National Grid 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

to revise their draft request for proposal consistent with the DPU’ s order and re-file it within seven days. The

Massachusetts Gas Companies cannot predict the outcome of this proceeding.

Energy Efficiency

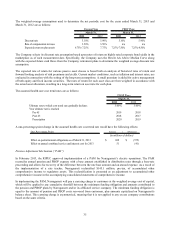

The Massachusetts Gas Companies operate a single combined Three-Year Energy Efficiency Plan. The recent plan

covering the period 2013 through 2015 was approved by the DPU on January 31, 2013 with a three-year budget of

$290.8 million ($94.2 million for 2013, $97.0 million for 2014, and $99.6 million for 2015). In addition, the

Massachusetts Gas Companies have the opportunity to recover a total performance incentive over the three-year plan of

approximately $8.3 million dollars with a fixed amount to be collected in the budget for each year of the plan. After the

conclusion of the plan, the Massachusetts Gas Companies will reconcile the energy efficiency surcharge amounts as well

as amount collected for the performance incentives.

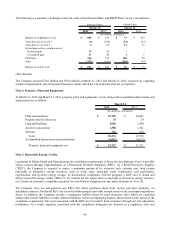

National Grid Generation

In January 2009, our indirectly-owned subsidiary, National Grid Generation filed an application with the FERC for a rate

increase of $92 million for the final five year rate term of the fifteen year contract under the PSA. In December 2009, the

FERC approved the proposed tariff rates, effective from February 1, 2009, subject to refund and the outcome of any

proceedings instituted by the FERC. In October 2009, LIPA and National Grid Generation filed a settlement with the

FERC for a revenue requirement of $436 million, an annual increase of approximately $66 million, a ROE of 10.75%

and a capital structure of 50% debt and 50% equity, which was approved by the FERC in January 2010. All outstanding

balances associated with the revenue increases were settled in March 2010.

On October 2, 2012, National Grid Generation announced it had reached an agreement with LIPA to amend and restate

the current PSA (the “A&R PSA”) upon expiration of the current agreement. Pursuant to the A&R PSA, LIPA will

continue to purchase all of the energy and capacity from the generating units designated in the PSA. The A&R PSA has a

term of fifteen years, expiring April 2028, provided LIPA has the option to terminate the agreement as early as April

2025 on two years advance notice. On May 23, 2013, the FERC accepted the PSA, and approved a revenue requirement

of $418.6 million, an annual decrease of $27.4 million, a ROE of 9.75% and a capital structure of 50% debt and 50%

equity. The PSA became effective as of May 28, 2013.

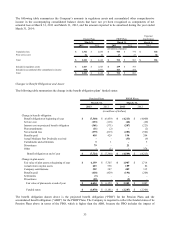

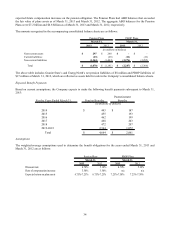

Note 3. Employee Benefits

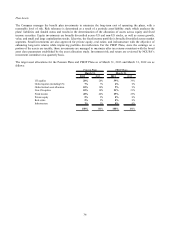

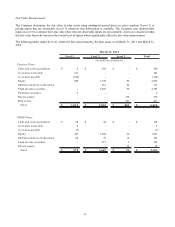

The Company sponsors numerous non-contributory defined benefit pension plans (the “Pension Plans”) and several

postretirement benefit other than pension plans (the “PBOP Plans”). In general, we calculate benefits under these plans

based on age, years of service and pay using March 31 as a measurement date. In addition, the Company also sponsors

defined contribution plans for eligible employees.

Pension Plans

The Pension Plans are comprised of both qualifying and non-qualifying plans. The qualified pension plans provide union

employees, as well as non-union employees hired before January 1, 2011, with a retirement benefit. Supplemental, non-

qualified, non-contributory executive retirement programs provide additional defined pension benefits for certain

executives. We fund the qualified plans by contributing at least the minimum amount required under IRS regulations.

The Company expects to contribute approximately $278 million to the Pension Plans during fiscal year 2014.

PBOP Plans

The PBOP Plans provide health care and life insurance coverage to eligible retired employees. Eligibility is based on age

and length of service requirements and, in most cases, retirees must contribute to the cost of their coverage. We fund

these plans based on the requirements of the various regulatory jurisdictions in which the Company operates. The

Company expects to contribute approximately $298 million to the PBOP Plans during fiscal year 2014.

Defined Contribution Plan

The Company also has several defined contribution pension plans (primarily 401(k) employee savings fund plans) that

cover substantially all employees. In addition, employees may receive certain employer contributions, including

matching contributions and a 15% discount on the purchase of National Grid plc common stock. Employer matching