LensCrafters 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

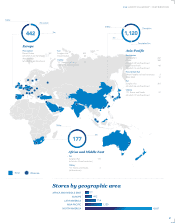

2.6

Luxottica’s global distribution network is one of the Group’s core strengths.

It includes retail stores as well as a wholesale network of third-party

stores and chains. Luxottica operates in all the world’s major markets and

continues to expand in emerging markets, where it has made substantial

investments over the last few years and intends to broaden and strengthen

its distribution platform going forward.

Luxottica’s efficient distribution network makes it

possible to maintain close contact with customers

while maximizing the visibility of the Group’s brand

portfolio. In addition, the Group’s experience in the

retail business has given it a unique understanding of

consumer needs and tastes in certain key countries.

All of this makes it possible to achieve tight control

and strategic optimization of brand diffusion, for

both proprietary and licensed brands.

Wholesale

The wholesale distribution structure covers more than

130 countries, with approximately 50 commercial

subsidiaries in major markets and approximately 100

independent distributors in other markets.

Wholesale customers are mostly retailers of mid

to premium-priced eyewear, such as independent

opticians, optical retail chains, specialty sun retailers,

department stores and duty-free shops. The Group

is currently seeking to further exploit new channels

of distribution, such as department stores, travel

retail and e-commerce. Certain brands, including

Oakley, are also distributed to sporting goods stores

and specialty sport stores, including bike, surf, snow,

skate, golf and motor sport stores.

In addition to giving wholesale customers access

to some of the most popular brands, with a broad

array of models tailored to the needs of each market,

Luxottica also seeks to provide them with pre- and

post sale services to enhance their business. These

services are designed to provide customers with

the best products in the best possible time frame.

Luxottica also maintains close contact with its

distributors in order to monitor sales and the quality

of the points of sale that display its products.

In 2002, Luxottica introduced the STARS program

within its Wholesale division, to provide third-party

customers with an enhanced service that leverages

Luxottica’s knowledge of local markets and brands

to deliver fresh, high-turnover products and maintain

optimal inventory levels at each point of sale. By

strengthening the partnership between Luxottica

and its customers, this program directly manages

product selection activities, assortment planning

and automatic replenishment of Luxottica’s products

in the store on behalf of the third-party customer,

utilizing ad hoc systems, tools and state-of-the-art

planning techniques. At the end of 2014, STARS

served a total of over 4,000 stores in the major

European markets, United States, Middle East and

emerging markets.

Distribution

2014 ANNUAL REVIEW

38