Hyundai 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

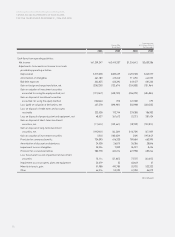

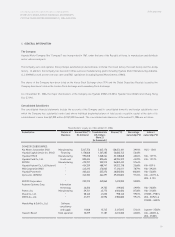

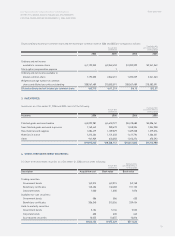

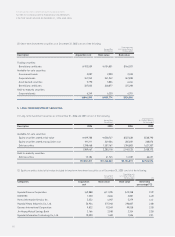

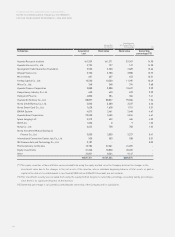

76

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2006 AND 2005

If the recoverable amount of an intangible asset becomes less than its carrying amount as a result of obsolescence, sharp decline in

market value or other causes of impairment, the carrying amount of an intangible asset is adjusted to its recoverable amount and the

reduced amount is recognized as impairment loss. If the recoverable amount of a previously impaired intangible asset exceeds its carrying

amount in subsequent periods, an amount equal to the excess is recorded as reversal of impairment loss; however, it cannot exceed the

carrying amount that would have been determined had no impairment loss been recognized in prior years.

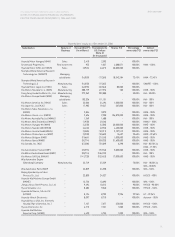

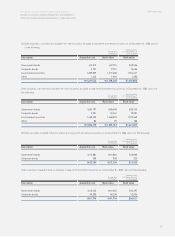

Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term installment transactions are stated at present value, if the difference between nominal

value and present value is material. The present value discount is amortized using the effective interest rate method, and the amortization

is included in interest expense or interest income. As of December 31, 2006 and 2005, an interest rate of 8.25 percent is used in valuing the

receivables and payables at present value.

Accounting for Lease Contracts

Whether a lease is a finance lease or an operating lease depends on the substance of the transaction rather than the form of the contract.

The situations that individually or in combination normally lead to a lease being classified as a finance lease are: (1) the lease transfers

ownership of the asset to the lessee by the end of the lease term; (2) the lessee has the option to purchase the asset at a price that is

expected to be sufficiently lower than the fair value at the date the option becomes exercisable for it to be reasonably certain, at the

inception of the lease, that the option will be exercised; (3) the lease term is for the major part of the economic life of the asset even if title is

not transferred; (4) at the inception of the lease, the present value of the minimum lease payments amounts to at least substantially all of

the fair value of the leased asset; and (5) the leased assets are of such a specialized nature that only the lessee can use them without major

modifications; otherwise, it is classified as an operating lease.

At the commencement of the lease term, finance leases are recognized as assets and liabilities in their balance sheets at amounts equal to

the fair value of the leased property or, if lower, the present value of the minimum lease payments, each determined at the inception of the

lease. The discount rate to be used in calculating the present value of the minimum lease payments is the interest rate implicit in the lease,

if this is practicable to determine; if not, the lessee's incremental borrowing rate is used. Minimum lease payments are apportioned

between the finance charge and the reduction of the outstanding liability. The finance charge is allocated to each period during the lease

term so as to produce a constant periodic rate of interest on the remaining balance of the liability.

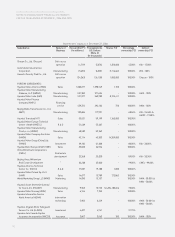

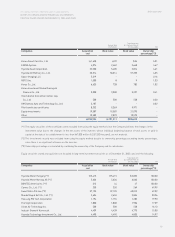

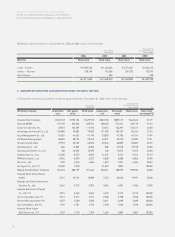

Accrued Severance Benefits

Employees and directors of the Company and its domestic subsidiaries with more than one year of service are entitled to receive a lump-

sum payment upon termination of their service with each company, based on their length of service and rate of pay at the time of

termination. The accrued severance benefits that would be payable assuming all eligible employees were to resign amount to 3,020,377

million (US$3,249,115 thousand) and 3,015,591 million (US$3,243,966 thousand) as of December 31, 2006 and 2005, respectively.

In accordance with the National Pension Act, certain portions of the accrued severance benefits are deposited with the National Pension

Fund and deducted from the accrued severance benefits.

Actual payments of severance benefits by the Company and its subsidiaries amounted to 728,662 million (US$783,845 thousand) and

423,551 million (US$455,627 thousand) in 2006 and 2005, respectively.

Also, overseas subsidiaries accrued severance benefits in accordance with each subsidiary’ policies and their counties’ regulations.