Hormel Foods 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

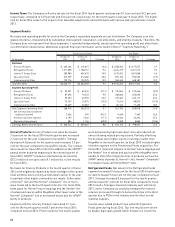

26

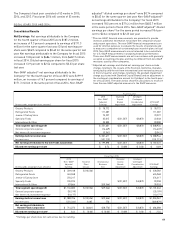

General corporate expense for the fourth quarter and fi scal

2014 was $6.2 million and $33.4 million, respectively, com-

pared to $7.5 million and $26.7 million for the comparable

periods of fi scal 2013. The lower expense for the fourth

quarter refl ects lower salary and pension related expenses

compared to fi scal 2013. General corporate expense for fi scal

2014 was higher compared to fi scal 2013, primarily the result

of a bad debt incurred in the third quarter.

Net earnings attributable to the Company’s noncontrolling

interests were $0.6 million and $3.3 million for the fourth

quarter and fi scal 2014, respectively, compared to $1.1 million

and $3.9 million for the comparable periods of fi scal 2013.

Precept Foods generated lower results for both the fourth

quarter and full year of fi scal 2014 compared to fi scal 2013.

This joint venture was dissolved at the end of fi scal year

2014. For fi scal 2014, these declines were partially offset by

improved results from the Company’s China operations.

RELATED PARTY TRANSACTIONS

During the fourth quarter of fi scal 2015, the company pur-

chased 400,000 shares of common stock from The Hormel

Foundation at $62.32 per share, representing the average

closing price for the three days of September 15, September

16, and September 17, 2015. Settlement took place on

September 18, 2015.

The Company was not party to any other material related

party transactions during fi scal years 2015, 2014, or 2013.

Liquidity and Capital Resources

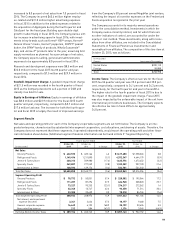

Cash and cash equivalents were $347.2 million at the end of

fi scal 2015 compared to $334.2 million at the end of fi scal

2014 and $434.0 million at the end of fi scal 2013.

During fi scal 2015, cash provided by operating activities was

$992.0 million compared to $746.9 million in fi scal 2014 and

$637.8 million in fi scal 2013. Continued higher earnings and

net positive working capital changes largely generated the

increase in fi scal 2015.

Cash used in investing activities increased to $900.9 million

in fi scal 2015 from $616.8 million in fi scal 2014 and $691.1

million in fi scal 2013. Fiscal 2015 included $774.1 used to

purchase Applegate Farms, LLC in the third quarter. The

fourth quarter of fi scal 2014 included $424.3 million used to

purchase CytoSport Holdings, Inc. and fi scal 2014 included

$41.9 million used to purchase the China based SKIPPY®

peanut butter business in Weifang, China from Unilever United

States Inc. Fiscal 2013 included $665.4 million used to acquire

the U.S. based SKIPPY® peanut butter business. In anticipation

of that purchase, the Company liquidated its marketable secu-

rities portfolio at the end of the fi rst quarter of fi scal 2013,

which generated $77.6 million in cash. Capital expenditures in

fi scal 2015 decreased to $144.1 million, from $159.1 million in

2014 and increased from $106.8 million in 2013. The primary

reason for lower capital expenditures in fi scal 2015 compared

to fi scal 2014 was the Company’s decision to delay the addi-

tion of capacity at JOTS in the face of the lower turkey supply

in fi scal 2015 due to the impacts of HPAI. Capital expenditures

for fi scal 2016 are estimated to be approximately $250.0 mil-

lion as several projects in process during fi scal 2015 will be

completed, including construction of the Company’s new plant

in Jiaxing, China.

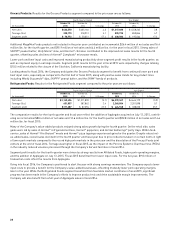

Cash used in fi nancing activities was $70.6 million in fi scal

2015 compared to $229.4 million in fi scal 2014 and $195.5

million in fi scal 2013. In the third quarter of fi scal 2015, in

connection with the purchase of Applegate, the Company

borrowed $300.0 million under a term loan facility and $50.0

million under a revolving credit facility, of which $165.0 million

was paid down in the fourth quarter. On March 16, 2015, the

Company purchased the remaining 19.29% ownership interest

in its Shanghai Hormel Foods Corporation joint venture from

the minority partner Shanghai Shangshi Meat Products Co.

