National Grid 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

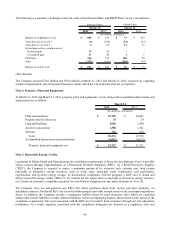

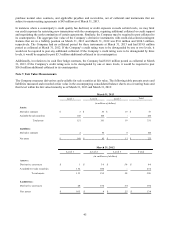

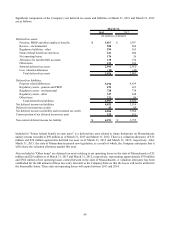

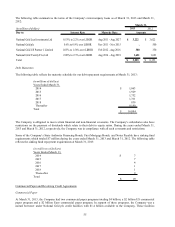

The following table presents the amounts and expiration dates of operating losses as of March 31, 2013:

Expiration of net operating losses: Federal

(in millions of dollars)

03/31/2024 $ 543

Expiration of New York state and city net operating losses NYS NYC

03/31/2024 $ 1 -$

03/31/2025 81 81

03/31/2028 8 7

03/31/2029 183 37

03/31/2030 58 28

03/31/2032 33 10

03/31/2033 57 1

(in millions of dollars)

The Company files a consolidated federal income tax return with its subsidiaries, all of which have joint and several

liability for any potential assessments against the consolidated group.

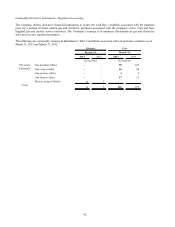

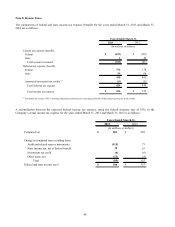

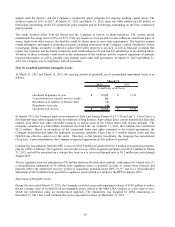

As of March 31, 2013 and March 31, 2012, the Company’ s unrecognized tax benefits totaled $986 million and $1,114

million, respectively, of which $310 million and $417 million would affect the effective tax rate, if recognized.

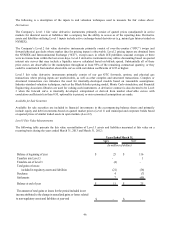

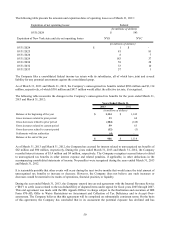

The following table reconciles the changes to the Company’ s unrecognized tax benefits for the years ended March 31,

2013 and March 31, 2012:

2013 2012

Balance at the beginning of the year 1,114$ 1,142$

Gross increases related to prior period 33 60

Gross decreases related to prior period (204) (148)

Gross increases related to current period 59 63

Gross decreases related to current period (12) (3)

Settlements with tax authorities (4) -

Balance at the end of the year 986$ 1,114$

Years Ended March 31,

(in millions of dollars)

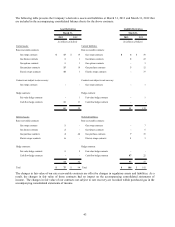

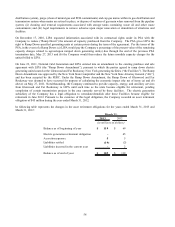

As of March 31, 2013 and March 31, 2012, the Company has accrued for interest related to unrecognized tax benefits of

$82 million and $90 million, respectively. During the years ended March 31, 2013 and March 31, 2012, the Company

recorded interest income of $5.4 million and $4 million, respectively. The Company recognizes accrued interest related

to unrecognized tax benefits in other interest expense and related penalties, if applicable, in other deductions in the

accompanying consolidated statements of income. No penalties were recognized during the years ended March 31, 2013

and March 31, 2012.

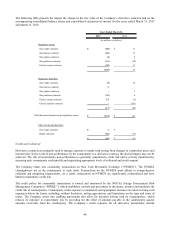

It is reasonably possible that other events will occur during the next twelve months that would cause the total amount of

unrecognized tax benefits to increase or decrease. However, the Company does not believe any such increases or

decreases would be material to its results of operations, financial position, or liquidity.

During the year ended March 31, 2013, the Company entered into an oral agreement with the Internal Revenue Service

(“IRS”) to settle issues related to the tax deductibility of disputed items under appeal for fiscal years 2005 through 2007.

This oral agreement was made with the IRS Appeals Officer in charge subject to the finalization and execution of IRS

Form 870-AD, Offer to Waive Restrictions on Assessment and Collection of Tax Deficiency and to Accept Over-

assessment. The Company believes that this agreement will be completed on substantially consistent terms. On the basis

of this agreement, the Company has concluded that in its assessment the potential exposure has declined and has