LensCrafters 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3.

North America was the primary driver of growth

in Group net sales in 2014, recording an increase

in total adjusted2,3 net sales in US dollars of 5.3%.

This confirms the demand American consumers

have for Luxottica’s brands and eyewear collections

and supports the strength of the business in both

traditional and new channels, such as department

stores and e-commerce. The performance in

Europe5 was positive overall, with increased net

sales of 4.6% at constant exchange rates4 for the full

year, which reflects market share growth in major

European markets. Emerging markets5 continued

to yield excellent results with net sales increasing

at constant exchange rates4 by 17.6% for the full

year. China and Brazil5, over the course of the year,

increased net sales by 19.3% and 19.9% respectively

at constant exchange rates4, despite a challenging

macroeconomic environment.

Adjusted2,3 operating income for 2014 amounted

to a record Euro 1,177.6 million, up 10.6% from

an adjusted2,3 Euro 1,064.7 million in 2013 with an

adjusted2,3 operating margin of 15.3% (14.6% in 2013).

In fiscal 2014, Luxottica recorded adjusted2,3 net sales growth of 5.3%

(+6.7% at constant exchange rates4) to over Euro 7.6 billion. The Wholesale

and Retail divisions both contributed to the Company’s strong results.

Group trends in 2014

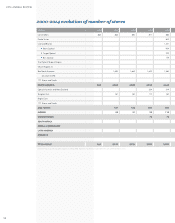

Group trends 20141

(millions of Euro, except for EPS - in Euro)

at current exchange rates

FY 2013

at current exchange

rates

Change at constant

exchange rates4

Change at current

exchange rates

Group net sales 7,652.3 7,312.6 +6.1% +4.6%

Adjusted2,3 7,698.9 7,312.6 +6.7% +5.3%

Wholesale Division 3,193.8 2,991.3 +8.6% +6.8%

Retail Division 4,458.6 4,321.3 +4.3% +3.2%

Adjusted2,3 4,505.1 4,321.3 +5.4% +4.3%

Operating income 1,157.6 1,055.7 +9.7%

Adjusted2,3 1,177.6 1,064.7 +10.6%

Net income attributable to Luxottica

Group stockholders 642.6 544.7 +18.0%

Adjusted2,3 687.4 617.3 +11.4%

Earnings per share 1.35 1.15 +17.0%

Adjusted2,3 1.44 1.31 +10.4%

Earnings per share in US$ 1.79 1.53 +17.1%

Adjusted2,3 1.92 1.74 +10.5%

2014 ANNUAL REVIEW

52