National Grid 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

National Grid North America Inc. and Subsidiaries

(formerly National Grid Holdings Inc.)

Consolidated Financial Statements

For the years ended March 31, 2013 and March 31, 2012

Table of contents

-

Page 1

National Grid North America Inc. and Subsidiaries (formerly National Grid Holdings Inc.) Consolidated Financial Statements For the years ended March 31, 2013 and March 31, 2012 -

Page 2

NATIONAL GRID NORTH AMERICA INC. AND SUBSIDIARIES TABLE OF CONTENTS Independent Auditor's Report ...Consolidated Balance Sheets...March 31, 2013 and March 31, 2012 Consolidated Statements of Income...Years Ended March 31, 2013 and March 31, 2012 Consolidated Statements of Comprehensive Income...... -

Page 3

..., the financial position of National Grid North America Inc. and Subsidiaries at March 31, 2013 and March 31, 2012, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. October 30... -

Page 4

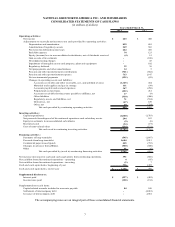

NATIONAL GRID NORTH AMERICA INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions of dollars) March 31, 2013 2012 ASSETS Current assets: Cash and cash equivalents Restricted cash Accounts receivable Allowance for doubtful accounts Other receivable Accounts receivable from affiliates ... -

Page 5

NATIONAL GRID NORTH AMERICA INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in millions of dollars) March 31, 2013 2012 LIABILITIES AND CAPITALIZATION Current liabilities: Accounts payable Accounts payable to affiliates Commercial paper Other tax liabilities Current portion of long-term debt ... -

Page 6

NATIONAL GRID NORTH AMERICA INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (in millions of dollars) Years Ended March 31, 2012 2013 Operating revenues: Electric services Gas distribution Other Total operating revenues Operating expenses: Purchased electricity Purchased gas Contract ... -

Page 7

NATIONAL GRID NORTH AMERICA INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions of dollars) Years Ended March 31, 2012 2013 Net income Other comprehensive income (loss): Foreign currency translation, net of $1 tax expense Unrealized gains on securities, net of $0 and... -

Page 8

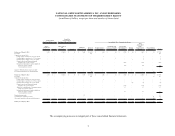

... income taxes Bad debt expense Equity (income) loss in unconsolidated subsidiaries, net of dividends received Gain on sale of investments Decommissioning charges Impairment of intangible assets and property, plant and equipment Regulatory deferrals Net prepayments and other amortizations Pension and... -

Page 9

... Electric Facility Revenue Bonds First M ortgage Bonds State Authority Financing Bonds Industrial Development Revenue Bonds Intercompany Notes Total debt Other Current maturities Total long-term debt Total capitalization Interest Rate Variable $ 8,483 26 $ 7,898 9 Maturity Date December 2013... -

Page 10

... and other postretirement obligations, net of $73 tax benefit Adjustment for establishment of Narragansett pension tracker, net of $54 tax expense Reclassification adjustment for gains included in net income, net of $61 tax expense Total comprehensive income Share based compensation Consolidation of... -

Page 11

... Mohawk Power Corporation ("Niagara Mohawk"), National Grid Generation, LLC ("National Grid Generation"), The Brooklyn Union Gas Company ("Brooklyn Union"), and KeySpan Gas East Corporation ("KeySpan Gas East"). On July 3, 2012, our previous subsidiaries, Granite State Electric Company ("Granite... -

Page 12

... ("FERC"), the New York State Public Service Commission ("NYPSC"), the Massachusetts Department of Public Utilities ("DPU"), and the Rhode Island Public Utilities Commission ("RIPUC") provide the final determination of the rates that the Company' s regulated subsidiaries charge their customers... -

