Hormel Foods 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

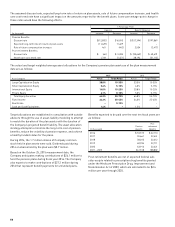

55

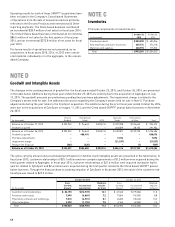

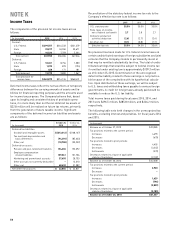

Investments in and receivables from affi liates consists of the following:

October 25, October 26,

(in thousands) Segment % Owned 2015 2014

MegaMex Foods, LLC Grocery Products 50% $ 200,110 $ 208,221

Foreign Joint Ventures International & Other Various (26 – 50%) 58,888 56,230

Total $ 258,998 $ 264,451

Equity in earnings of affi liates consists of the following:

(in thousands) Segment 2015 2014 2013

MegaMex Foods, LLC Grocery Products $ 26,849 $ 14,415 $ 17,261

Foreign Joint Ventures International & Other (2,962) 3,170 3,252

Total $ 23,887 $ 17,585 $ 20,513

Equity in earnings in fi scal year 2015 included charges related to the exit from international joint venture businesses. Dividends

received from affi liates for the fi scal years ended October 25, 2015, October 26, 2014, and October 27, 2013, were $37.3 million,

$22.8 million, and $34.0 million, respectively. The Company recognized a basis difference of $21.3 million associated with the

formation of MegaMex Foods, LLC, of which $16.2 million is remaining as of October 25, 2015. This difference is being amortized

through equity in earnings of affi liates.

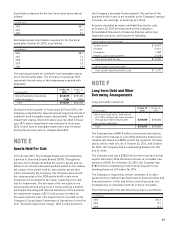

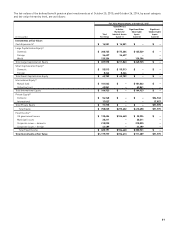

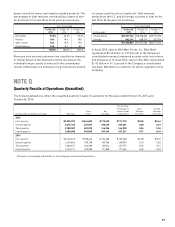

NOTE J

Accumulated Other Comprehensive Loss

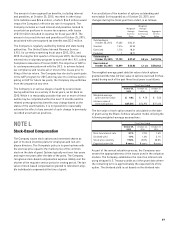

Components of accumulated other comprehensive loss are as follows:

Accumulated

Foreign Deferred Other

Currency Pension & Gain (Loss) Comprehensive

(in thousands) Translation Other Benefi ts – Hedging Loss

Balance at October 28, 2012 $ 12,415 $ (345,465) $ 9,481 $ (323,569)

Unrecognized gains (losses):

Gross (3,024) 273,408 (18,329) 252,055

Tax effect – (102,846) 6,898 (95,948)

Reclassifi cation into net earnings:

Gross – 35,327(1) (5,871)(2) 29,456

Tax effect – (13,425) 2,217 (11,208)

Net of tax amount (3,024) 192,464 (15,085) 174,355

Balance at October 27, 2013 $ 9,391 $ (153,001) $ (5,604) $ (149,214)

Unrecognized gains (losses):

Gross (1,911) (91,684) (16,701) (110,296)

Tax effect – 34,737 6,305 41,042

Reclassifi cation into net earnings:

Gross – 6,387(1) 10,925(2) 17,312

Tax effect – (2,425) (4,119) (6,544)

Net of tax amount (1,911) (52,985) (3,590) (58,486)

Balance at October 26, 2014 $ 7,480 $ (205,986) $ (9,194) $ (207,700)

Unrecognized gains (losses):

Gross (6,116) (46,389) 3,409 (49,096)

Tax effect – 17,492 (1,285) 16,207

Reclassifi cation into net earnings:

Gross – 12,259(1) 12,369(2) 24,628

Tax effect – (4,642) (4,670) (9,312)

Net of tax amount (6,116) (21,280) 9,823 (17,573)

Purchase of additional ownership of noncontrolling interest (395) – – (395)

Balance at October 25, 2015 $ 969 $ (227,266) $ 629 $ (225,668)

(1) Included in computation of net periodic cost (see Note G for additional details).

(2) Included in cost of products sold in the Consolidated Statements of Operations.