Hyundai 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2006 AND 2005

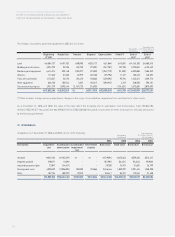

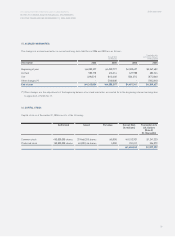

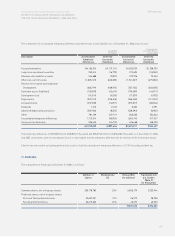

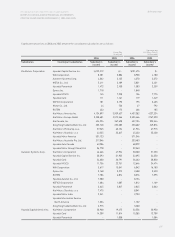

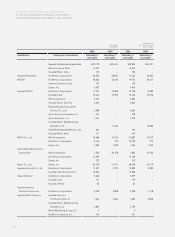

The components of accumulated temporary differences and deferred tax assets (liabilities) as of December 31, 2006 are as follows:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description Accumulated Deferred Accumulated Deferred

temporary tax assets tax assets tax assets

differences (liabilities) differences (liabilities)

Accrued warranties 4,186,016 1,151,154 $4,503,029 $1,238,333

Long-term investment securities 253,414 (16,770) 272,605 (18,040)

Allowance for doubtful accounts 254,688 70,039 273,976 75,343

Other non-current assets (1,805,122) (628,300) (1,941,827) (675,882)

Reserve for research and manpower

Development (685,799) (188,595) (737,736) (202,878)

Derivative assets (liabilities) (158,598) (43,614) (170,609) (46,917)

Development cost (16,574) (4,558) (17,829) (4,903)

Depreciation (322,151) (106,456) (346,548) (114,518)

Accrued income (272,258) (74,871) (292,877) (80,540)

Dividends 7,745 2,130 8,332 2,291

Advanced depreciation provisions (509,786) (8,352) (548,393) (8,985)

Other 781,439 329,119 840,620 354,043

Accumulated temporary differences 1,713,014 480,926 1,842,743 517,347

Carry over tax deduction 396,445 416,730 426,468 448,290

2,109,459 897,656 $2,269,211 $965,637

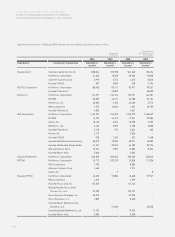

The temporary differences of 35,809 million (US$38,521 thousand) and 523,704 million (US$563,365 thousand) as of December 31, 2006

and 2005, respectively, were not recognized since it is not probable that the temporary difference will be reversed in the foreseeable future.

Effective tax rate used in calculating deferred tax assets or liabilities arising from temporary differences is 27.5% including resident tax.

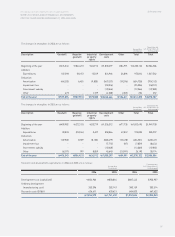

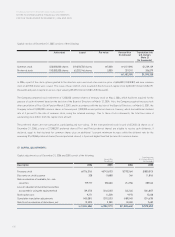

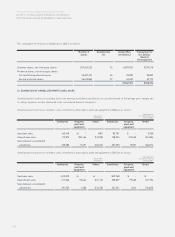

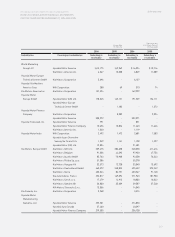

21. DIVIDENDS:

The computation of the proposed dividends for 2006 is as follows:

Number of Dividend rate Korean Won Translation into

shares (%) (In millions) U.S. Dollars

(Note 2)

(In thousands)

Common shares, net of treasury shares 208,178,785 20% 208,179 $223,944

Preferred shares, net of treasury shares:

First and Third preferred shares 25,637,321 21% 26,919 28,958

Second preferred shares 36,613,865 22% 40,275 43,325

275,373 $296,227