Hyundai 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2006 AND 2005

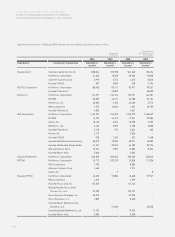

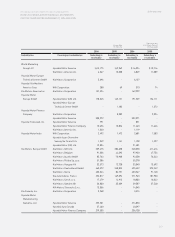

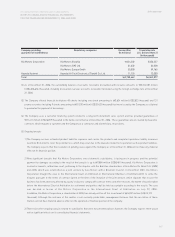

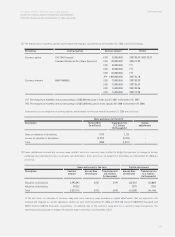

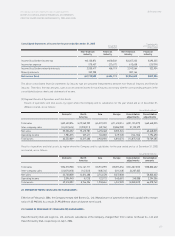

(6) As of December 31, 2006, the Company’s consolidated subsidiaries have been provided for payment guarantee by other companies as

follows:

Consolidated Subsidiaries Company providing Amounts of Translation into

guarantee of indebtedness guarantee U.S. Dollars (Note 2)

(In thousands) (In thousands)

Dymos Inc. Seoul Guarantee Insurance Company KRW 5,510,000 $5,927

Korea Housing Guarantee Co., Ltd KRW 166,847,000 179,483

KEFICO Corporation Korea Exchange Bank USD 2,537 2,537

Korea Exchange Bank JPY 113,707 956

Korea Exchange Bank EUR 774 1,018

Seoul Guarantee Insurance Company KRW 105,000 113

ROTEM Machinery Insurance Cooperative KRW 1,177,819,000 1,267,017

and other USD 214,838 214,838

EUR 153,916 202,370

NTD 6,870 206

CAD 8,033 6,922

HKD 45,138 5,807

SGD 11,409 7,434

TND 1,500 1,163

TTD 5,000 800

Autoever Systems Corp. Korea Software Financial Cooperative KRW 42,460,000 45,676

Hyundai Card Co., Ltd. Seoul Guarantee Insurance Company KRW 23,888,000 25,697

WIA Corp. The Export-Import Bank of Korea KRW 26,107,000 28,084

Machinery Insurance Cooperative KRW 134,180,000 144,342

Hyundai Autonet Financial Institutions KRW 6,286,000 6,762

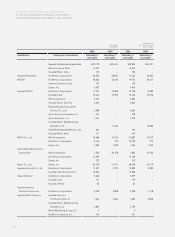

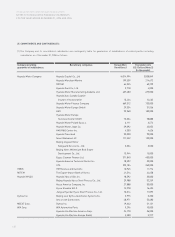

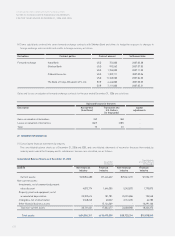

(7) The Company and Kia Motors Corporation made an agreement with its European sales subsidiaries and agents for them to be

responsible for projected costs for dismantling and recycling vehicles sold in corresponding countries to comply with European

Parliament directive regarding End-of-Life vehicles (ELV).

(8) In 2006, the Company sold 10,658,367 shares of ROTEM to MSPE Metro Investment AB and entered into a shareholders’ agreement.

MSPE Metro Investment AB is entitled to put option to sell those shares back to the Company in certain events (as defined) in accordance

with the agreement.

(9) Some directors of the Company and certain subsidiaries are sued in the Seoul District Court with respect to certain money transactions

of the prior years. Currently, it is impossible to reasonably measure the probability and amount of an outflow of resources required to

settle the consequence of this trial; however, the management estimates that the effect of this trial on the financial statements will not

be material. Therefore, no adjustment is reflected in the accompanying financial statements.

(10) The Company has been investigated by the Fair Trade Commission (FTC) in connection with business activities of the prior years.

Currently, it is impossible to reasonably measure the expenditure required to settle the consequence of this investigation: however, the

management estimates that the effect of this investigation on the financial statements will not be material. Therefore, no adjustment is

reflected in the accompanying financial statements.