Lumber Liquidators 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Lumber Liquidators annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview and Trends

Lumber Liquidators is the largest specialty retailer of hardwood flooring in the United States, based on industry sources

and our experience. We believe we have achieved a reputation for offering great value, superior service and a broad selection

of high-quality hardwood flooring products. We offer our products through multiple, complementary channels, including 223

Lumber Liquidators stores in 46 states at December 31, 2010, a full-service call center in Toano, Virginia, our website and

our catalog. We seek to appeal to customers who desire a high-quality product at an attractive value and are willing to travel

to less convenient locations to get it. We sell our products principally to existing homeowners, who we believe represent over

90% of our customer count. Historically, these homeowners are in their mid-30’s or older, are well-educated and have been

living in their homes for at least several years.

We offer an extensive selection of premium hardwood flooring products under multiple proprietary brands at everyday

low prices designed to appeal to a diverse customer base. Substantially all of our products are purchased directly from mills

or associated brokers with whom we have cultivated long-standing relationships to ensure a consistent supply of high-quality

product at the lowest prices. Our mill partners are located primarily in North America, South America, Asia and Australia.

We believe that our vertically integrated business model enables us to offer a broad assortment of high-quality products to

our customers at a lower cost than our competitors.

We believe that our brands, value proposition and integrated multi-channel approach are important competitive

advantages in a hardwood flooring market that is highly fragmented. We compete on the basis of price, quality, selection

and availability of the wood flooring that we offer our customers, as well as the level of customer service we can provide.

We position ourselves as hardwood flooring experts and believe our high level of customer service reflects this

positioning.

The wood flooring market for homeowners is dependent on home-related discretionary spending, which is influenced

by a number of complex economic and demographic factors that may vary locally, regionally and nationally. In 2006,

many of the economic indicators associated with the wood flooring market weakened, and in the latter half of 2008,

consumer discretionary spending came under pressure. We expect the weakness to continue in 2011 with only gradual

improvement throughout the year when comparing 2011 to 2010. We believe general discretionary spending will improve

prior to home-related discretionary spending. We expect to capture share in our market primarily through store base

expansion.

We continue to invest in the infrastructure supporting our store growth and operations. In recent years, our focus has

been on product assortment, in-stock inventory position, international and domestic logistics, store management training, and

an integrated technology solution to support our future growth. We expect to continue to focus in these areas.

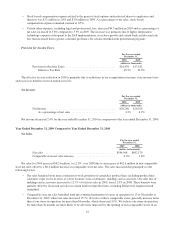

We implemented the first, and most significant, phase of our integrated technology solution in August 2010. This

implementation included an enhanced point-of-sale solution across our entire store base, a warehouse management and

inventory control system serving our entire distribution network, an integrated merchandising and product allocation system,

and certain related management reporting functionality. We continued to conduct our business without interruption, but the

implementation had a pervasive impact across our operations, primarily resulting in reduced productivity in our store and

warehouse operations, adversely impacting our results in the second half of 2010. By the end of the fourth quarter of 2010,

we believe our overall productivity was very close to the pre-implementation level, reaching that level in the first quarter of

2011. We remain confident in the long-term benefits of the integrated solution, and we believe our operations will ultimately

benefit from enhancements not available through our previous information system.

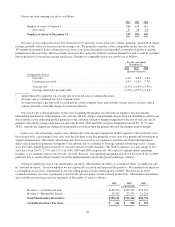

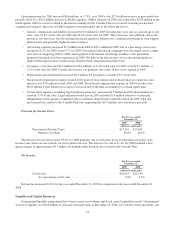

We have grown our store base rapidly with approximately 50% of our total store locations opened in the past three

years, including 37 new store locations in 2010. We believe our existing primary and secondary metropolitan markets will

benefit from additional stores, and in 2010, we opened 23 new store locations in these markets. Our experience has shown

that our store model is well suited for markets smaller than the primary and secondary metropolitan areas, and going forward,

the majority of our new market stores will be located in these smaller markets. We expect to open 40 to 50 new store

locations in each of the next few years, including new store locations in Canada, with an approximately equal mix of new

markets and existing markets.

25