Lumber Liquidators 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

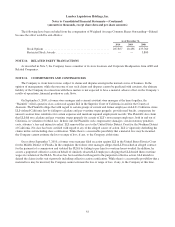

NOTE 7. INCOME TAXES

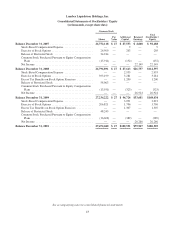

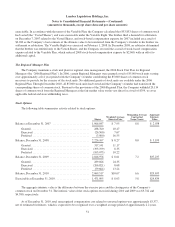

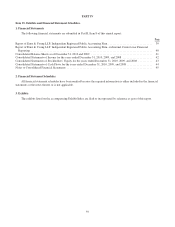

The provision for income taxes consists of the following:

Year Ended December 31,

2010 2009 2008

Current

Federal ...................................................... $10,231 $14,681 $12,955

State ........................................................ 1,945 3,456 3,174

Total Current ..................................................... 12,176 18,137 16,129

Deferred

Federal ...................................................... 3,842 (776) (390)

State ........................................................ 458 (180) (96)

Total Deferred .................................................... 4,300 (956) (486)

Total Provision for Income Taxes ..................................... $16,476 $17,181 $15,643

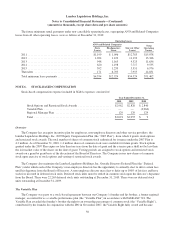

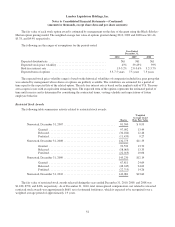

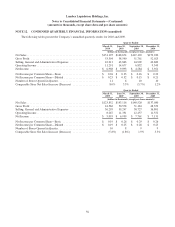

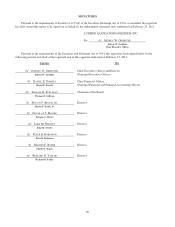

The reconciliation of significant differences between income tax expense applying the federal statutory rate of 35% and

the actual income tax expense at the effective rate are as follows:

Year Ended December 31,

2010 2009 2008

Income Tax Expense at Federal Statutory Rate ..................... $14,960 35.0% $15,437 35.0% $13,227 35.0%

Increases (Decreases):

State Income Taxes, Net of Federal Income Tax Benefit ......... 1,478 3.5% 2,150 4.9% 1,939 5.1%

Net Reduction of Deferred Tax Benefit Associated with the

Variable Plan ......................................... — 0.0% — 0.0% 638 1.7%

Other .................................................. 38 0.0% (406) (0.9%) (161) (0.4%)

Total ...................................................... $16,476 38.5% $17,181 39.0% $15,643 41.4%

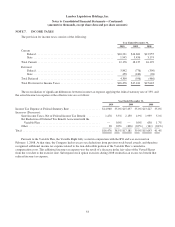

Pursuant to the Variable Plan, the Variable Right fully vested in conjunction with the IPO and was exercised on

February 1, 2008. At that time, the Company had no excess tax deductions from previous stock-based awards, and therefore

recognized additional income tax expense related to the non-deductible portion of the Variable Plan’s cumulative

compensation costs. This additional income tax expense was the result of a decrease in the fair value of the Vested Shares

from the vest date to the exercise date. Subsequent stock option exercises during 2008 resulted in an excess tax benefit that

reduced income tax expense.

53