Hormel Foods 2015 Annual Report Download - page 16

Download and view the complete annual report

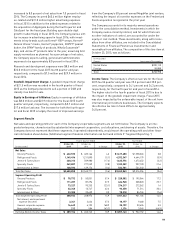

Please find page 16 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2016 Outlook: We are pleased with our momentum

heading into fi scal 2016 and expect renewed revenue growth

as the year proceeds. Lower input costs are expected to

provide a benefi t for Grocery Products and Refrigerated

Foods value-added margins, offsetting modestly lower

pork operating margins compared to fi scal 2015. Strong

demand for Applegate® natural and organic products will

be an additional growth catalyst for the Refrigerated Foods

segment. We expect the Jennie-O Turkey Store segment to

return to growth in the second half of fi scal 2016, benefi ting

from strong demand for branded Jennie-O® products and low

grain costs if there are no signifi cant recurrences of HPAI.

Specialty Foods should deliver increases through the growth

of its Muscle Milk® protein nutrition products, and we expect

the International & Other segment to achieve year-over-year

improved results through the expansion of our business in

China along with increased sales of the SPAM® and SKIPPY®

families of products.

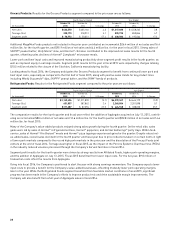

Critical Accounting Policies

This discussion and analysis of fi nancial condition and

results of operations is based upon the consolidated fi nancial

statements of Hormel Foods Corporation (the Company),

which have been prepared in accordance with U.S. generally

accepted accounting principles (GAAP). The preparation of

these fi nancial statements requires the Company to make

estimates and judgments that affect the reported amounts of

assets, liabilities, revenues and expenses, and related disclo-

sure of contingent assets and liabilities. The Company eval-

uates, on an ongoing basis, its estimates for reasonableness

as changes occur in its business environment. The Company

bases its estimates on experience, the use of independent

third-party specialists, and various other assumptions that

are believed to be reasonable under the circumstances, the

results of which form the basis for making judgments about

the carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ mate-

rially from these estimates under different assumptions or

conditions.

Critical accounting policies are defi ned as those that are

refl ective of signifi cant judgments, estimates, and uncertain-

ties, and potentially result in materially different results under

different assumptions and conditions. The Company believes

the following are its critical accounting policies:

Revenue Recognition: The Company recognizes sales when

title passes upon delivery of its products to customers, net of

applicable provisions for discounts, returns, and allowances.

Products are delivered upon receipt of customer purchase

orders with acceptable terms, including price and collectabil-

ity that is reasonably assured.

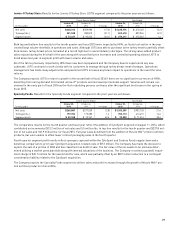

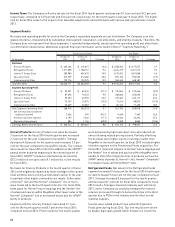

Executive Overview

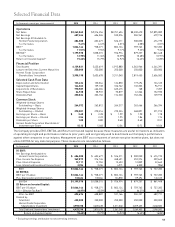

Fiscal 2015: Hormel Foods achieved record earnings for fi scal

2015. Sales for the year were $9.3 billion, a 1 percent decrease

from last year as the effects of avian infl uenza tempered sales

for the Jennie-O Turkey Store segment and price defl ation

in the pork markets impacted our Refrigerated Foods and

International & Other segments. Net earnings attributable to

the Company for fi scal 2015 increased 13.8 percent to $686.1

million, from $602.7 million in fi scal 2014. Diluted earnings

per share for fi scal 2015 increased 13.9 percent to $2.54

compared to $2.23 per share last year. Non-GAAP adjusted

net earnings for the year were $714.4 million, an increase of

18.5 percent over 2014, with all fi ve segments contributing to

the growth. Non-GAAP adjusted earnings per diluted share

were $2.64, an 18.4 percent improvement compared to last

year. (See explanation of non-GAAP fi nancial measures in the

Consolidated Results section).

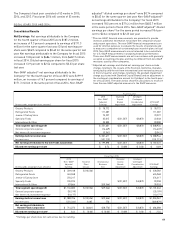

Improved performance for the Grocery Products, Refrigerated

Foods, and Specialty Foods segments drove fi nancial results

for the year. The Grocery Products segment benefi ted from

lower input costs, especially in the second half of the year,

with strong sales growth for the SPAM® family of products,

Dinty Moore® items, Hormel® hash, and Wholly Guacamole®

products in MegaMex Foods. Financial performance for the

Refrigerated Foods segment improved over last year, also

benefi ting from lower input costs for the value-added prod-

ucts in Foodservice and Meat Products. Continued strong

value-added sales, and the addition of Applegate Farms,

LLC (Applegate) were additional catalysts for growth in the

segment. Specialty Foods segment net sales and profi t

were higher, driven by the contributions of Muscle Milk®

sports nutrition products and synergies captured within the

CytoSport and Century Foods supply chain. The Jennie-O

Turkey Store segment, propelled by an excellent start through

the fi rst half of the year, delivered segment profi t ahead of last

year. Signifi cant turkey supply shortages, the result of highly

pathogenic avian infl uenza (HPAI), impacted sales, volume,

and plant operational effi ciencies in the second half of the

year. Strong demand for fresh lean ground turkey products

was a leading contributor to the year’s improved performance.

The International & Other segment saw nice growth in China

and export sales of SKIPPY® peanut butter, offsetting softer

exports of fresh pork and the SPAM® family of products which

were impacted by shipping delays caused by port issues and

further hindered by a stronger dollar. General corporate

expense was higher due to an increase in employee-related

expenses and higher professional and legal fees. Our fi nancial

performance continued to generate substantial operating cash

fl ows. We completed the acquisition of Applegate, spending a

total of $774.1 million. We announced a 16 percent increase to

our dividend after a 25 percent increase last year. The annual

dividend for 2016 will be $1.16 per share and marks the 50th

consecutive year of dividend increases.

14

Management’s Discussion and Analysis of Financial Condition

and Results of Operations