Hyundai 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

HYUNDAI MOTOR COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2006 AND 2005

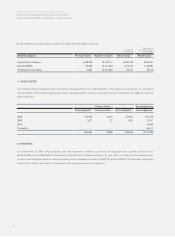

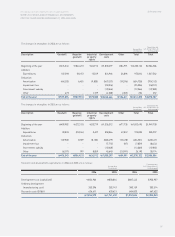

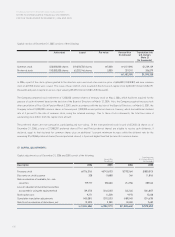

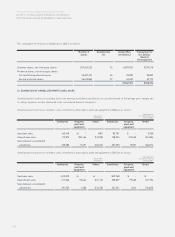

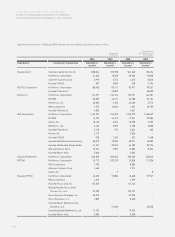

Capital stock as of December 31, 2005 consists of the following:

Authorized Issued Par value Korean Won Translation into

(In millions) U.S. Dollars

(Note 2)

(In thousands)

Common stock 450,000,000 shares 219,058,702 shares 5,000 1,151,894 $1,239,129

Preferred stock 150,000,000 shares 65,202,146 shares 5,000 331,011 356,079

1,482,905 $1,595,208

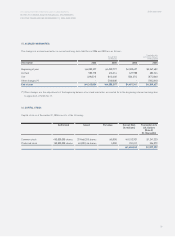

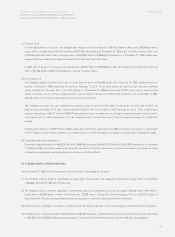

In 2006, a part of the stock options granted to the directors were exercised at an exercise price of 26,800 (US$28.83) and new common

stock of 407,553 shares were issued. This issue of new common stock resulted in the increase in capital stock by 2,037 million (US$2,191

thousand) and paid-in capital in excess of par value by 13,552 million (US$14,578 thousand).

The Company completed stock retirement of 1,320,000 common shares of treasury stock on May 4, 2004, which had been acquired for the

purpose of such retirement based on the decision of the Board of Directors on March 12, 2004. Also, the Company acquired treasury stock

after cancellation of Trust Cash Fund on March 2, 2001, and in accordance with the decision of the Board of Directors, on March 5, 2001, the

Company retired 10,000,000 common shares in treasury and 1,000,000 second preferred shares in treasury, which had additional dividend

rate of 2 percent to the rate of common stock, using the retained earnings. Due to these stock retirements, the total face value of

outstanding stock differs from the capital stock amount.

The preferred shares are non-cumulative, participating and non-voting. Of the total preferred stock issued of 65,202,146 shares as of

December 31, 2006, a total of 27,588,281 preferred shares (First and Third preferred shares) are eligible to receive cash dividends, if

declared, equal to that declared for common shares plus an additional 1 percent minimum increase while the dividend rate for the

remaining 37,613,865 preferred shares (Second preferred shares) is 2 percent higher than that declared for common shares.

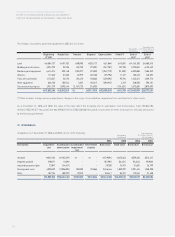

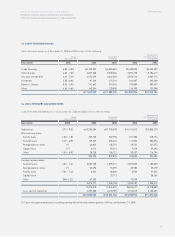

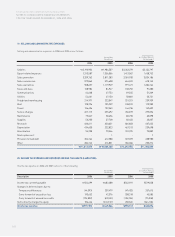

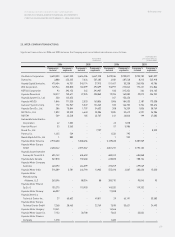

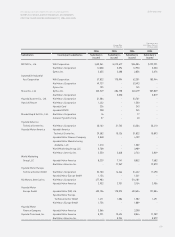

17. CAPITAL ADJUSTMENTS:

Capital adjustments as of December 31, 2006 and 2005 consist of the following:

Korean Won

(In millions)

Translation into

U.S. Dollars (Note 2)

(In thousands)

Description 2006 2005 2006 2005

Treasury stock (716,316) (743,692) $(770,564) $(800,013)

Discounts on stock issuance 338 (1,688) 364 (1,816)

Gain on valuation of available-for- sale

securities 199,777 358,400 214,906 385,542

Loss on valuation of investment securities

accounted for using the equity method (39,270) (246,220) (42,244) (264,867)

Stock option cost 9,271 14,528 9,973 15,628

Cumulative translation adjustments (455,081) (292,525) (489,545) (314,678)

Gain (loss) on valuation of derivatives, net (3,305) 9,000 (3,555) 9,682

(1,004,586) (902,197) $(1,080,665) $(970,522)