Page 13

...utility tariffs. The CGAF provision requires an annual reconciliation of recoverable gas costs and revenues. Any difference is deferred pending recovery from or refund to customers. Narragansett, Massachusetts Electric, Nantucket, Boston Gas, Colonial Gas, Niagara Mohawk, Brooklyn Union, and KeySpan... -

Page 14

... 2012 are as follows: Electric Gas Common March 31, March 31, March 31, 2013 2012 2013 2012 2013 2012 Composite rates - depreciation 2.1% 2.1% 2.2% 2.2% 2.1% 2.1% Composite rates - cost of removal 0.5% 0.3% 0.9% 0.9% 0.1% 0.1% Total composite rates 2.6% 2.4% 3.1% 3.1% 2.2% 2.2% Average service lives... -

Page 15

... utilizing the market approach, the Company followed a market comparable methodology. Specifically, the Company applied a valuation multiple of earnings before interest, taxes, depreciation and amortization ("EBITDA"), derived from data of publicly-traded benchmark companies, to business operating... -

Page 16

...March 31, 2013 or March 31, 2012. Gas in storage is stated at weighted average cost, and is expensed when delivered to customers. Existing rate orders allow the Company to pass through the cost of gas purchased directly to customers along with any applicable authorized delivery surcharge adjustments... -

Page 17

... value from the price of an underlying item such as interest rates, foreign exchange, credit spreads, commodities, equity or other indices. Derivatives enable their users to manage their exposure to these markets or credit risks. The Company uses derivative instruments to manage operational market... -

Page 18

... There were no changes to the Company' s approach to measuring fair value as a result of adopting this new guidance. Goodwill Impairment In September 2011, the FASB issued accounting guidance related to goodwill impairment testing, whereby an entity has the option to first assess qualitative factors... -

Page 19

... Company adopted this guidance for the fiscal year ended March 31, 2013, with no impact on its consolidated financial position, results of operations, or cash flows. Accounting Guidance Not Yet Adopted Offsetting Assets and Liabilities In December 2011, the FASB issued accounting guidance requiring... -

Page 20

...Revisions and Reclassifications During 2013, management determined that the Company' s previously issued financial statements for the year ended March 31, 2012 included an error relating to the classification of the gain on sale of its previous subsidiary, Seneca. The error consisted of an incorrect... -

Page 21

... at March 31, 2013 and March 31, 2012: March 31, 2013 Regulatory assets Current: Renewable energy credits Rate adjustment mechanisms Derivative contracts Pos tretirement benefits Gas costs Revenue decoupling Storm cos ts Transmission service Contract termination charges Environmental cos ts Yankee... -

Page 22

... Companies submitted a filing on the status of its regulatory deferrals so that the NYPSC could determine if the New York Gas Companies should adjust their revenue levels under the rate plan so as to minimize outstanding deferral balances. On November 28, 2012, the NYPSC issued an order authorizing... -

Page 23

... actual revenues and targeted amounts as approved by the applicable state regulatory bodies. Recovery of acquisition premium: This represents the unrecovered amount (plus related taxes) by which the purchase price paid exceeded the net book value of Colonial Gas' assets in the 1998 acquisition of... -

Page 24

... agreement was filed December 7, 2012 and Niagara Mohawk received a final order from the NYPSC in these proceedings in March 2013. The term of the new rate plan is from April 1, 2013 through March 31, 2016. The joint proposal provides for an increase in the electric revenue requirement of $43... -

Page 25

...2013, the NYPSC initiated a focused operations audit of the investor owned New York utilities, including Niagara Mohawk, KeySpan Gas East Corporation and The Brooklyn Union Gas Company. The purpose of the audit is to review the accuracy of electric interruption, gas safety, and customer service data... -

Page 26

... by the DPU. The DPU approved a revenue decoupling mechanism ("RDM") arising from the Massachusetts Electric Companies' 2009 distribution rate case. In connection with the Massachusetts Electric Companies' first RDM filing made in November 2010 and supplemented in February 2011, the DPU opened... -

