Lumber Liquidators 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

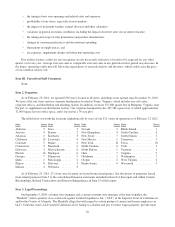

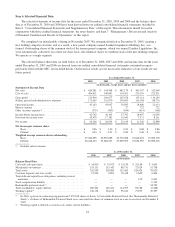

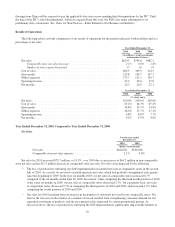

Our recent store opening activity is as follows:

2010 2009 2008

Number of stores at January 1 .......................................... 186 150 116

New stores ..................................................... 37 36 34

Number of stores at December 31 ..................................... 223 186 150

Net sales at our comparable stores have been driven by increases in our total sales volume, primarily measured in square

footage, partially offset by decreases in our average sale. We generally consider a store comparable on the first day of the

13th month of operation. Sales volume increases have come from demand for our expanded assortment of products and the

maturation of our store base. Macroeconomic pressures have generally shifted consumer demand towards certain key product

lines which have a lower than average retail price. Changes to comparable prior year results are as follows:

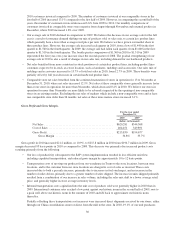

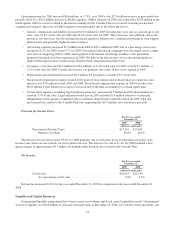

For the year ended

December 31,

2010 2009 2008

increase (decrease)

Comparable Stores:

Net sales ..................................................... 2.1% 0.0% 1.6%

Customers invoiced1............................................ 4.5% 12.4% 5.7%

Average sale2.................................................. (2.4%) (11.0%) (3.8%)

Average retail price per unit sold3.................................. (3.7%) (10.5%) (4.4%)

1Approximated by applying our average sale to total net sales at comparable stores

2Average sale is calculated on a total company basis

3Average retail price per unit sold is calculated on a total company basis and excludes certain service revenue, which

consists primarily of freight charges for in-home delivery

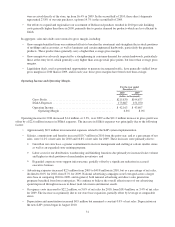

Our cost of sales is driven primarily by the cost of acquiring the products we sell from our suppliers, but also includes

international and domestic transportation costs, customs and duty charges, transportation charges from our distribution center to our

stores and the cost of delivering product purchases to the customer. Our gross margin is impacted by the cost of sales, the mix of

products sold and the average retail price per unit sold. In 2010, 2009 and 2008, our gross margin has been 34.8%, 35.7% and

34.8%, respectively. Significant changes in transportation costs have been the primary driver of the changes in gross margin.

Labor costs and advertising expenses have historically been our most significant SG&A expenses. Our total labor costs

have increased as a percentage of net sales over the last three years due primarily to our store base growth and investment in

support infrastructure. Our annual advertising costs have increased as we continue to promote our brand and implement

direct sales generation programs in support of our growth, but we continue to leverage national advertising across a larger

store base and commit greater resources to our most effective media channels. Our SG&A expenses as a percentage of net

sales have been 28.0%, 27.7% and 27.1% in 2010, 2009 and 2008, respectively. We expect to expand annual operating

margins as we continue to grow our net sales. In 2010, however, our operating margin decreased to 6.8% from 8.0% in 2009,

primarily due to certain adverse impacts from the implementation of our integrated technology solution.

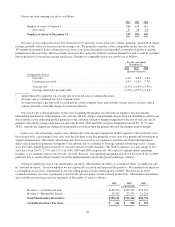

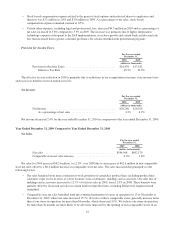

Our most significant asset is our merchandise inventory. Merchandise inventory is considered either “available for sale”

or “inbound in-transit,” based on whether we have physically received and inspected the products. We launched our initiative

to strengthen our in-stock commitment to our top selling products in the fourth quarter of 2009. The increase in 2010

available inventory per store is primarily a result of the adverse impact of our reduced productivity. Merchandise inventories

and available inventory per store in operation on December 31 were as follows:

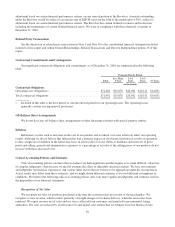

2010 2009 2008

(in thousands)

Inventory—Available for Sale ............................. $136,179 $109,369 $75,521

Inventory—Inbound In-Transit ............................. 18,952 23,973 13,210

Total Merchandise Inventories ........................... $155,131 $133,342 $88,731

Available Inventory Per Store ............................ $ 611 $ 588 $ 503

26