National Grid 2013 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

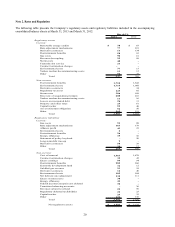

J. Restricted Cash and Special Deposits

Restricted cash primarily consists of deposits held by the New York Independent System Operator (“NYISO”) and the

ISO New England (“ISO-NE”). Special deposits primarily consist of health care claims deposits and are included within

prepaid and other current assets in the accompanying consolidated balance sheets.

K. Allowance for Doubtful Accounts

The Company recognizes an allowance for doubtful accounts to record accounts receivable at estimated net realizable

value. The allowance is calculated by applying a reserve factor to outstanding receivables. The reserve factor is based

upon historical write-off experience and assessment of customer collectability.

L. Materials, Supplies and Gas in Storage

Materials and supplies are stated at the lower of weighted average cost or market, and are expensed or capitalized into

specific capital additions as used. At March 31, 2013 and March 31, 2012, materials and supplies were $175 million and

$167 million, respectively. The Company’ s policy is to write-off obsolete inventory. There were no material write-offs

of obsolete inventory for the years ended March 31, 2013 or March 31, 2012.

Gas in storage is stated at weighted average cost, and is expensed when delivered to customers. Existing rate orders

allow the Company to pass through the cost of gas purchased directly to customers along with any applicable authorized

delivery surcharge adjustments. Accordingly, the value of gas in storage does not fall below the cost to the Company.

Gas costs passed through to customers are subject to regulatory approvals and are reported periodically to the state

regulatory authorities. At March 31, 2013 and March 31, 2012, gas in storage was $164 million and $292 million,

respectively.

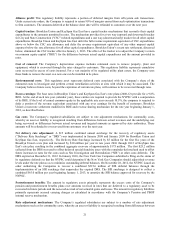

M. Income and Other Taxes

Federal and state income taxes have been computed utilizing the asset and liability approach that requires the recognition

of deferred tax assets and liabilities for the tax consequences of temporary differences by applying enacted statutory tax

rates applicable to future years to differences between the consolidated financial statement carrying amounts and the tax

basis of existing assets and liabilities. NGNA files consolidated federal tax returns including all of the activities of its

subsidiaries. Each subsidiary company is included in the consolidated group and determines its current and deferred

taxes based on the separate return method. Each included subsidiary settles its current tax liability or benefit each year

with NGNA pursuant to a tax sharing arrangement between NGNA and its included subsidiaries.

Deferred income taxes reflect the tax effect of net operating losses, capital losses and general business credit

carryforwards and the net tax effects of temporary differences between the carrying amounts of assets and liabilities for

consolidated financial statement and income tax purposes, as determined under enacted tax laws and rates. The financial

effect of changes in tax laws or rates is accounted for in the period of enactment. Deferred investment tax credits are

amortized over the useful life of the underlying property. Additionally, the Company follows the current accounting

guidance relating to uncertainty in income taxes which applies to all income tax positions reflected in the accompanying

consolidated balance sheets that have been included in previous tax returns or are expected to be included in future tax

returns. The accounting guidance for uncertainty in income taxes provides that the financial effects of a tax position shall

initially be recognized in the consolidated financial statements when it is more likely than not, based on the technical

merits, that the position will be sustained upon examination, assuming the position will be audited and the taxing

authority has full knowledge of all relevant information.

The state of New York imposes on corporations a franchise tax that is computed as the higher of a tax based on income

or a tax based on capital. To the extent the Company’ s New York state tax based on capital is in excess of the state tax

based on income, the Company reports such excess in other taxes and taxes accrued in the accompanying consolidated

financial statements.

The Company collects from customers various taxes that are levied by state and local governments on the sale or

distribution of gas. The Company presents taxes that are imposed on customers (such as sales taxes) on a net basis (i.e.,

excluded from revenues) and presents excise taxes on a gross basis.