National Grid 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

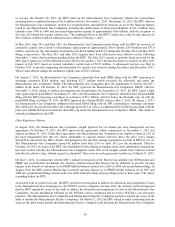

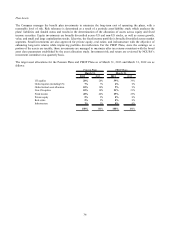

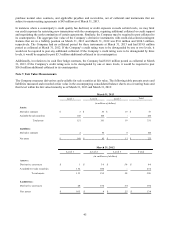

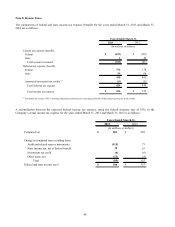

The following is a summary of changes in the fair value of the Pension Plans’ and PBOP Plans’ Level 3 investments:

2013 2012 2013 2012

Balance at beginning of year 804$ 874$ 73$ 103$

Transfers out of Level 3 (4) (338) (24) (55)

Transfers in to Level 3 665 27 11

Actual gain or loss on plan assets

Realized gain 17 29 --

Unrealized gain 37 20 11

Purchases 296 457 188 60

Sales (355) (303) (209) (47)

Balance at end of year 801$ 804$ 56$ 73$

(in millions of dollars)

Pension Plans PBOP Plans

March 31, March 31,

Other Benefits

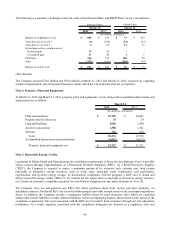

The Company accrued $74.6 million and $58.4 million at March 31, 2013 and March 31, 2012, respectively, regarding

workers compensation, auto and general insurance claims which have been incurred but not yet reported.

Note 4. Property, Plant and Equipment

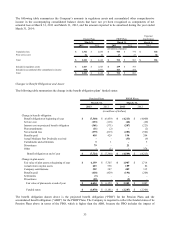

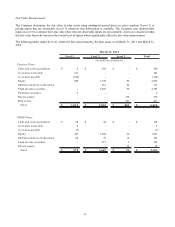

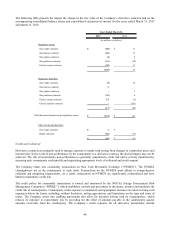

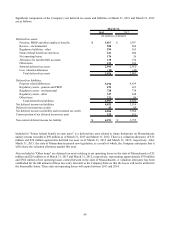

At March 31, 2013 and March 31, 2012, property, plant and equipment, at cost, along with accumulated depreciation and

amortization are as follows:

2013

2012

Plant and machinery 25,195$ 24,061$

Property held for future use

24

24

Land and buildings 2,030 1,980

Assets in construction 1,388 1,341

Software 736 552

Total 29,373 27,958

Accumulated depreciation and amortization

(6,851)

(6,637)

Property, plant and equipment, net 22,522$ 21,321$

March 31,

(in millions of dollars)

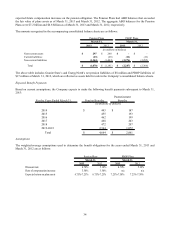

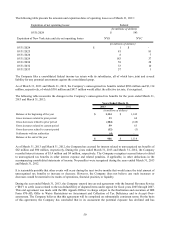

Note 5. Renewable Energy Credits

Legislation in Rhode Island and Massachusetts has established requirements to foster the development of new renewable

energy sources through implementation of a Renewable Portfolio Standard (“RPS”). As a Retail Electricity Supplier

(“RES”), the Company is required to source a minimum portion of its resources each calendar year from certain

renewable or alternative energy resources, such as wind, solar, municipal waste combustion, coal gasification,

cogeneration, and flywheel energy storage. To demonstrate compliance with the program, a RES can (1) obtain and

deliver renewable energy credits (“RECs”); (2) contract for the output from a renewable or alternative energy resource;

or (3) make an alternative compliance payment for each Mwh of obligation not met under alternatives (1) or (2).

The Company does not self-generate any RECs but rather purchases them from various providers primarily via

standalone contracts. Purchased RECs are recorded within prepaid and other current assets on the accompanying balance

sheets. In addition, the Company records a compliance liability based on retail electricity sales, which are classified

within other current liabilities or other deferred liabilities on the accompanying balance sheets based on the period of the

compliance requirement. Our costs associated with the RPS are recoverable from customers through our rate adjustment

mechanism. As a result, expenses associated with the compliance obligation are deferred as a regulatory asset and