Ltd., resulting in 100.0% ownership at the end of the second

quarter. The interest was purchased with $11.7 million in

cash, along with the transfer of land use rights and buildings

held by the joint venture.

The Company used $24.9 million for common stock repur-

chases during fi scal 2015, compared to $58.9 million in

fi scal 2014 and $70.8 million in fi scal 2013. During fi scal

year 2015, 0.4 million shares were repurchased from The

Hormel Foundation at the average closing price for the three

days of September 15, September 16, and September 17,

2015, or $62.32. On January 29, 2013, the Company’s Board

of Directors had authorized the repurchase of 10.0 million

shares of its common stock with no expiration date. At of the

end of fi scal 2015, there were 7.8 million shares remaining for

repurchase under that authorization.

Cash dividends paid to the Company’s shareholders continues

to be an ongoing fi nancing activity for the Company, with

$250.8 million in dividends paid in fi scal 2015, compared to

$203.2 million in the fi scal 2014 and $174.3 million in fi scal

2013. The dividend rate was $1.00 per share in 2015, which

refl ected a 25.0 percent increase over the fi scal 2014 rate

of $0.80 per share. The Company has paid dividends for 349

consecutive quarters and expects to continue doing so in the

future. The annual dividend rate for fi scal 2016 was increased

16.0 percent to $1.16 per share, representing the 50th consec-

utive annual dividend increase.

Cash fl ows from operating activities continue to provide the

Company with its principal source of liquidity. The Company

does not anticipate a signifi cant risk to cash fl ows from

this source in the foreseeable future because the Company

operates in a relatively stable industry and has strong brands

across many product lines.

The Company takes pride in its legacy of increasing the divi-

dend returned to shareholders year-after-year. The Company

remains focused on growing the business through supporting

innovation to drive organic growth, along with strategic

acquisitions. Reinvesting in the business is a top priority, with

employee safety and food safety taking top priority. Capital

spending to enhance and expand current operations will also

be a signifi cant cash outfl ow in fi scal 2016.

26

General corporate expense for the fourth quarter and fiscal

2014 was $6.2 million and $33.4 million, respectively, com-

pared to $7.5 million and $26.7 million for the comparable

periods of fiscal 2013. The lower expense for the fourth

quarter reflects lower salary and pension related expenses

compared to fiscal 2013. General corporate expense for fiscal

2014 was higher compared to fiscal 2013, primarily the result

of a bad debt incurred in the third quarter.

Net earnings attributable to the Company’s noncontrolling

interests were $0.6 million and $3.3 million for the fourth

quarter and fiscal 2014, respectively, compared to $1.1 million

and $3.9 million for the comparable periods of fiscal 2013.

Precept Foods generated lower results for both the fourth

quarter and full year of fiscal 2014 compared to fiscal 2013.

This joint venture was dissolved at the end of fiscal year

2014. For fiscal 2014, these declines were partially offset by

improved results from the Company’s China operations.

RELATED PARTY TRANSACTIONS

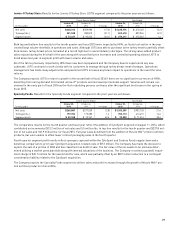

During the fourth quarter of fiscal 2015, the company pur-

chased 400,000 shares of common stock from The Hormel

Foundation at $62.32 per share, representing the average

closing price for the three days of September 15, September

16, and September 17, 2015. Settlement took place on

September 18, 2015.

The Company was not party to any other material related

party transactions during fiscal years 2015, 2014, or 2013.

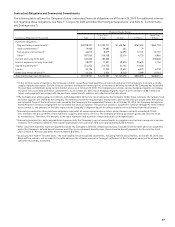

Liquidity and Capital Resources

Cash and cash equivalents were $347.2 million at the end of

fiscal 2015 compared to $334.2 million at the end of fiscal

2014 and $434.0 million at the end of fiscal 2013.

