Hormel Foods 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

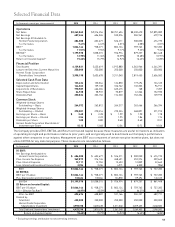

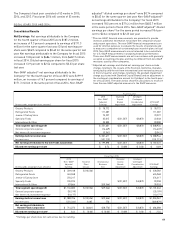

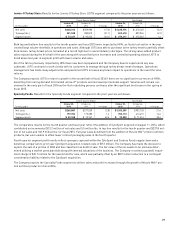

Grocery Products: Results for the Grocery Products segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 422,570 $ 405,166 4.3 $ 1,617,680 $ 1,558,265 3.8

Tonnage (lbs.) 230,170 218,912 5.1 890,735 850,844 4.7

Segment profi t $ 78,772 $ 50,051 57.4 $ 228,582 $ 195,064 17.2

Additional MegaMex Foods products not included in the prior year contributed an incremental $26.4 million of net sales and 16.4

million lbs. for the fourth quarter, and $95.9 million of net sales and 64.4 million lbs. for the year in fi scal 2015. Strong sales of

SKIPPY® peanut butter, Dinty Moore® stew, and Hormel® chili also contributed to the improved net sales results for the fourth

quarter, offsetting sales declines of Hormel Compleats® microwave meals.

Lower pork and beef input costs and improved manufacturing productivity drove segment profi t results in the fourth quarter, as

well as improved equity in earnings results. Segment profi t results for the year in fi scal 2015 were impacted by charges totaling

$10.5 million related to the closure of the Stockton, California manufacturing facility.

Looking ahead to fi scal 2016, the Company anticipates the Grocery Products segment to benefi t from continued lower pork and

beef input costs, especially as compared to the fi rst half of fi scal 2015, along with positive sales trends for key product lines

including Wholly Guacamole® dips, SKIPPY® peanut butter, and the SPAM® family of products.

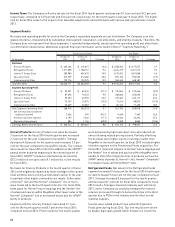

Refrigerated Foods: Results for the Refrigerated Foods segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 1,149,496 $ 1,211,890 (5.1) $ 4,372,347 $ 4,644,179 (5.9)

Tonnage (lbs.) 601,857 587,862 2.4 2,368,804 2,351,898 0.7

Segment profi t $ 111,287 $ 87,296 27.5 $ 424,968 $ 338,020 25.7

The comparative results for the fourth quarter and fi scal year refl ect the addition of Applegate acquired on July 13, 2015, contrib-

uting an incremental $80.4 million of net sales and 12.6 million lbs. for the fourth quarter and $92.8 million of net sales and 14.6

million lbs. for fi scal 2015.

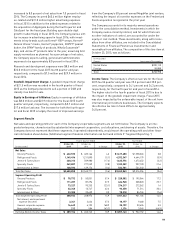

Many of the Company’s value-added products enjoyed strong sales growth during the fourth quarter. On the retail side, sales

gains were led by sales of Hormel® refrigerated entrees, Hormel® pepperoni, and Hormel Gatherings® party trays. Within food-

service, sales of Hormel® Fire Braised™ meats and Hormel® pizza toppings experienced gains for the quarter. Despite robust val-

ue-added sales, overall sales declined for the fourth quarter and fi scal year due to price reductions taken on certain items in light

of lower pork markets compared to the record high pork markets in the prior year and the dissolution of the Precept Foods joint

venture at the end of fi scal 2014. Tonnage was higher in fi scal 2015, as the impact of the Porcine Epidemic Diarrhea Virus (PEDv)

in the industry reduced volumes processed through the Company’s harvest facilities in fi scal 2014.

Segment profi t results for the fourth quarter were driven by strong results from Affi liated Foods, higher pork operating margins,

and the addition of Applegate on July 13, 2015. Fiscal 2015 benefi tted from lower input costs. For the full year, $9.0 million of

transaction costs offset the results from Applegate.

