Hormel Foods 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

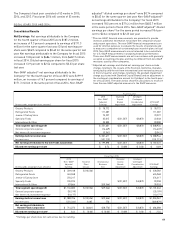

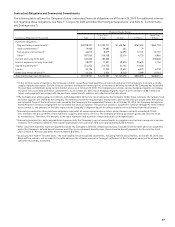

Contractual Obligations and Commercial Commitments

The following table outlines the Company’s future contractual fi nancial obligations as of October 25, 2015 (for additional informa-

tion regarding these obligations, see Note F “Long-term Debt and Other Borrowing Arrangements” and Note N “Commitments

and Contingencies”):

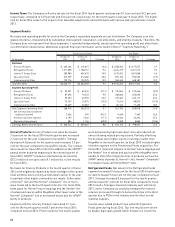

Payments Due by Periods

Less Than More Than

Contractual Obligations (in thousands) Total 1 Year 1-3 Years 3-5 Years 5 Years

Purchase obligations:

Hog and turkey commitments(1) $3,998,937 $1,339,771 $1,633,961 $763,452 $261,753

Grain commitments(1) 79,900 79,387 434 79 –

Turkey grow-out contracts(2) 66,012 8,019 14,095 12,141 31,757

Other(3) 587,063 518,158 55,314 4,725 8,866

Current and Long-term debt 435,000 185,000 – – 250,000

Interest payments on long-term debt 58,097 11,691 20,625 20,625 5,156

Capital expenditures(4) 254,252 216,750 24,102 13,400 –

Leases 35,194 11,250 10,627 6,579 6,738

Other long-term liabilities(5) (6) 64,446 5,056 8,540 7,089 43,761

Total Contractual Cash Obligations $5,578,901 $2,375,082 $1,767,698 $828,090 $608,031

(1) In the normal course of business, the Company commits to purchase fi xed quantities of livestock and grain from producers to ensure a steady

supply of production inputs. Certain of these contracts are based on market prices at the time of delivery, for which the Company has estimated

the purchase commitment using current market prices as of October 25, 2015. The Company also utilizes various hedging programs to manage

the price risk associated with these commitments. As of October 25, 2015, these hedging programs result in a net decrease of $6.5 million in

future cash payments associated with the purchase commitments, which is not refl ected in the table above.

(2)

The Company also utilizes grow-out contracts with independent farmers to raise turkeys for the Company. Under these contracts, the turkeys, feed,

and other supplies are owned by the Company. The farmers provide the required labor and facilities, and receive a fee per pound when the turkeys

are delivered. Some of the facilities are sub-leased by the Company to the independent farmers. As of October 25, 2015, the Company had approxi-

mately 90 active contracts ranging from two to twenty-fi ve years in duration. The grow-out activity is assumed to continue through the term of these

active contracts, and amounts in the table represent the Company’s obligation based on turkeys expected to be delivered from these farmers.

(3) Amounts presented for other purchase obligations represent all known open purchase orders and all known contracts exceeding $1.0 mil-

lion, related to the procurement of raw materials, supplies, and various services. The Company primarily purchases goods and services on an

as-needed basis. Therefore, the amounts in the table represent only a portion of expected future cash expenditures.

(4) Amounts presented for capital expenditures represent only the Company’s current commitments to complete construction in progress at various

locations. The Company estimates total capital expenditures for fi scal year 2016 to be approximately $250.0 million.

(5) Other long-term liabilities represent payments under the Company’s deferred compensation plans. Excluded from the table above are payments

under the Company’s defi ned benefi t pension and other post-retirement benefi t plans. (See estimated benefi t payments for the next ten fi scal

years in Note G “Pension and Other Post-retirement Benefi ts.”)

(6)

As discussed in Note K “Income Taxes,” the total liability for unrecognized tax benefi ts, including interest and penalties, at October 25, 2015, was

$24.6 million, which is not included in the table above as the ultimate amount or timing of settlement of the Company’s reserves for income taxes

cannot be reasonably estimated.