Lumber Liquidators 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Lumber Liquidators Holdings, Inc.

Notes to Consolidated Financial Statements—(Continued)

(amounts in thousands, except share data and per share amounts)

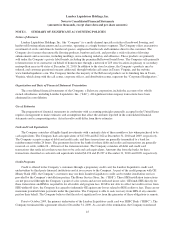

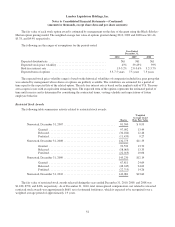

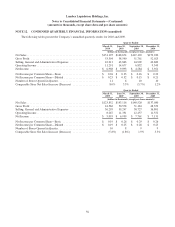

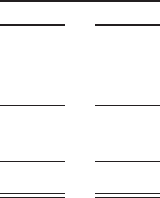

NOTE 3. PROPERTY AND EQUIPMENT

Property and equipment consisted of:

December 31,

2010 2009

Property and Equipment .............................................. $25,314 $21,393

Computer Software and Hardware ...................................... 23,838 11,330

Leasehold Improvements ............................................. 9,092 6,005

58,244 38,728

Less: Accumulated Depreciation and Amortization ........................ 22,930 18,237

Property and Equipment, net ...................................... $35,314 $20,491

Computer software and hardware costs capitalized of $15,225 and $3,897 relates to the Company’s integrated

information technology solution as of December 31, 2010 and 2009, respectively. The Company began amortizing these

assets in August 2010, and approximately $500 was recorded as amortization expense at December 31, 2010.

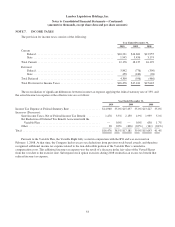

NOTE 4. REVOLVING CREDIT AGREEMENT

A revolving credit agreement (the “Revolver”) providing for borrowings up to $25,000 is available to LLI through

expiration on August 10, 2012. During 2010 and 2009, LLI did not borrow against the Revolver and at December 31, 2010

and 2009, there were no outstanding commitments under letters of credit. The Revolver is primarily available to fund

inventory purchases, including the support of up to $5,000 for letters of credit, and for general operations. The Revolver is

secured by LLI’s inventory, has no mandated payment provisions and a fee of 0.125% per annum, subject to adjustment

based on certain financial performance criteria, on any unused portion of the Revolver. Amounts outstanding under the

Revolver would be subject to an interest rate of LIBOR (reset on the 10th of the month) plus 0.50%, subject to adjustment

based on certain financial performance criteria. The Revolver has certain defined covenants and restrictions, including the

maintenance of certain defined financial ratios. LLI was in compliance with these financial covenants at December 31, 2010.

Interest payments on capital leases totaled $0, $2, and $4 in 2010, 2009, and 2008, respectively.

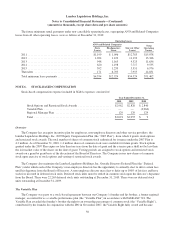

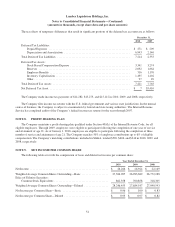

NOTE 5. LEASES

The Company has operating leases for its stores, Corporate Headquarters, supplemental distribution facilities and certain

equipment. The store location leases are operating leases and generally have five-year base periods with one or more five-

year renewal periods.

The Company’s founder is the sole owner of ANO LLC and Wood on Wood Road, Inc., and he has a 50% membership

interest in BMT Holdings, LLC (collectively, “ANO and Related Companies”). As of December 31, 2010, 2009 and 2008 the

Company leased 27, 25 and 26 of its locations from ANO and Related Companies representing 12.1%, 13.4% and 17.3% of

the total number of store leases in operation, respectively. In addition, the Company leases the Corporate Headquarters from

ANO LLC under an operating lease with a base term running through December 31, 2019.

Rental expense for 2010, 2009, and 2008 was $13,784, $11,464, and $9,276, respectively, with rental expense

attributable to ANO and Related Companies of $2,635, $2,531, and $2,505, respectively.

49