Lumber Liquidators 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

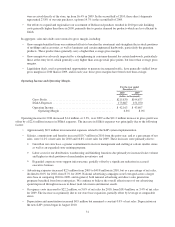

OCustomer orders that were placed in the weeks subsequent to implementation, combined with orders

outstanding at implementation, resulted in a significant build of both open demand and related customer

deposits at the end of the third quarter of 2010. Further, low productivity across the supply chain and in our

stores resulted in us invoicing that demand over a longer period of time. We estimated that the build in our

customer deposits at the end of the third quarter of 2010 equated approximately $12.0 million to $14.0 million

in unrealized net sales. We believe we realized a substantial portion of that build through net sales in the

fourth quarter of 2010 and refunded a small portion of the deposits to customers. However, those net sales

were not able to overcome the adverse impact of our inconsistent servicing of new customers in the fourth

quarter.

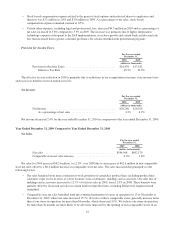

• Efficient product movement: Our gross margin was adversely impacted, primarily in the third quarter of 2010, by

inefficient product flow immediately before and after the implementation. Prior to implementation, we built

in-store inventory levels to establish a greater level of safety stock, then significantly reduced product flow in

preparation for a physical inventory at points within our distribution network, including our central warehouse

operation. In the first few weeks following implementation, we were not able to re-establish the product flow as

quickly as expected. Though we returned to anticipated levels of product distribution in September, the unit count

shipped during the third quarter of 2010 was significantly lower than our expectations. In addition, delays in

shipping products necessary to fulfill orders resulted in our usage of more expedited modes of transportation,

generally at higher costs. The reduction in warehousing and merchandising productivity also impacted our

finishing operations for the first few weeks following implementation. We finished fewer units per hour in

comparison to historic norms due to the physical inventory procedures and slower ramp up of operations after

implementation. We estimate these costs reduced gross margin by approximately 10 to 12 basis points for the full

year 2010.

• Additional supporting resources: We allocated a greater amount of internal and external resources than expected to

stabilize our system after implementation, support operations and address the loss of productivity in certain key

areas. As a result, our implementation costs increased, and certain SG&A expenses were higher than expected. We

believe these non-recurring costs were approximately $0.9 million and included certain warehousing costs, support

for store point-of-sale functionality, additional customer service and certain professional fees.

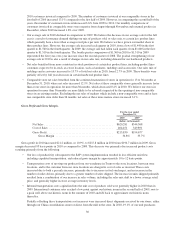

External Factors Impacting Our Business

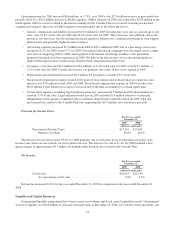

The wood flooring market for homeowners is highly fragmented and dependent on home-related discretionary spending,

which is influenced by a number of complex economic and demographic factors that may vary locally, regionally and

nationally. We are impacted by home remodeling activity, employment levels, housing turnover, real estate prices, new

housing starts, consumer confidence, credit availability and the general health of consumer discretionary spending. Many of

the economic indicators associated with the wood flooring market and more generally associated with consumer

discretionary spending are weak. Though we believe we have seen signs of stabilization in 2010, the wood flooring market is

likely to remain in a weakened state during 2011, with only gradual recovery throughout the year. We believe the number of

independent retailers serving the homeowner-based segment of the wood flooring market will continue to decline, however,

presenting us with an opportunity for market share growth, primarily through store base expansion. We also believe that the

longer term trends for our industry remain favorable, including customer perception of hardwood flooring as an attractive

alternative to other floor coverings, evolution of the hardwood flooring market, overall home improvement spending, and

certain demographic trends. See “Item 1A. Risk Factors—Risks Related to Our Business and Industry.”

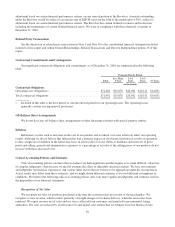

In October 2010, a conglomeration of domestic manufacturers of multilayered wood flooring filed a Petition for the

Imposition of Antidumping and Countervailing Duties (the “Petition”) with the United States Department of Commerce (the

“DOC”) and the United States International Trade Commission (the “ITC”) seeking the imposition of antidumping and

countervailing duties on multilayered wood flooring imported from China. We, along with a number of entities involved in

various aspects of the industry, are opposing the Petition. In December 2010, the ITC made a preliminary determination that

there is a reasonable indication that imports of multilayered wood flooring from China have caused injury to the domestic

suppliers. As a result, the DOC continues to conduct its countervailing and antidumping duty investigations, with preliminary

duty determinations currently expected in March 2011. Although the scope of products that may be subject to the

countervailing and antidumping duties has yet to be determined, approximately 7% – 9% of our net sales in 2010 were

products manufactured in China that may fall within the scope proposed by the conglomeration. Our suppliers of

multilayered wood flooring have been actively participating in the ITC and DOC proceedings. The preliminary duty

determinations are expected in March. At the time of the preliminary determinations, importers of multilayered wood

28