Page 27

... DPU has issued final orders approving recovery for each of the sites. In May 2010, the Massachusetts Electric Companies announced that they entered into a 15-year power purchase agreement with Cape Wind Associates, LLC to purchase half of the energy, capacity and renewable energy credits generated... -

Page 28

... tax adjustment mechanism. New rates resulting from the approved settlement went into effect for both the electric and gas business on February 1, 2013. In May 2010, Rhode Island enacted a decoupling law that provides for the annual reconciliation of the revenue requirement allowed in Narragansett... -

Page 29

...20, 2013. The Company will file its 2014 annual program plan on November 1, 2013. Brooklyn Union and KeySpan Gas East (the "New York Gas Companies") Rate Matters The New York Gas Companies are subject to a rate plan with a primary term of five years (through December 31, 2012) that remains in effect... -

Page 30

... to Brooklyn Union' s SIR balance for the benefit of customers. Carrying Charges During fiscal year 2013, the New York Gas Companies received an order from the NYPSC relating to SIR, requiring that carrying charges on SIR related balances be calculated net of deferred taxes. As a result, management... -

Page 31

...as of March 31, 2013. On June 1, 2011, in conjunction with the DPU' s annual investigation of the Boston Gas calendar year 2009 pension and PBOP rate reconciliation mechanism, the Attorney General argued that Boston Gas be obligated to provide carrying charges to the benefit of customers on its PBOP... -

Page 32

...the FERC approved the proposed tariff rates, effective from February 1, 2009, subject to refund and the outcome of any proceedings instituted by the FERC. In October 2009, LIPA and National Grid Generation filed a settlement with the FERC for a revenue requirement of $436 million, an annual increase... -

Page 33

...Income The following table summarizes the Company' s Pension Plans and PBOP Plans costs during the years ended March 31, 2013 and March 31, 2012: Pension Plans March 31, 2012 2013 Service cost, benefits earned during the year Interest cost Expected return on plan assets Net amortization and deferral... -

Page 34

... Divestitures Other Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Company contributions Benefits paid Settlements Divestitures Fair value of plan assets at end of year Funded status 2012 2013 (in millions... -

Page 35

...: Pension Plans March 31, 2013 2012 4.70% 5.10% 3.50% 3.50% 6.75%-7.25% 6.75%-7.25% PBOP Plans March 31, 2013 4.70% n/a 7.25%-7.50% 2012 5.10% n/a 7.25%-7.50% $ 443 455 462 468 472 2,364 4,664 $ 187 193 199 203 207 1,072 2,061 $ $ Discount rate Rate of compensation increase Expected return on... -

Page 36

... contributed to the pension and PBOP plans by Narragansett and/or its affiliated service company. The minimum funding obligation is equal to the amount of pension and PBOP costs recovered from customers, plus amounts capitalized on Narragansett's balance sheet. This carrying charge is asymmetrical... -

Page 37

Plan Assets The Company manages the benefit plan investments to minimize the long-term cost of operating the plans, with a reasonable level of risk. Risk tolerance is determined as a result of a periodic asset/liability study which analyzes the plans' liabilities and funded status and results in the... -

Page 38

... measurement. The following tables depict by level, within the fair value hierarchy, the plan assets as of March 31, 2013 and March 31, 2012: March 3 1 , 2 0 13 Level 1 Pensio n Plan s: Cas h and cas h eq uiv alents A cco u nts receivable A cco u nts p ay ab le Eq u ity Glo b al tactical as s et... -

Page 39

... and foreign markets plus investments in commingled funds, which are valued on a daily basis. The Company can exchange shares of the publicly traded securities and the fair values are primarily sourced from the closing prices on stock exchanges where there is active trading, in which case they are... -

Page 40

... inputs and often require significant management judgment or estimation based on the best available information. Market data includes observations of the trading multiples of public companies considered comparable to the private companies being valued. As a result, the Company classifies these... -

