Hormel Foods 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

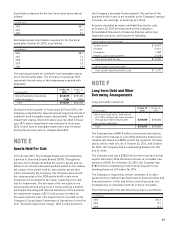

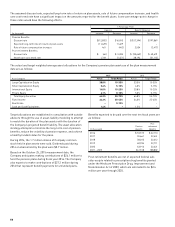

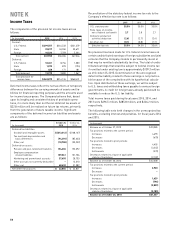

Reconciliation of the statutory federal income tax rate to the

Company’s effective tax rate is as follows:

2015 2014 2013

U.S. statutory rate 35.0% 35.0% 35.0%

State taxes on income,

net of federal tax benefi t 2.7 2.8 2.7

Domestic production

activities deduction (2.6) (2.7) (2.4)

All other, net (0.1) (0.8) (1.7)

Effective tax rate 35.0% 34.3% 33.6%

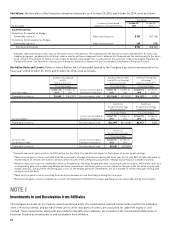

No provision has been made for U.S. federal income taxes on

certain undistributed earnings of foreign subsidiaries and joint

ventures that the Company intends to permanently invest or

that may be remitted substantially tax-free. The total of undis-

tributed earnings that would be subject to federal income tax

if remitted under existing law is approximately $109.3 million

as of October 25, 2015. Determination of the unrecognized

deferred tax liability related to these earnings is not practica-

ble because of the complexities with its hypothetical calcula-

tion. Upon distribution of these earnings, we will be subject

to U.S. taxes and withholding taxes payable to various foreign

governments. A credit for foreign taxes already paid would be

available to reduce the U.S. tax liability.

Total income taxes paid during fi scal years 2015, 2014, and

2013 were $296.5 million, $285.8 million, and $226.2 million,

respectively.

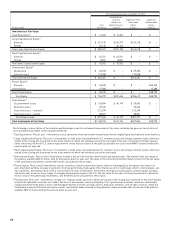

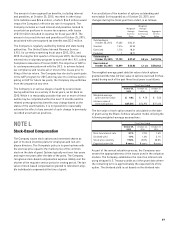

The following table sets forth changes in the unrecognized tax

benefi ts, excluding interest and penalties, for fi scal years 2014

and 2015.

(in thousands)

Balance as of October 27, 2013 $ 20,085

Tax positions related to the current period:

Increases 4,693

Decreases (670)

Tax positions related to prior periods:

Increases 4,455

Decreases (3,245)

Settlements (573)

Decreases related to a lapse of applicable

statute of limitations (2,137)

Balance as of October 26, 2014 $ 22,608

Tax positions related to the current period:

Increases 2,920

Decreases –

Tax positions related to prior periods:

Increases 1,629

Decreases (796)

Settlements (2,839)

Decreases related to a lapse of applicable

statute of limitations (2,185)

Balance as of October 25, 2015 $ 21,337

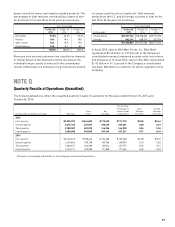

NOTE K

Income Taxes

The components of the provision for income taxes are as

follows:

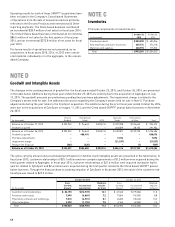

(in thousands) 2015 2014 2013

Current:

U.S. Federal $ 299,557 $ 264,533 $ 231,359

State 39,817 34,034 30,671

Foreign 10,526 7,759 5,334

Total current 349,900 306,326 267,364

Deferred:

U.S. Federal 18,451 8,756 1,080

State 1,070 873 (194)

Foreign 458 171 181

Total deferred 19,979 9,800 1,067

Total provision for

income taxes $ 369,879 $ 316,126 $ 268,431

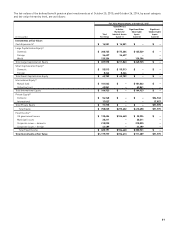

Deferred income taxes refl ect the net tax effects of temporary

differences between the carrying amounts of assets and lia-

bilities for fi nancial reporting purposes and the amounts used

for income tax purposes. The Company believes that, based

upon its lengthy and consistent history of profi table opera-

tions, it is more likely than not the net deferred tax assets of

$22.8 million will be realized on future tax returns, primarily

from the generation of future taxable income. Signifi cant

components of the deferred income tax liabilities and assets

are as follows:

October 25, October 26,

(in thousands) 2015 2014

Deferred tax liabilities:

Goodwill and intangible assets $ (213,312) $ (168,167)

Tax over book depreciation and

basis differences (94,496) (85,623)

Other, net (18,788) (30,252)

Deferred tax assets:

Pension and post-retirement benefi ts 154,306 152,392

Employee compensation

related liabilities 109,061 101,706

Marketing and promotional accruals 37,603 28,703

Other accruals not currently deductible – 13,010

Other, net 48,432 51,082

Net deferred tax assets $ 22,806 $ 62,851