Hormel Foods 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

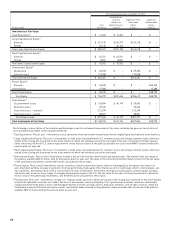

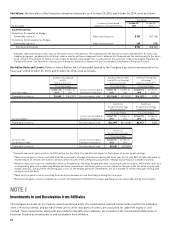

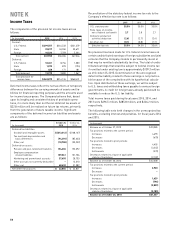

58

approved by the Company’s Board of Directors and the stock

price on the grant date. The expected volatility assumption is

set based primarily on historical volatility. As a reasonable-

ness test, implied volatility from exchange traded options is

also examined to validate the volatility range obtained from

the historical analysis. The expected life assumption is set

based on an analysis of past exercise behavior by option

holders. In performing the valuations for option grants, the

Company has not stratifi ed option holders as exercise behav-

ior has historically been consistent across all employee and

non-employee director groups.

The Company’s nonvested shares granted on or before

September 26, 2010, vest after fi ve years or upon retirement.

Nonvested shares granted between September 27, 2010,

and July 27, 2014, vest after one year. Nonvested shares

granted on or after July 28, 2014 vest on the earlier of the day

before the Company’s next annual meeting date or one year.

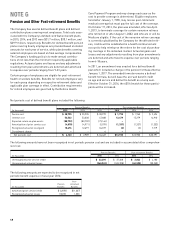

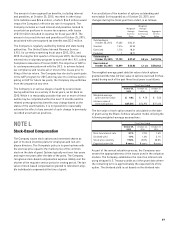

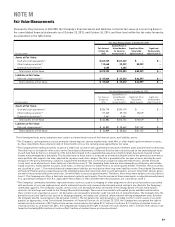

A reconciliation of the nonvested shares (in thousands) as

of October 25, 2015 and changes during the fi scal year then

ended, is as follows:

Weighted-

Average

Grant Date

Shares Fair Value

Nonvested at October 26, 2014 70 $ 33.58

Granted 37 51.74

Vested 70 33.58

Forfeited – –

Nonvested at October 25, 2015 37 $ 51.74

The weighted-average grant date fair value of nonvested shares

granted, the total fair value (in thousands) of nonvested shares

granted, and the fair value (in thousands) of shares that have

vested during each of the past three fi scal years is as follows:

Fiscal Year Ended

October 25, October 26, October 27,

2015 2014 2013

Weighted-average

grant date fair value $ 51.74 $ 44.12 $ 35.42

Fair value of nonvested

shares granted $ 1,920 $ 1,760 $ 1,600

Fair value of shares vested $ 2,347 $ 2,085 $ 1,824

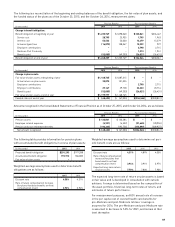

Stock-based compensation expense, along with the related

income tax benefi t, for each of the past three fi scal years is

presented in the table below:

Fiscal Year Ended

October 25, October 26, October 27,

(in thousands) 2015 2014 2013

Stock-based compensation

expense recognized $ 15,717 $ 14,393 $ 17,596

Income tax benefi t

recognized (5,967) (5,469) (6,655)

After-tax stock-based

compensation expense $ 9,750 $ 8,924 $ 10,941

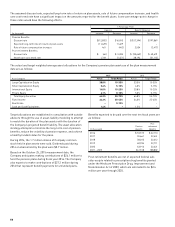

At October 25, 2015, there was $9.3 million of total unrecog-

nized compensation expense from stock-based compensation

arrangements granted under the plans. This compensation is

expected to be recognized over a weighted-average period of

approximately 2.6 years. During fi scal years 2015, 2014, and

2013, cash received from stock option exercises was $10.5

million, $10.5 million, and $30.2 million, respectively. The total

tax benefi t to be realized for tax deductions from these option

exercises was $25.6 million, $28.4 million, and $29.4 million,

respectively.

Shares issued for option exercises and nonvested shares

may be either authorized but unissued shares, or shares of

treasury stock acquired in the open market or otherwise. The

number of shares available for future grants was 25.1 million

at October 25, 2015, 26.6 million at October 26, 2014, and 27.9

million at October 27, 2013.