Page 41

... renewable energy credits ("RECs"); (2) contract for the output from a renewable or alternative energy resource; or (3) make an alternative compliance payment for each Mwh of obligation not met under alternatives (1) or (2). The Company does not self-generate any RECs but rather purchases them... -

Page 42

... March 31, 2013 and March 31, 2012, respectively. Note 6. Derivatives In the normal course of business, the Company enters into derivative instruments, such as swaps and physical contracts that are principally used to manage commodity prices associated with natural gas distribution operations. These... -

Page 43

... with the purchase price for a portion of future natural gas and electricity purchases associated with the Company' s New York and New England gas and electric service territories. The Company' s strategy is to minimize fluctuations in gas and electricity sales prices to our regulated customers. The... -

Page 44

... for the above contracts: Asset Derivatives March 31, 2013 2012 2013 Liability Derivatives March 31, 2012 (in millions of dollars) Current assets: Rate recoverable contracts: Gas swaps contracts Gas futures contracts Gas options contracts Gas purchase contracts Electric swaps contracts $ 15 1 1 15... -

Page 45

... and credit support. The Company enters into commodity transactions on New York Mercantile Exchange ("NYMEX"). The NYMEX clearinghouses act as the counterparty to each trade. Transactions on the NYMEX must adhere to comprehensive collateral and margining requirements. As a result, transactions... -

Page 46

... agreements. Similarly, the Company may be required to post collateral to its counterparties. The aggregate fair value of the Company' s derivative instruments with credit-risk-related contingent features that are in a liability position on March 31, 2013 and March 31, 2012 was $5.0 million and... -

Page 47

... liabilities utilizing Level 1 inputs include active exchange-based derivatives (e.g. natural gas futures traded on NYMEX). The Company' s Level 2 fair value derivative instruments primarily consist of over-the-counter ("OTC") swaps and forward physical gas deals where market data for pricing inputs... -

Page 48

...term of open positions. Other Fair Value Measurements The Company' s consolidated balance sheets reflect long-term debt at amortized cost. The fair value of the Company' s long-term debt was estimated based on quoted market prices for similar issues or on current rates offered to the Company and its... -

Page 49

... Years Ended March 31, 2012 2013 (in millions of dollars) $ 201 Computed tax Change in computed taxes resulting from: Audit and related reserve movements State income tax, net of federal benefit Investment tax credit Other items, net Total Federal and state income taxes $ 230 $ (115) 39 (6) (13... -

Page 50

... 31, 2012, respectively. After March 31, 2013, the state of Massachusetts passed new legislation, as a result of which, the Company anticipates that it will release the valuation allowance against this asset. Also included in "Other items" are deferred tax assets relating to net operating losses in... -

Page 51

... Company does not believe any such increases or decreases would be material to its results of operations, financial position, or liquidity. During the year ended March 31, 2013, the Company entered into an oral agreement with the Internal Revenue Service ("IRS") to settle issues related to the tax... -

Page 52

... tax returns for the fiscal years ended March 31, 2009 through March 31, 2013 remain subject to examination by the State of New York. The Company has filed New York Investment Tax Credit claims for the tax years ended December 31, 2002 through March 31, 2010. New York State has disallowed the claims... -

Page 53

... Revenue Bonds Brooklyn Union has outstanding tax-exempt Gas Facilities Revenue Bonds ("GFRB") issued through the New York State Energy Research and Development Authority ("NYSERDA"). There are no sinking fund requirements for any of the Company' s GFRB. At March 31, 2013 and March 31, 2012... -

Page 54

... 31, 2013, the Company had $52 million of tax exempt Electric Revenue Bonds in commercial paper mode with varying maturity dates from 2016 through 2042 and variable interest rates ranging from 0.38% to 0.55% during the year ended March 31, 2013. The bonds were issued by the Massachusetts Development... -

