Hormel Foods 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

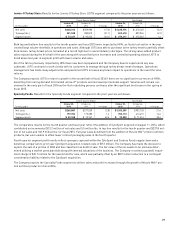

17

adjusted(1) diluted earnings per share(2) were $0.74 compared

to $0.63 for the same quarter last year. Non-GAAP adjusted(1)

net earnings attributable to the Company(2) for fi scal 2015

increased 18.5 percent to $714.4 million from $602.7 million

in the same period of fi scal 2014. Non-GAAP adjusted(1) diluted

earnings per share(2) for the same period increased 18.4 per-

cent to $2.64 compared to $2.23 last year.

(1) The non-GAAP fi nancial measurements are presented to provide

investors additional information to facilitate the comparison of past

and present operations. The non-GAAP fi nancial measurements are

used for internal purposes to evaluate the results of operations and

to measure a component of certain employee incentive plans in fi scal

2015. Non-GAAP measurements are not intended to be a substitute

for U.S. GAAP measurements in analyzing fi nancial performance.

These non-GAAP measurements are not in accordance with generally

accepted accounting principles and may be different from non-GAAP

measures used by other companies.

(2) Adjusted net earnings and diluted net earnings per share exclude

charges relating to the closure of the Stockton, California, manufac-

turing facility and the exit from international joint venture businesses

in the fi rst quarter, and charges relating to the goodwill impairment

charge associated with Diamond Crystal Brands and an adjustment to

the contingent consideration accrual for CytoSport in the fourth quar-

ter of fi scal 2015. The tables below show the calculations to reconcile

from the non-GAAP adjusted measures to the GAAP measures.

The Company’s fi scal year consisted of 52 weeks in 2015,

2014, and 2013. Fiscal year 2016 will consist of 53 weeks.

FISCAL YEARS 2015 AND 2014:

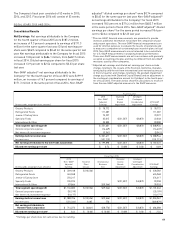

Consolidated Results

Net Earnings: Net earnings attributable to the Company

for the fourth quarter of fi scal 2015 were $187.2 million,

an increase of 9.3 percent compared to earnings of $171.3

million for the same quarter last year. Diluted earnings per

share were $0.69 compared to $0.63 for the same quarter last

year. Net earnings attributable to the Company for fi scal 2015

increased 13.8 percent to $686.1 million, from $602.7 million

in fi scal 2014. Diluted earnings per share for fi scal 2015

increased 13.9 percent to $2.54 compared to $2.23 per share

last year.

Non-GAAP adjusted(1) net earnings attributable to the

Company(2) for the fourth quarter of fi scal 2015 were $199.9

million, an increase of 16.7 percent compared to earnings of

$171.3 million in the same period of fi scal 2014. Non-GAAP

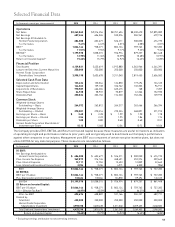

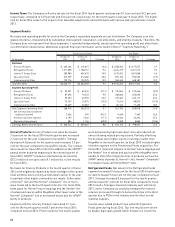

Fourth Quarter

2015 Diamond CytoSport

Non- GAAP Crystal Contingent

Adjusted Brands Consideration 2015 GAAP

(In thousands, except per share amounts) Earnings Impairment Adjustment Earnings

Grocery Products $ 78,772 $ 78,772

Refrigerated Foods 111,287 111,287

Jennie-O Turkey Store 73,227 73,227

Specialty Foods 35,015 $ (21,537) $ 8,870 22,348

International & Other 23,300 23,300

Total segment operating profi t $ 321,601 $ (21,537) $ 8,870 $ 308,934

General corporate expense (16,649) (16,649)

Net interest & investment expense (3,341) (3,341)

Earnings before income taxes $ 301,611 $ (21,537) $ 8,870 $ 288,944

Income taxes (101,713) (101,713)

Net earnings attributable to Hormel Foods Corporation $ 199,898 $ (21,537) $ 8,870 $ 187,231

Diluted net earnings per share $ 0.74 $ (0.08) $ 0.03 $ 0.69

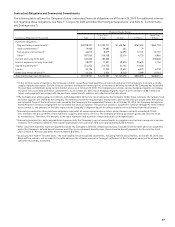

Fiscal Year 2015

2015 Diamond CytoSport

Non- GAAP Stockton International Crystal Contingent

Adjusted Plant Business Brands Consideration 2015 GAAP

(In thousands, except per share amounts) Earnings Closure Exit Impairment Adjustment Earnings

Grocery Products $ 239,108 $ (10,526) $ 228,582

Refrigerated Foods 424,968 424,968

Jennie-O Turkey Store 276,217 276,217

Specialty Foods 105,925 $ (21,537) $ 8,870 93,258

International & Other 87,864 $ (9,546) 78,318

Total segment operating profi t $ 1,134,082 $ (10,526) $ (9,546) $ (21,537) $ 8,870 $ 1,101,343

General corporate expense (35,199) (35,199)

Net interest & investment expense (10,177) (10,177)

Earnings before income taxes $ 1,088,706 $ (10,526) $ (9,546) $ (21,537) $ 8,870 $ 1,055,967

Income taxes (374,334) 3,685 770 (369,879)

Net earnings attributable to

Hormel Foods Corporation $ 714,372 $ (6,841) $ (8,776) $ (21,537) $ 8,870 $ 686,088

Diluted net earnings per share* $ 2.64 $ (0.03) $ (0.03) $ (0.08) $ 0.03 $ 2.54

*Earnings per share does not sum across due to rounding.