Hormel Foods 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

from the Company’s 50 percent owned MegaMex joint venture,

refl ecting the impact of incentive expenses on the Fresherized

Foods acquisition recognized in the prior year.

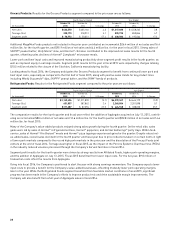

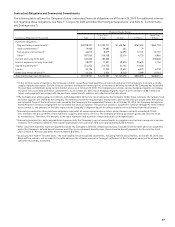

The Company accounts for its majority-owned operations

under the consolidation method. Investments in which the

Company owns a minority interest, and for which there are

no other indicators of control, are accounted for under the

equity or cost method. These investments, along with receiv-

ables from other affi liates, are included in the Consolidated

Statements of Financial Position as investments in and

receivables from affi liates. The composition of this line item at

October 25, 2015, was as follows:

(in thousands)

Country Investments/Receivables

United States $200,110

Foreign 58,888

Total $258,998

Income Taxes: The Company’s effective tax rate for the fi scal

2015 fourth quarter and year was 35.2 percent and 35.0 per-

cent, respectively, compared to 34.1 percent and 34.3 percent,

respectively, for the fourth quarter and year in fi scal 2014.

The higher rate for the fourth quarter of fi scal 2015 is due to

the impact of the goodwill impairment charge. Fiscal 2015

was also impacted by the unfavorable impact of the exit from

international joint venture businesses. The Company expects

the effective tax rate in fi scal 2016 to be approximately

34.0 percent.

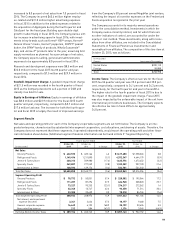

increased to 8.0 percent of net sales from 7.0 percent in fi scal

2014. The Company incurred $40.4 million higher employ-

ee-related and $31.0 million higher advertising expenses

in fi scal 2015 in addition to the added expenses related to

the acquisition of Applegate during the fourth quarter and

CytoSport for the fi scal year. Building upon double-digit

growth in advertising in fi scal 2015, the Company plans a sim-

ilar increase in advertising spend in fi scal 2016, with invest-

ments in key brands such as Hormel® REV® wraps, Hormel®

Natural Choice® meats, Hormel® pepperoni, SKIPPY® peanut

butter, the SPAM® family of products, Wholly Guacamole®

dips, and Jennie-O® products later in the year, assuming bird

supply normalizes as planned. As a percentage of net sales,

the Company expects selling, general and administrative

expenses to be approximately 8.0 percent in fi scal 2016.

Research and development expenses were $8.5 million and

$32.0 million for the fi scal 2015 fourth quarter and year,

respectively, compared to $7.5 million and $29.9 million in

fi scal 2014.

Goodwill Impairment Charge: A goodwill impairment charge

of $21.5 million was recorded in the fourth quarter of fi scal

2015 as the Company decided to sell a portion of DCB and

classify it as held for sale.

Equity in Earnings of Affi liates: Equity in earnings of affi liates

was $8.0 million and $23.9 million for the fi scal 2015 fourth

quarter and year, respectively, compared to $5.7 million and

$17.6 million last year. The increase for both the fourth quar-

ter and fi scal 2015 is largely the result of improved earnings

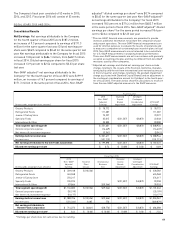

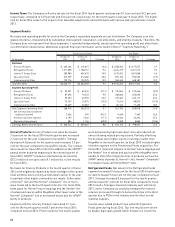

Segment Results

Net sales and operating profi ts for each of the Company’s reportable segments are set forth below. The Company is an inte-

grated enterprise, characterized by substantial intersegment cooperation, cost allocations, and sharing of assets. Therefore, the

Company does not represent that these segments, if operated independently, would report the operating profi t and other fi nan-

cial information shown below. (Additional segment fi nancial information can be found in Note P “Segment Reporting.”)

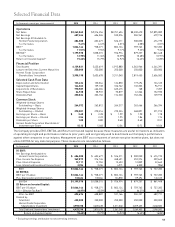

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net Sales

Grocery Products $ 422,570 $ 405,166 4.3 $ 1,617,680 $ 1,558,265 3.8

Refrigerated Foods 1,149,496 1,211,890 (5.1) 4,372,347 4,644,179 (5.9)

Jennie-O Turkey Store 420,312 509,980 (17.6) 1,635,776 1,672,452 (2.2)

Specialty Foods 269,887 277,559 (2.8) 1,103,359 907,120 21.6

International & Other 138,593 139,176 (0.4) 534,701 534,240 0.1

Total Net Sales $ 2,400,858 $ 2,543,771 (5.6) $ 9,263,863 $ 9,316,256 (0.6)

Segment Operating Profi t

Grocery Products $ 78,772 $ 50,051 57.4 $ 228,582 $ 195,064 17.2

Refrigerated Foods 111,287 87,296 27.5 424,968 338,020 25.7

Jennie-O Turkey Store 73,227 95,253 (23.1) 276,217 272,362 1.4

Specialty Foods 22,348 13,747 62.6 93,258 71,514 30.4

International & Other 23,300 22,629 3.0 78,318 84,745 (7.6)

Total Segment Operating Profi t 308,934 268,976 14.9 1,101,343 961,705 14.5

Net interest and investment

expense (income) 3,341 2,626 27.2 10,177 9,468 7.5

General corporate expense 16,649 6,192 168.9 35,199 33,434 5.3

Noncontrolling interest 212 584 (63.7) 1,176 3,349 (64.9)

Earnings Before Income Taxes $ 289,156 $ 260,742 10.9 $ 1,057,143 $ 922,152 14.6