Page 55

... of tax-exempt bonds with a 5.25% coupon maturing in June 2027, $53 million of these Industrial Development Revenue Bonds were issued on its behalf through the Nassau County Industrial Development Authority for the construction of the Glenwood Energy Center, an electric-generation peaking plant, and... -

Page 56

... Agreements Commercial Paper At March 31, 2013, the Company had two commercial paper programs totaling $4 billion; a $2 billion US commercial paper program and a $2 billion Euro commercial paper program. In support of these programs, the Company was a named borrower under National Grid plc credit... -

Page 57

... to Granite State Regulatory recovery Goodwill, end of year $ 7,133 20 (1) (1) 7,151 $ 7,133 7,133 $ $ In January 2013, the Company made an investment in Clean Line Energy Partners LLC ("Clean Line"). Clean Line is a development-stage entity engaged in the development of long distance, high... -

Page 58

... Energy Purchase and Capital Expenditure Commitments The Company' s electric subsidiaries have several long-term contracts for the purchase of electric power. Substantially all of these contracts require power to be delivered before the subsidiaries are obligated to make payment. The Company' s gas... -

Page 59

... capacity charges for the unit(s) billed to LIPA. On June 23, 2011, National Grid Generation and LIPA entered into an amendment to the existing purchase and sale agreement with LIPA (the "Ramp Down Amendment"), pursuant to which the parties agreed to ramp down electric generating units located at... -

Page 60

... guaranteed the payment obligations of its subsidiaries with regard to $128 million of Industrial Development Revenue Bonds issued through the Nassau County and Suffolk County Industrial Development Authorities for the construction of two electric-generation peaking plants on Long Island, New York... -

Page 61

... March 31, 2012, Brooklyn Union received new information concerning the proposed remediation plans for a site in downstate New York which resulted in Brooklyn Union increasing its environmental reserve by approximately $107 million. During the year ended March 31, 2013, Brooklyn Union increased its... -

Page 62

... waste products which may pose a risk to human health and the environment. Since July 12, 2006, several lawsuits have been filed which allege damages resulting from contamination associated with the historic operations of a former manufactured gas plant located in Bay Shore, New York. KeySpan has... -

Page 63

... of the fuel supply for our Long Island generating facilities, pursuant to the EMA, which was renewed on May 28, 2013. KeySpan' s compensation for managing the electric transmission and distribution system owned by LIPA under the MSA consists of two components: a minimum fixed compensation component... -

Page 64

...-line basis over the 24-month term, from June 2011 through May 2013, as a reduction in operating revenues. Pursuant to the EMA, KeySpan procures and manages fuel supplies for LIPA to fuel KeySpan' s Long Island based generating facilities. In exchange for these services, KeySpan earns an annual... -

Page 65

... at March 31, 2013 in the amount of $67 million relating to claims filed against property damage and business interruption insurance policies, net of insurance deductibles. Total costs from SuperStorm Sandy associated with electricity customers' service restoration charged to LIPA through March 31... -

Page 66

... hold the Golden Share subject to a Services and Indemnity Agreement requiring GSS to vote the Golden Share in the best interests of New York State. On July 8, 2011, the Company issued a total of 3 Golden Shares pertaining to Niagara Mohawk, Brooklyn Union, and KeySpan Gas East each with a par value... -

Page 67

... the stock based compensation expense recognized by the Company for the years ended March 31, 2013 and March 31, 2012: Weighted Average Grant Date Fair Value $ 45.42 53.92 42.19 51.26 42.19 45.53 48.29 42.97 $ 40.36 Nonvested as of March 31, 2011 Vested Granted Forfeited/Cancelled Nonvested... -

Page 68

... Liberty Energy purchased all of the common stock of Granite State and EnergyNorth. The sale of Granite State and EnergyNorth was consummated on July 3, 2012 for proceeds of $294 million. On September 23, 2011, National Grid Development Holdings Corp., a wholly-owned subsidiary of KeySpan, entered...