LensCrafters 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

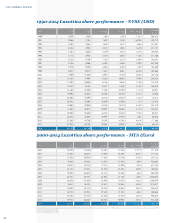

1 All comparisons, including percentage changes, are between the

12-month periods ended December 31, 2013 and December 31, 2014.

The fiscal year 2014 for the Retail Division included 53 weeks, compared

to 52 weeks in fiscal 2013.

2 EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin,

adjusted net sales, adjusted operating income/profit, adjusted operating

margin, free cash flow, net debt, net debt/adjusted EBITDA ratio,

adjusted net income and adjusted EPS are not measures in accordance

with IAS/IFRS. For further information on non-IAS/IFRS measures, please

refer to the section “Non-IFRS measures”, from page 28 of the Annual

Report 2014 attached hereto as 1.1 Appendix.

3 The adjusted data for the 12-month periods ended December 31, 2014: (i)

does not take into account a change in the presentation of a component

of EyeMed net sales that was previously included on a gross basis and

is currently included on a net basis due to a change in the terms of an

insurance underwriting agreement, resulting in a Euro 46.6 million

reduction to net sales; (ii) excludes non-recurring expenses relating to

redundancy incentive payments of Euro 20 million (Euro 14.5 million

impact on Group net income); and (iii) excludes the Euro 30.3 million

impact on net income relating to tax audits of the 2008, 2009, 2010 and

2011 tax years. The adjusted data for 2013 excludes the following items: (i)

non-recurring costs relating to reorganization of Alain Mikli International

acquired in January 2013 amounting to an approximately Euro 9 million

adjustment to Group operating income (approximately Euro 6 million net

of tax effect); (ii) Euro 26.7 impact on net income relating to a tax audit

for the 2007 tax year; and (iii) an accrual relating to open tax audits for tax

years after 2007 in the amount of Euro 40 million.

4 Figures at constant exchange rates have been calculated using the

average exchange rates in effect for the corresponding period in the

previous year. For further information, please refer to the exchange rates

table on page 144 of the Annual Report 2014 attached hereto as Annex 1.

5 At current exchange rates (i) net sales in Europe grew by 4.5% in 2014;

(ii) net sales in emerging markets grew by 11.8% in 2014; (iii) net sales

in China and Brazil grew by 19% and 10.2%, respectively, in 2014; (iv)

wholesale sales in Brazil grew by 7.4% in 2014.

6 Comparable store sales reflect the change in sales from one period to

another that, for comparison purposes, includes in the calculation only

stores open in the more recent period that also were open during the

comparable prior period, and applies to both periods the average

exchange rate for the prior period and the same geographic area.

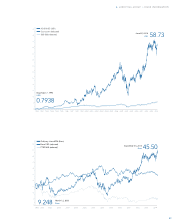

2013

1,013

1,461

2014

Net debt 2

(millions of Euro)

2013

2014

1.0x 0.6x

Net debt/adjusted

EBITDA2,3

3.

55