Lumber Liquidators 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

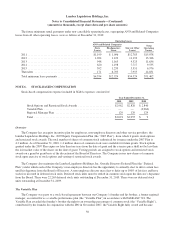

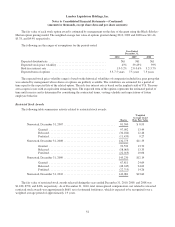

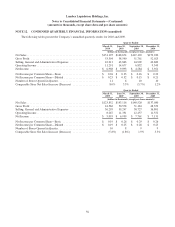

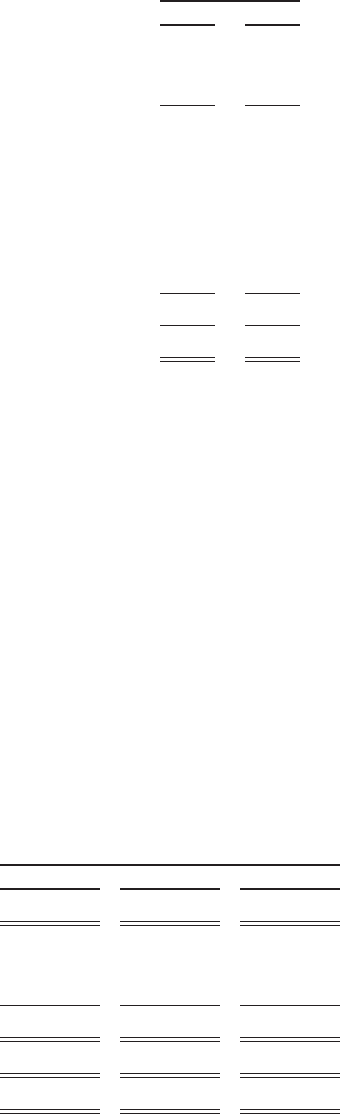

The tax effects of temporary differences that result in significant portions of the deferred tax accounts are as follows:

December 31,

2010 2009

Deferred Tax Liabilities:

Prepaid Expenses ......................................................... $ 271 $ 209

Depreciation and Amortization .............................................. 6,943 2,146

Total Deferred Tax Liabilities ................................................... 7,214 2,355

Deferred Tax Assets:

Stock-Based Compensation Expense .......................................... 3,341 3,274

Reserves ................................................................ 2,032 1,864

Employee Benefits ........................................................ 316 1,176

Inventory Capitalization .................................................... 1,435 1,402

Other ................................................................... 97 49

Total Deferred Tax Assets ...................................................... 7,221 7,765

Net Deferred Tax Asset ........................................................ $ 7 $5,410

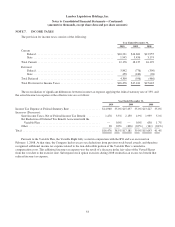

The Company made income tax payments of $14,282, $15,273, and $15,112 in 2010, 2009, and 2008, respectively.

The Company files income tax returns with the U.S. federal government and various state jurisdictions. In the normal

course of business, the Company is subject to examination by federal and state taxing authorities. The Internal Revenue

Service has completed audits of the Company’s federal income tax returns for the years through 2007.

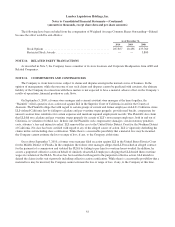

NOTE 8. PROFIT SHARING PLAN

The Company maintains a profit-sharing plan, qualified under Section 401(k) of the Internal Revenue Code, for all

eligible employees. Through 2009, employees were eligible to participate following the completion of one year of service

and attainment of age 21. As of January 1, 2010, employees are eligible to participate following the completion of three

months of service and attainment of age 21. The Company matches 50% of employee contributions up to 6% of eligible

compensation. The Company’s matching contributions, included in SG&A, totaled $520, $404, and $344 in 2010, 2009, and

2008, respectively.

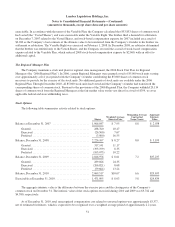

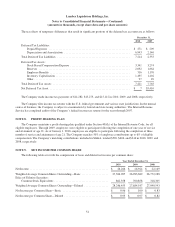

NOTE 9. NET INCOME PER COMMON SHARE

The following table sets forth the computation of basic and diluted net income per common share:

Year Ended December 31,

2010 2009 2008

Net Income ....................................................... $ 26,266 $ 26,924 $ 22,149

Weighted Average Common Shares Outstanding—Basic ................... 27,384,095 26,983,689 26,772,288

Effect of Dilutive Securities:

Common Stock Equivalents ...................................... 862,358 700,858 318,305

Weighted Average Common Shares Outstanding—Diluted ................. 28,246,453 27,684,547 27,090,593

Net Income per Common Share—Basic ................................ $ 0.96 $ 1.00 $ 0.83

Net Income per Common Share—Diluted ............................... $ 0.93 $ 0.97 $ 0.82

54