Lumber Liquidators 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

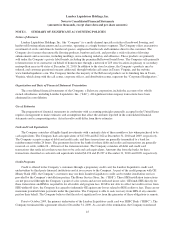

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

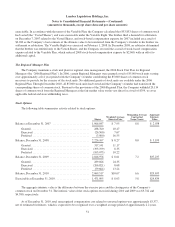

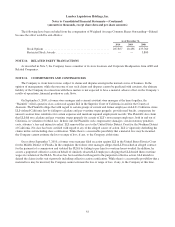

exercisable. In accordance with the terms of the Variable Plan, the Company calculated that 853,853 shares of common stock

had vested (the “Vested Shares”) and were exercisable under the Variable Right. The brother filed a demand for arbitration

on December 7, 2007 related to the Vested Shares, and stock-based compensation expense for 2007 included an accrual of

$2,960 as the Company’s best estimate of the ultimate value to be transferred from the Company’s founder to his brother via

settlement or arbitration. The Variable Right was exercised on February 1, 2008. In December 2008, an arbitrator determined

that the brother was entitled only to the Vested Shares, and the Company reversed the accrual of stock-based compensation

expense related to the Variable Plan, which reduced 2008 stock-based compensation expense by $2,960, with an offset to

additional capital.

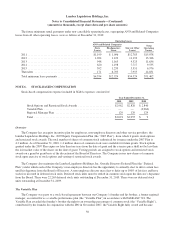

The Regional Manager Plan

The Company maintains a stock unit plan for regional store management, the 2006 Stock Unit Plan for Regional

Managers (the “2006 Regional Plan”). In 2006, certain Regional Managers were granted a total of 85,000 stock units vesting

over approximately a five year period with the Company’s founder contributing the 85,000 shares of common stock

necessary to provide for the exercise of the stock units. No additional grants of stock units are available under the 2006

Regional Plan. Through December 2010, all 85,000 stock units had vested and the Company’s founder had transferred the

corresponding shares of common stock. Pursuant to the provisions of the 2006 Regional Plan, the Company withheld 20,134

shares of common stock from the Regional Managers at the fair market value on the vest dates for a total of $354, to cover

applicable federal and state withholding taxes.

Stock Options

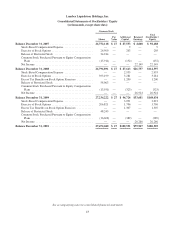

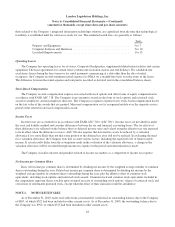

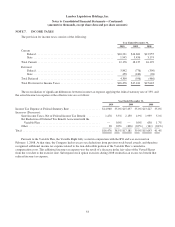

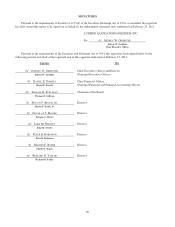

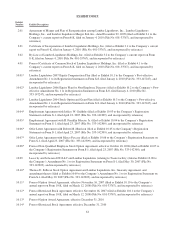

The following table summarizes activity related to stock options:

Shares

Weighted Average

Exercise Price

Remaining Average

Contractual

Term (Years)

Aggregate

Intrinsic

Value

Balance at December 31, 2007 .......................... 1,966,847 $ 7.95 8.8 $ 2,038

Granted ......................................... 288,760 10.47

Exercised ....................................... (26,500) 7.67

Forfeited ........................................ (3,000) 16.55

Balance, December 31, 2008 ............................ 2,226,107 $ 8.27 8.0 $ 5,199

Granted ......................................... 317,141 11.17

Exercised ....................................... (393,199) 8.35

Forfeited ........................................ (103,073) 10.22

Balance, December 31, 2009 ............................ 2,046,976 $ 8.61 7.2 $37,237

Granted ......................................... 289,026 24.35

Exercised ....................................... (206,821) 8.68

Forfeited ........................................ (59,664) 13.24

Balance, December 31, 2010 ............................ 2,069,517 $10.67 6.6 $29,635

Exercisable at December 31, 2010 ........................ 1,471,095 $ 8.03 5.8 $24,839

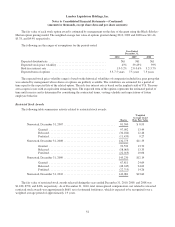

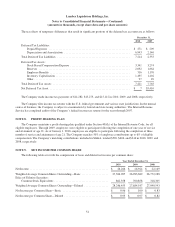

The aggregate intrinsic value is the difference between the exercise price and the closing price of the Company’s

common stock on December 31. The intrinsic value of the stock options exercised during 2010 and 2009 was $3,742 and

$4,380, respectively.

As of December 31, 2010, total unrecognized compensation cost related to unvested options was approximately $3,377,

net of estimated forfeitures, which is expected to be recognized over a weighted average period of approximately 2.2 years.

51