tax and Treasury Director, Senior Vice President (“SVP”) Regulatory

Affairs, SVP US General Counsel and Regulatory, and Vice President US Treasury. The EPRMC reports to the Finance

Committee. The forward curves used for financial reporting are developed and verified by the middle office. The

Company considers nonperformance risk and liquidity risk in the valuation of derivative contracts categorized in Level 2

and Level 3.

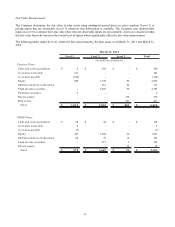

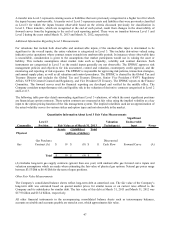

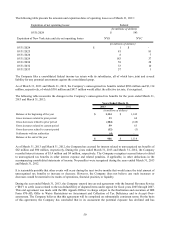

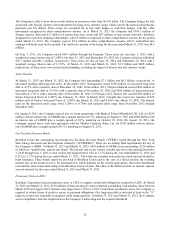

The following table provides detail surrounding significant Level 3 valuations, of which the most significant positions

are financial gas option contracts. These option contracts are measured at fair value using the implied volatility as a key

input to the option pricing function of the risk management system. The implied volatilities used are an approximation of

the actual volatility curves for various strikes and option types and not observable in the market.

Commodity

Level 3

Position

Valuation

Technique(s)

Significant

Unobservable

Input Range

Assets (Liabilities) Total

Physical

Gas

Gas Purchase

Contract (A) 19$ (8)$ 11$

Discounted

Cash Flow Forward Curve (A)

Total 19$ (8)$ 11$

Quantitative Information About Level 3 Fair Value Measurements

Fair Value as of March 31, 2013

(millions of dollars)

(A) Includes long-term gas supply contracts (greater than one year) with unobservable gas forward curve inputs and

valuation assumptions which are made when estimating the fair value of physical gas options. Natural gas prices range

between $3.53/Dth to $6.41/Dth for the term of open positions.

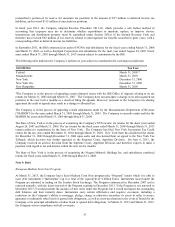

Other Fair Value Measurements

The Company’ s consolidated balance sheets reflect long-term debt at amortized cost. The fair value of the Company’ s

long-term debt was estimated based on quoted market prices for similar issues or on current rates offered to the

Company and its subsidiaries for similar debt. The fair value of this debt at March 31, 2013 and March 31, 2012 was

$17.9 billion and $15.4 billion, respectively.

All other financial instruments in the accompanying consolidated balance sheets such as intercompany balances,

accounts receivable and accounts payable are stated at cost, which approximates fair value.