National Grid 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

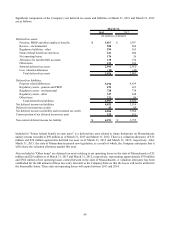

reclassified a portion of its reserve for uncertain tax positions in the amount of $37 million to deferred income tax

liabilities, and reversed $115 million of uncertain tax positions.

In fiscal year 2012, the Company adopted Revenue Procedure 2011-43, which provides a safe harbor method of

accounting that taxpayers may use to determine whether expenditures to maintain, replace, or improve electric

transmission and distribution property must be capitalized under Section 263(a) of the Internal Revenue Code and

therefore has reversed $92 million of tax reserves related to unrecognized tax benefits recorded in prior years, with a

corresponding offset in deferred income tax liabilities.

In September 2011, the IRS commenced an audit of NGNA and subsidiaries for the fiscal years ending March 31, 2008

and March 31, 2009, as well as KeySpan Corporation and subsidiaries for the short year ended August 24, 2007. Fiscal

years ended March 31, 2010 through March 31, 2013 remain subject to examination by the IRS.

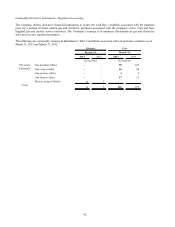

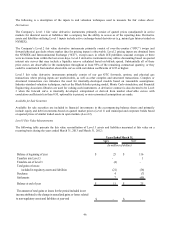

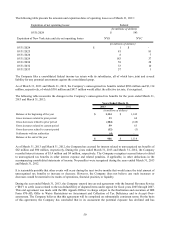

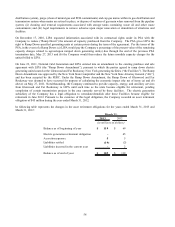

The following table indicates the Company’ s earliest tax year subject to examination for each major jurisdiction:

Jurisdiction Tax Year

Federal

March 31, 2005 *

Massachusetts

March 31, 2010

New York

December 31, 2000

New York City

December 31, 2000

New Hampshire March 31, 2009

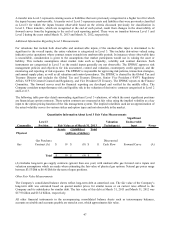

*The Company is in the process of appealing certain disputed issues with the IRS Office of Appeals relating to its tax

returns for March 31, 2005 through March 31, 2007. The Company does not anticipate a change in its unrecognized tax

positions in the next twelve months as a result of filing the appeals. However, pursuant to the Company's tax sharing

agreement the audit or appeals may result in a change to allocated tax.

The Company is in the process of appealing certain adjustments made by the Massachusetts Department of Revenue

("MADOR") for the years ended March 31, 2003 through March 31, 2005. The Company is currently under audit by the

MADOR for years ended March 31, 2006 through March 31, 2008.

The State of New York is in the process of examining the Company's NYS income tax returns for the short years ended

August 24, 2007 and March 31, 2008. The tax returns for the fiscal years ended March 31, 2009 through March 31, 2013

remain subject to examination by the State of New York. The Company has filed New York Investment Tax Credit

claims for the tax years ended December 31, 2002 through March 31, 2010. New York State has disallowed the claims

for December 31, 2002 through December 31, 2006 upon audit, and also denied them on appeal to the New York Tax

Tribunal, which decision was further appealed to the Supreme Court, Appellate Division. On June 6, 2013, the

Company received an adverse decision from the Supreme Court, Appellate Division, and therefore expects to make a

payment with regard to tax and interest within the next twelve months.

The State of New York is in the process of examining the Niagara Mohawk Holdings Inc. and subsidiaries combined

returns for fiscal years ended March 31, 2006 through March 31, 2008.

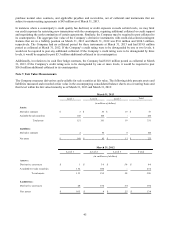

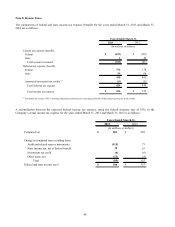

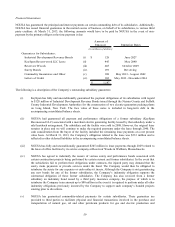

Note 9. Debt

European Medium Term Note Program

At March 31, 2013, the Company had a Euro Medium Term Note program (the “Program”) under which it is able to

issue debt instruments (“Instruments”) up to a total of the equivalent of 4 billion Euros. Instruments issued under the

Program are admitted to trading on the London Stock Exchange. The Program commenced in December 2007 and is

renewed annually, with the latest renewal of the Program expiring in December 2013. If the Program is not renewed in

December 2013, it would preclude the issuance of new notes under this Program, but it would not impact the outstanding

debt balances and their maturity dates. Instruments carry certain affirmative and negative covenants, including a

restriction on the Company’ s ability to mortgage, pledge, charge or otherwise encumber its assets in order to secure,

guarantee or indemnify other listed or quoted debt obligations, as well as cross-acceleration in the event of breach by the

Company or its principal subsidiaries of other listed or quoted debt obligations. At March 31, 2013 and March 31, 2012,

the Company was in compliance with all covenants.