National Grid 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

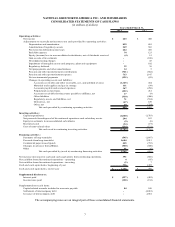

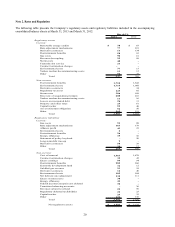

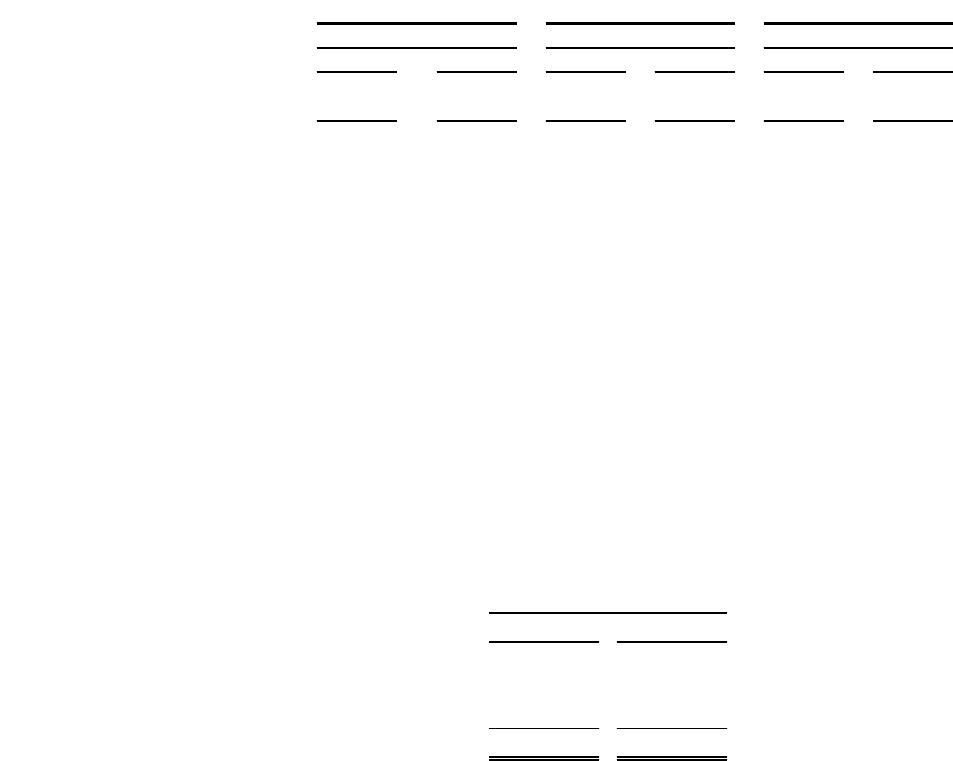

The average composite rates and average service lives for the years ended March 31, 2013 and March 31, 2012 are as

follows:

2013 2012 2013 2012 2013 2012

Composite rates - depreciation 2.1% 2.1% 2.2% 2.2% 2.1% 2.1%

Composite rates - cost of removal 0.5% 0.3% 0.9% 0.9% 0.1% 0.1%

Total composite rates 2.6% 2.4% 3.1% 3.1% 2.2% 2.2%

Average service lives 48 years 48 years 45 years 45 years 47 years 47 years

March 31, March 31, March 31,

Electric Gas Common

Depreciation expense for the Company’ s regulated subsidiaries includes estimated costs to remove property, plant and

equipment, which is recovered through rates charged to customers. At March 31, 2013 and March 31, 2012, the

Company had cumulative costs recovered in excess of costs incurred totaling $1.6 billion and $1.5 billion, respectively.

These amounts are reflected as regulatory liabilities in the accompanying consolidated balance sheets.

In accordance with applicable regulatory accounting guidance, the Company records AFUDC, which represents the

estimated debt and equity costs of capital funds necessary to finance the construction of new regulated facilities. The

equity component of AFUDC is a non-cash amount within the consolidated statements of income. AFUDC is capitalized

as a component of the cost of property, plant and equipment, with an offsetting credit to other income and deductions for

the equity component and other interest expense for the debt component in the accompanying consolidated statements of

income. After construction is completed, the Company’ s regulated entities are permitted to recover these costs through

inclusion in rate base and corresponding depreciation expense.

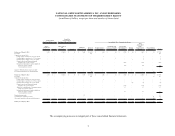

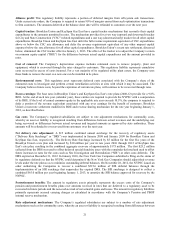

The components of AFUDC capitalized and composite AFUDC rates for the years ended March 31, 2013 and March 31,

2012 are as follows:

2013 2012

Debt 7$ 7$

Equity 21 22

28$ 29$

Composite AFUDC rate 4.1% 6.1%

March 31,

(in millions of dollars)

In addition, approximately $8 million of interest was capitalized for construction of non-regulated projects during fiscal

year 2013.

F. Goodwill and Other Intangible Assets

Goodwill

Goodwill represents the excess of the purchase price of a business over the fair value of the tangible and intangible assets

acquired, net of the fair value of liabilities assumed and the fair value of any non-controlling interest in the acquisition.

The Company tests goodwill for impairment annually on January 31, and whenever events occur or circumstances

change that would more likely than not reduce the fair value of the reporting unit below its carrying amount.

The goodwill impairment analysis is comprised of two steps. In the first step, the estimated fair value of the reporting

unit is compared with its carrying value. If the fair value exceeds the carrying value, goodwill is not impaired and no

further analysis is required. If the carrying value exceeds the fair value, then a second step is performed to determine the

implied fair value of goodwill. If the carrying value of goodwill exceeds its implied fair value, then an impairment

charge equal to the difference is recorded.