During fiscal 2015, cash provided by operating activities was

$992.0 million compared to $746.9 million in fiscal 2014 and

$637.8 million in fiscal 2013. Continued higher earnings and

net positive working capital changes largely generated the

increase in fiscal 2015.

Cash used in investing activities increased to $900.9 million

in fiscal 2015 from $616.8 million in fiscal 2014 and $691.1

million in fiscal 2013. Fiscal 2015 included $774.1 used to

purchase Applegate Farms, LLC in the third quarter. The

fourth quarter of fiscal 2014 included $424.3 million used to

purchase CytoSport Holdings, Inc. and fiscal 2014 included

$41.9 million used to purchase the China based SKIPPY®

peanut butter business in Weifang, China from Unilever United

States Inc. Fiscal 2013 included $665.4 million used to acquire

the U.S. based SKIPPY® peanut butter business. In anticipation

of that purchase, the Company liquidated its marketable secu-

rities portfolio at the end of the first quarter of fiscal 2013,

which generated $77.6 million in cash. Capital expenditures in

fiscal 2015 decreased to $144.1 million, from $159.1 million in

2014 and increased from $106.8 million in 2013. The primary

reason for lower capital expenditures in fiscal 2015 compared

to fiscal 2014 was the Company’s decision to delay the addi-

tion of capacity at JOTS in the face of the lower turkey supply

in fiscal 2015 due to the impacts of HPAI. Capital expenditures

for fiscal 2016 are estimated to be approximately $250.0 mil-

lion as several projects in process during fiscal 2015 will be

completed, including construction of the Company’s new plant

in Jiaxing, China.

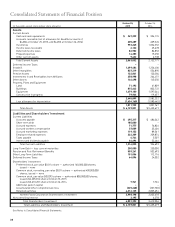

Cash used in financing activities was $70.6 million in fiscal

2015 compared to $229.4 million in fiscal 2014 and $195.5

million in fiscal 2013. In the third quarter of fiscal 2015, in

connection with the purchase of Applegate, the Company

borrowed $300.0 million under a term loan facility and $50.0

million under a revolving credit facility, of which $165.0 million

was paid down in the fourth quarter. On March 16, 2015, the

Company purchased the remaining 19.29% ownership interest

in its Shanghai Hormel Foods Corporation joint venture from

the minority partner Shanghai Shangshi Meat Products Co.

Ltd., resulting in 100.0% ownership at the end of the second

quarter. The interest was purchased with $11.7 million in

cash, along with the transfer of land use rights and buildings

held by the joint venture.

The Company used $24.9 million for common stock repur-

chases during fiscal 2015, compared to $58.9 million in

fiscal 2014 and $70.8 million in fiscal 2013. During fiscal

year 2015, 0.4 million shares were repurchased from The

Hormel Foundation at the average closing price for the three

days of September 15, September 16, and September 17,

2015, or $62.32. On January 29, 2013, the Company’s Board

of Directors had authorized the repurchase of 10.0 million

shares of its common stock with no expiration date. As of the

end of fiscal 2015, there were 7.8 million shares remaining for

repurchase under that authorization.

Cash dividends paid to the Company’s shareholders continues

to be an ongoing financing activity for the Company, with

$250.8 million in dividends paid in fiscal 2015, compared to

$203.2 million in the fiscal 2014 and $174.3 million in fiscal

2013. The dividend rate was $1.00 per share in 2015, which

reflected a 25.0 percent increase over the fiscal 2014 rate

of $0.80 per share. The Company has paid dividends for 349

consecutive quarters and expects to continue doing so in the

future. The annual dividend rate for fiscal 2016 was increased

16.0 percent to $1.16 per share, representing the 50th consec-

utive annual dividend increase.

Cash flows from operating activities continue to provide the

Company with its principal source of liquidity. The Company

does not anticipate a significant risk to cash flows from

this source in the foreseeable future because the Company

operates in a relatively stable industry and has strong brands

across many product lines.

The Company takes pride in its legacy of increasing the divi-

dend returned to shareholders year-after-year. The Company

remains focused on growing the business through supporting

innovation to drive organic growth, along with strategic

acquisitions. Reinvesting in the business is a top priority, with

employee safety and food safety taking top priority. Capital

spending to enhance and expand current operations will also

be a significant cash outflow in fiscal 2016.