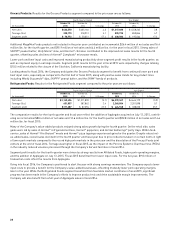

Going into fi scal 2016, the Company is positioned to start the year with strong earnings momentum. The Company expects lower

input costs to provide a benefi t for the Company’s value-added businesses, offsetting modestly lower pork operating margins

later in the year. While the Refrigerated Foods segment benefi ted from favorable market conditions in fi scal 2015, signifi cant

progress has been made in the Company’s efforts to improve product mix and drive sustainable margin improvements. The

Company will also benefi t from a full year of Applegate sales in fi scal 2016.

20

Grocery Products: Results for the Grocery Products segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 422,570 $ 405,166 4.3 $ 1,617,680 $ 1,558,265 3.8

Tonnage (lbs.) 230,170 218,912 5.1 890,735 850,844 4.7

Segment profit $ 78,772 $ 50,051 57.4 $ 228,582 $ 195,064 17.2

Additional MegaMex Foods products not included in the prior year contributed an incremental $26.4 million of net sales and 16.4

million lbs. for the fourth quarter, and $95.9 million of net sales and 64.4 million lbs. for the year in fiscal 2015. Strong sales of

SKIPPY® peanut butter, Dinty Moore® stew, and Hormel® chili also contributed to the improved net sales results for the fourth

quarter, offsetting sales declines of Hormel® Compleats® microwave meals.

Lower pork and beef input costs and improved manufacturing productivity drove segment profit results in the fourth quarter, as

well as improved equity in earnings results. Segment profit results for the year in fiscal 2015 were impacted by charges totaling

$10.5 million related to the closure of the Stockton, California manufacturing facility.

Looking ahead to fiscal 2016, the Company anticipates the Grocery Products segment to benefit from continued lower pork and

beef input costs, especially as compared to the first half of fiscal 2015, along with positive sales trends for key product lines

including Wholly Guacamole® dips, SKIPPY® peanut butter, and the SPAM® family of products.

Refrigerated Foods: Results for the Refrigerated Foods segment compared to the prior year are as follows:

Fourth Quarter Ended Year Ended

October 25, October 26, October 25, October 26,

(in thousands) 2015 2014 % Change 2015 2014 % Change

Net sales $ 1,149,496 $ 1,211,890 (5.1) $ 4,372,347 $ 4,644,179 (5.9)

Tonnage (lbs.) 601,857 587,862 2.4 2,368,804 2,351,898 0.7

Segment profit $ 111,287 $ 87,296 27.5 $ 424,968 $ 338,020 25.7

The comparative results for the fourth quarter and fiscal year reflect the addition of Applegate acquired on July 13, 2015, contrib-

uting an incremental $80.4 million of net sales and 12.6 million lbs. for the fourth quarter and $92.8 million of net sales and 14.6

million lbs. for fiscal 2015.

Many of the Company’s value-added products enjoyed strong sales growth during the fourth quarter. On the retail side, sales

gains were led by sales of Hormel® refrigerated entrees, Hormel® pepperoni, and Hormel Gatherings® party trays. Within food-

service, sales of Hormel® Fire Braised™ meats and Hormel® pizza toppings experienced gains for the quarter. Despite robust val-

ue-added sales, overall sales declined for the fourth quarter and fiscal year due to price reductions taken on certain items in light

of lower pork markets compared to the record high pork markets in the prior year and the dissolution of the Precept Foods joint

venture at the end of fiscal 2014. Tonnage was higher in fiscal 2015, as the impact of the Porcine Epidemic Diarrhea Virus (PEDv)

in the industry reduced volumes processed through the Company’s harvest facilities in fiscal 2014.

Segment profit results for the fourth quarter were driven by strong results from Affiliated Foods, higher pork operating margins,

and the addition of Applegate on July 13, 2015. Fiscal 2015 benefitted from lower input costs. For the full year, $9.0 million of

transaction costs offset the results from Applegate.

Going into fiscal 2016, the Company is positioned to start the year with strong earnings momentum. The Company expects lower

input costs to provide a benefit for the Company’s value-added businesses, offsetting modestly lower pork operating margins

later in the year. While the Refrigerated Foods segment benefited from favorable market conditions in fiscal 2015, significant

progress has been made in the Company’s efforts to improve product mix and drive sustainable margin improvements. The

Company will also benefit from a full year of Applegate sales in fiscal 2016.