National Grid 2013 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

actual revenues and the underlying cost being recovered, or differences between actual revenues and targeted amounts as

approved by the applicable state regulatory bodies.

Recovery of acquisition premium: This represents the unrecovered amount (plus related taxes) by which the purchase

price paid exceeded the net book value of Colonial Gas’ assets in the 1998 acquisition of Colonial Gas by Eastern

Enterprises, Inc. In exchange for certain rate concessions and the achievement of certain merger savings targets, the

DPU has allowed Colonial Gas to recover the acquisition premium through rates for the next 26 years (through August

2039).

Storm costs: This regulatory asset represents the incremental operation and maintenance costs to restore power to

customers resulting from major storms.

Carrying Charges

The Company records carrying charges on the regulatory balances related to rate adjustment mechanisms, storm costs,

gas costs, postretirement benefits, environmental costs and revenue decoupling for which cash expenditures have been

made and are subject to recovery or for which cash has been collected and is subject to refund. The regulatory items

above are not included in the utility rate base at the time the expenses are incurred or the revenue is billed. Carrying

charges are not recorded on items for which expenditures have not yet been made. The Company anticipates recovering

these costs in the rates concurrently with future cash expenditures. If recovery is not concurrent with the cash

expenditures, the Company will record the appropriate level of carrying charges. Carrying charges are not earned on

regulatory deferred tax assets, losses on reacquired debt, renewable energy credits, transmission service, acquisition

premium, derivative contracts and certain postretirement benefits and environmental costs.

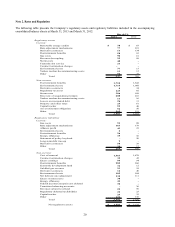

The following table presents the carrying charges that were recognized in the accompanying consolidated statements of

income during the years ended March 31, 2013 and March 31, 2012:

March 31,

2013 2012

(in millions of dollars)

Other interest income (expense), including affiliate interest 18$ (42)$

Other (deductions) income, net (9) 45

9$ 3$

Rate Matters

The Company’ s regulated subsidiaries are involved in numerous regulatory rate cases and proceedings as follows:

New England Power

The FERC enables transmission companies to recover their specific costs of providing transmission service.

Additionally, NEP has received authorization from the FERC to recover through CTCs, substantially all of the costs

associated with its former generating business not recovered through their divestiture. Therefore, substantially all of

NEP’ s business, including the recovery of its stranded costs, remains under cost-based rate regulation.

Under settlement agreements approved by state commissions and the FERC, NEP is permitted to recover costs

associated with its former generating investments (nuclear and nonnuclear) and related contractual commitments that

were not recovered through the sale of those investments (stranded costs). Stranded costs are recovered from NEP’ s

affiliated former wholesale customers with whom it has settlement agreements through a CTC. NEP’ s affiliated former

wholesale customers in turn recover the stranded cost charges through delivery charges to their distribution customers.

NEP earns a ROE of approximately 11% on stranded cost recovery. NEP will recover remaining stranded costs through

2020.

NEP is a Participating Transmission Owner (“PTO”) in the New England region operated by the Regional Transmission

Organization (“RTO”), ISO-NE, which commenced operations effective February 1, 2005. The ISO-NE has been

authorized by the FERC to exercise the operations and system planning functions required of RTOs and is the

independent regional transmission provider under the ISO-NE Open Access Transmission Tariff (“ISO-NE OATT”).