Hyundai 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2006 AND 2005

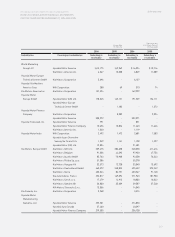

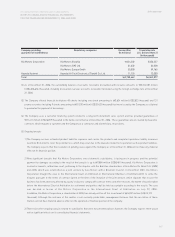

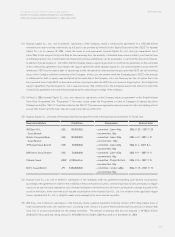

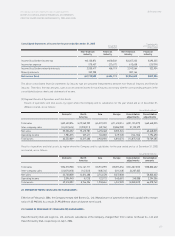

(11) Hyundai Capital Co., Ltd., one of domestic subsidiaries of the Company, made a credit facility agreement on a US$ 600 million

renewable one-year revolving credit facility up to 3 years to be provided by General Electric Capital Corporation (the “GECC”) to Hyundai

Capital Co., Ltd. on January 13, 2006. Under the terms of such agreement, Hyundai Capital Co., Ltd. shall pay commitment fee of

Libor+90bp for the usage of facility and 20bp for the remaining. Also, the maturity of individual draw-down is within 1 year from the time

of withdrawal and in case of termination, the maturity for previous withdrawals can be extended to 1 year from the time of termination.

In addition, Hyundai Capital Co., Ltd, GECC and the Company made a support agreement on credit facility agreement on the same date

of the credit facility agreement. According to the support agreement, when Hyundai Capital Co., Ltd cannot redeem in a year after the

withdrawal, GECC has the right of debt-to-equity swap for the relevant draw-down and has the put option that GECC can sell converted

stocks to the Company within the ownership of the Company. In this case, the amount which the Company pays to GECC is the amount

of withdrawal for debt-to-equity swap multiplied by the ownership of the Company. Also, the Company has the call option that it can

buy converted stocks from GECC on the same condition of put option when the GECC does not exercise the put option. According to the

support agreement, Hyundai Capital Co., Ltd is supposed to pay 15bp commission to the Company based on the amount on which the

credit facility agreement was established multiplied by the ownership percentage of the company.

(12) On May 12, 2006, Hyundai Capital Co., Ltd., one of domestic subsidiaries of the Company, made an agreement on the Global Medium

Term Note Programme (the “Programme”). The notes issued under the Programme is listed on Singapore Exchange Securities

Trading Limited (the “SGX-ST”) and then traded on the SGX-ST. The maximum aggregate nominal amount of notes outstanding will not

exceed USD 2 billion and the notes may be issued at any time up to the limit.

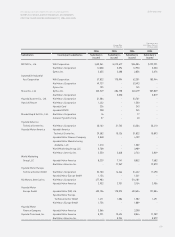

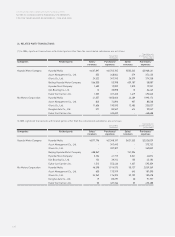

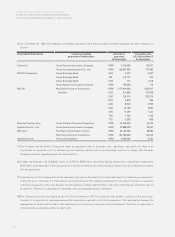

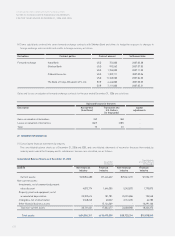

(13) Hyundai Capital Co., Ltd made a Revolving Credit Facility Agreement with following financial institutions for Credit Line.

(14) Hyundai Card Co., Ltd., one of domestic subsidiaries of the Company, made an agreement regarding asset backed securitization.

According to the agreement, in order for the credibility of the asset-backed securities, several required provisions are made as a trigger

clauses to be used for early redemption calls, thereby limiting the risk that investors will have resulting from a change in quality of the

assets in the future. In the event the asset-backed securitization of the Hyundai Card Co., Ltd. is in violation of the applicable trigger

clause, Hyundai Card Co., Ltd. is obliged to make early redemption for asset-backed securities.

(15) WIA Corp., one of domestic subsidiaries of the Company, made a general instalment financing contract with Yonhap Capital Corp. in

order to promote the sales of its machine tools. According to the contract, if a user of the instalment financing service is in default, WIA

Corp. has to accept responsibility for the default receivable. The amount of principal that has not matured is 98,321 million

(US$105,767 thousand) and ceiling amount is 150,000 million (US$161,360 thousand) as of December 31, 2006.

Financial institution Credit Line Commission Contract term

ING Bank N.V., US$ 100,000,000 - committed : Libor+45bp 2006.11.25 ~ 2007.11.25

Seoul Branch - uncommitted : 8bp

Mizuho Corporate Bank, US$ 100,000,000 - committed : Libor+75bp 2006. 4.12 ~ 2007. 4.12

Seoul Branch - uncommitted : 10bp

JP Morgan Seoul Branch US$ 50,000,000 - committed : Libor+45bp 2006. 8. 4 ~ 2007. 8. 4

- uncommitted : 8bp

ABN Amro, Seoul Branch US$ 50,000,000 - committed : Libor+45bp 2006. 9.11 ~ 2007. 9.11

- uncommitted : 8bp

Citibank, Seoul KRW 47,000million - committed : 91day CD+0.6% 2006. 9.15 ~ 2007. 9.15

- uncommitted : 8bp

MUFJ, Seoul Branch JPY 5,000,000,000 - committed : Libor+48bp 2006.11.15 ~ 2007.11.15

- uncommitted : 8bp