Lumber Liquidators 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

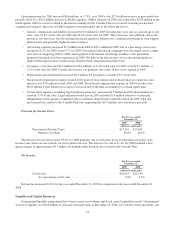

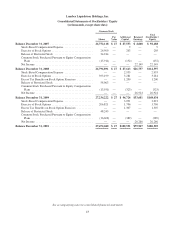

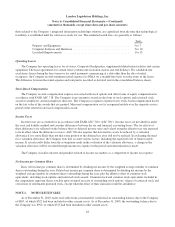

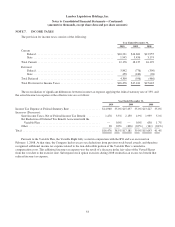

Lumber Liquidators Holdings, Inc.

Consolidated Statements of Cash Flows

(in thousands)

Year Ended December 31,

2010 2009 2008

Cash Flows from Operating Activities:

Net Income ........................................................... $26,266 $ 26,924 $ 22,149

Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities:

Depreciation and Amortization ........................................ 5,773 4,714 4,350

Deferred Income Taxes .............................................. 4,300 (956) (486)

Stock-Based Compensation Expense ................................... 3,091 2,955 9

Other ............................................................ — — (40)

Changes in Operating Assets and Liabilities:

Merchandise Inventories ......................................... (21,789) (44,611) (16,707)

Accounts Payable .............................................. 1,136 17,235 (281)

Customer Deposits and Store Credits ............................... 2,234 (613) 809

Prepaid Expenses and Other Current Assets .......................... (3,548) (155) (504)

Other Assets and Liabilities ...................................... (487) 2,319 62

Net Cash Provided by Operating Activities ............................ 16,976 7,812 9,361

Cash Flows from Investing Activities:

Purchases of Property and Equipment ....................................... (20,535) (11,433) (6,560)

Purchase of 1-800-HARDWOOD .......................................... — — (800)

Net Cash Used in Investing Activities ................................. (20,535) (11,433) (7,360)

Cash Flows from Financing Activities:

Proceeds from Exercise of Stock Options .................................... 1,796 3,281 203

Excess Tax Benefits on Stock Option Exercises ............................... 1,307 1,200 40

Common Stock Purchased Pursuant to Equity Compensation Plans ............... (389) (323) (152)

Repayments of Long-Term Debt and Capital Lease Obligations .................. — (1) (121)

Net Cash Provided by (Used In) Financing Activities .................... 2,714 4,157 (30)

Net (Decrease) Increase in Cash and Cash Equivalents .......................... (845) 536 1,971

Cash and Cash Equivalents, Beginning of Year ................................. 35,675 35,139 33,168

Cash and Cash Equivalents, End of Year ...................................... $ 34,830 $ 35,675 $ 35,139

See accompanying notes to consolidated financial statements

44