Hormel Foods 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

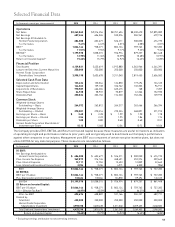

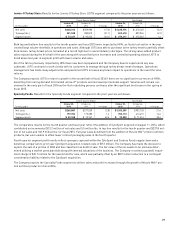

Jennie-O Turkey Store: Results for the Jennie-O Turkey Store (JOTS) segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 420,312 $ 509,980 (17.6) $ 1,635,776 $ 1,672,452 (2.2)

Tonnage (lbs.) 221,528 280,810 (21.1) 849,418 892,965 (4.9)

Segment profi t $ 73,227 $ 95,253 (23.1) $ 276,217 $ 272,362 1.4

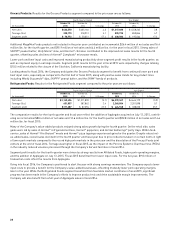

Both top and bottom-line results for the fourth quarter and fi scal 2015 were impacted by HPAI, as fl ocks lost earlier in the year

created large volume shortfalls in operations and sales. Although JOTS was able to purchase some turkey meat to partially offset

fl ock losses, turkey breast prices remained at a record high due to overall industry shortages. The strong value-added product

sales enjoyed during the fi rst half of the year along with second half price increases and controlled spending allowed JOTS to

fi nish above last year in segment profi t with lower volume and sales.

All of the farms previously impacted by HPAI have now been repopulated and the Company has not experienced any new

outbreaks. JOTS continues to work closely with its customers to manage through turkey breast meat shortages. Operations

management has made many adjustments and positioned JOTS to lessen any future impact to operations in the event the virus

returns.

The Company expects JOTS to return to growth in the second half of fi scal 2016 if there are no signifi cant recurrences of HPAI,

benefi ting from strong demand for branded Jennie-O® products and increased promotional support. Volumes will remain con-

strained in the early part of fi scal 2016 as the fl ock rebuilding process continues after the signifi cant bird losses in the spring of

fi scal 2015.

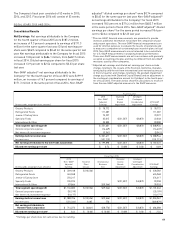

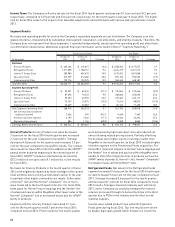

Specialty Foods: Results for the Specialty Foods segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 269,887 $ 277,559 (2.8) $ 1,103,359 $ 907,120 21.6

Tonnage (lbs.) 177,784 175,285 1.4 702,110 612,415 14.6

Segment profi t $ 22,348 $ 13,747 62.6 $ 93,258 $ 71,514 30.4

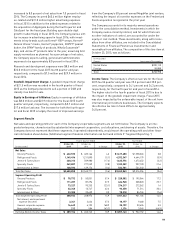

The comparative results for the fourth quarter and fi scal year refl ect the addition of CytoSport acquired on August 11, 2014, which

contributed an incremental $13.2 million of net sales and 5.5 million lbs. to top-line results for the fourth quarter and $237.8 mil-

lion of net sales and 102.9 million lbs. for fi scal 2015. Full year sales benefi ted from the addition of Muscle Milk® protein nutrition

products, but were unable to offset lower contract packaging sales in the fourth quarter.

Fourth quarter segment profi t results refl ect synergies captured within the CytoSport and Century Foods supply chain and a

benefi cial comparison to prior year CytoSport acquisition-related costs of $9.3 million. The Company has made the decision to

explore the sale of a portion of DCB and has classifi ed it as held for sale. The fair value of the net assets to be sold was deter-

mined utilizing a market participant bid along with internal valuations of the business. The Company recorded a goodwill impair-

ment charge of $21.5 million for the assets held for sale, which was partially offset by an $8.9 million reduction to a contingent

consideration liability related to the CytoSport acquisition.

The Company expects the Specialty Foods segment to deliver sales and profi t increases through the growth of Muscle Milk® pro-

tein nutrition products in fi scal 2016.

21

Jennie-O Turkey Store: Results for the Jennie-O Turkey Store (JOTS) segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 420,312 $ 509,980 (17.6) $ 1,635,776 $ 1,672,452 (2.2)

Tonnage (lbs.) 221,528 280,810 (21.1) 849,418 892,965 (4.9)

Segment profit $ 73,227 $ 95,253 (23.1) $ 276,217 $ 272,362 1.4

Both top and bottom-line results for the fourth quarter and fiscal 2015 were impacted by HPAI, as flocks lost earlier in the year

created large volume shortfalls in operations and sales. Although JOTS was able to purchase some turkey meat to partially offset

flock losses, turkey breast prices remained at a record high due to overall industry shortages. The strong value-added product

sales enjoyed during the first half of the year along with second half price increases and controlled spending allowed JOTS to

finish above last year in segment profit with lower volume and sales.

All of the farms previously impacted by HPAI have now been repopulated and the Company has not experienced any new

outbreaks. JOTS continues to work closely with its customers to manage through turkey breast meat shortages. Operations

management has made many adjustments and positioned JOTS to lessen any future impact to operations in the event the virus

returns.

The Company expects JOTS to return to growth in the second half of fiscal 2016 if there are no significant recurrences of HPAI,

benefiting from strong demand for branded Jennie-O® products and increased promotional support. Volumes will remain con-

strained in the early part of fiscal 2016 as the flock rebuilding process continues after the significant bird losses in the spring of

fiscal 2015.

Specialty Foods: Results for the Specialty Foods segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 269,887 $ 277,559 (2.8) $ 1,103,359 $ 907,120 21.6

Tonnage (lbs.) 177,784 175,285 1.4 702,110 612,415 14.6

Segment profit $ 22,348 $ 13,747 62.6 $ 93,258 $ 71,514 30.4

The comparative results for the fourth quarter and fiscal year reflect the addition of CytoSport acquired on August 11, 2014, which

contributed an incremental $13.2 million of net sales and 5.5 million lbs. to top-line results for the fourth quarter and $237.8 mil-

lion of net sales and 102.9 million lbs. for fiscal 2015. Full year sales benefited from the addition of Muscle Milk® protein nutrition

products, but were unable to offset lower contract packaging sales in the fourth quarter.

Fourth quarter segment profit results reflect synergies captured within the CytoSport and Century Foods supply chain and a

beneficial comparison to prior year CytoSport acquisition-related costs of $9.3 million. The Company has made the decision to

explore the sale of a portion of DCB and has classified it as held for sale. The fair value of the net assets to be sold was deter-

mined utilizing a market participant bid along with internal valuations of the business. The Company recorded a goodwill impair-

ment charge of $21.5 million for the assets held for sale, which was partially offset by an $8.9 million reduction to a contingent

consideration liability related to the CytoSport acquisition.

The Company expects the Specialty Foods segment to deliver sales and profit increases through the growth of Muscle Milk® pro-

tein nutrition products in fiscal 2016.