Hyundai 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2006 AND 2005

Korean Won

(In millions) (%)

Translation into

U.S. Dollars (Note 2)

(In thousands)

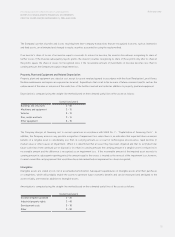

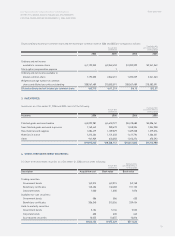

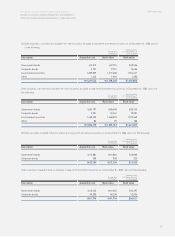

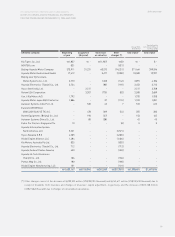

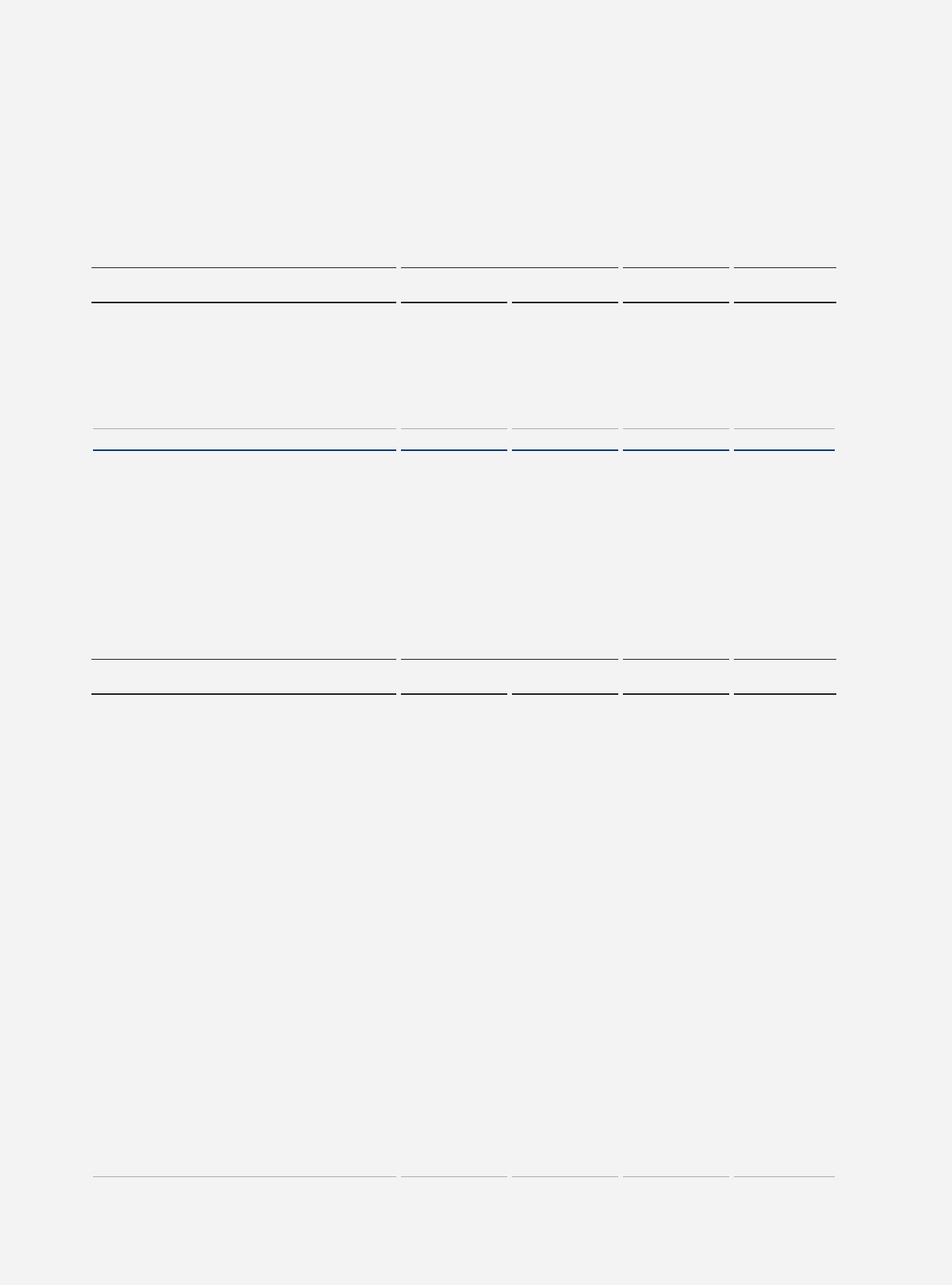

Companies Acquisition Book value Book value Ownership

cost percentage (*2)

Wigoglobal Co., Ltd. 904 4 $4 0.12

Tong Yang Investment Bank 282 115 124 0.01

Treasury Stock Fund 22,353 22,353 24,046 -

SK Networks Co., Ltd. (*1) 363 846 911 -

Other 98 2 2 -

241,779 528,747 $568,790

(*1) Disposal of stocks is restricted.

(*2) Ownership percentage is calculated by combining the ownership of the Company and its subsidiaries.

The differences between the acquisition cost and the book value stated at fair value in short-term investment securities and long-term

investment securities are recorded in capital adjustments (See Note 17).

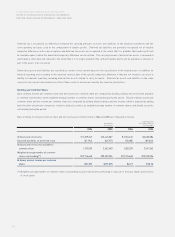

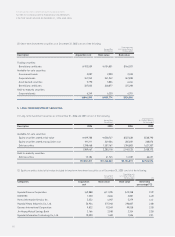

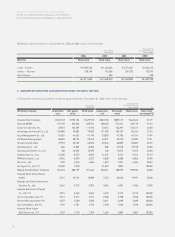

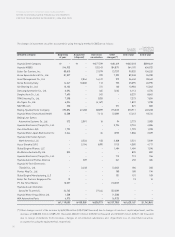

(3) Equity securities stated at acquisition cost included in long-term investment securities as of December 31, 2006 consist of the following:

Korean Won

(In millions) (%)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Companies Acquisition Book value Book value Ownership

cost percentage (*3)

Wia Trade Corporation (*1) 590 590 $635 100.00

HMCIS(*1) 3,959 3,959 4,259 80.00

NGVTEK.com (*1) 821 821 883 53.66

Carnes Co., Ltd. (*1) 250 250 269 49.99

Seoul Metro 9th line (*2) 41,779 41,779 44,944 49.02

Muan Environment System Corporation (*2) 1,394 1,394 1,500 29.90

The Sign Corporation (*1) 2,025 2,025 2,178 22.02

Heesung PM Tech Corporation 1,194 1,194 1,284 19.90

Clean Air Technology Inc. 500 500 538 16.13

Industri Otomotif Komersial 4,439 4,439 4,775 15.00

Hyundai Technology Investment Co., Ltd. 4,490 4,490 4,830 14.97

Hyundai Research Institute 1,359 1,271 1,367 14.90

Hyundai Unicorns Co., Ltd. 5,795 137 147 14.90

Gyeongnam Credit Guarantee Foundation 2,500 2,500 2,689 13.66

Kihyup Finance, Inc. 3,700 3,700 3,980 12.75

NESSCAP Inc. 1,997 1,997 2,148 12.05

Yonhap Capital Co., Ltd. 10,500 10,500 11,295 10.49

Micro Infinity 607 607 653 9.76

Daejoo Heavy Industry Co. Ltd. 650 650 699 9.29

Veloxsoft Inc. 1,000 1,000 1,076 8.00

Korea Credit Bureau Co., Ltd. 3,000 3,000 3,227 6.26

Hankyoreh Plus Inc. 4,800 284 306 5.43