Hormel Foods 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Hormel Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

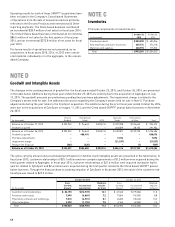

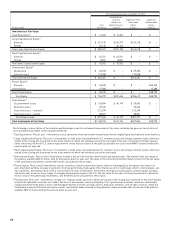

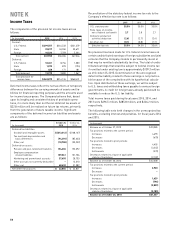

Benefi ts expected to be paid over the next ten fi scal years are

as follows:

Post-

Pension retirement

(in thousands) Benefi ts Benefi ts

2016 $ 53,515 $ 22,113

2017 55,661 22,441

2018 58,010 22,612

2019 60,934 22,711

2020 63,916 22,621

2021 – 2025 361,518 108,832

Post-retirement benefi ts are net of expected federal sub-

sidy receipts related to prescription drug benefi ts granted

under the Medicare Prescription Drug, Improvement and

Modernization Act of 2003, which are estimated to be $2.4

million per year through 2025.

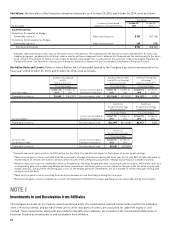

Target allocations are established in consultation with outside

advisors through the use of asset-liability modeling to attempt

to match the duration of the plan assets with the duration of

the Company’s projected benefi t liability. The asset allocation

strategy attempts to minimize the long-term cost of pension

benefi ts, reduce the volatility of pension expense, and achieve

a healthy funded status for the plans.

During 2014, the 1.7 million shares of Company common

stock held in plan assets were sold. Dividends paid during

2014 on shares held by the plan were $0.7 million.

Based on the October 25, 2015 measurement date, the

Company anticipates making contributions of $24.1 million to

fund the pension plans during fi scal year 2016. The Company

also expects to make contributions of $27.2 million during

2016 that represent benefi t payments for unfunded plans.

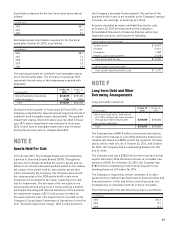

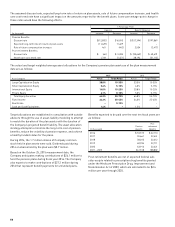

The assumed discount rate, expected long-term rate of return on plan assets, rate of future compensation increase, and health

care cost trend rate have a signifi cant impact on the amounts reported for the benefi t plans. A one-percentage-point change in

these rates would have the following effects:

1-Percentage-Point

Expense Benefi t Obligation

(in thousands) Increase Decrease Increase Decrease

Pension Benefi ts:

Discount rate $ (12,892) $ 16,810 $ (157,394) $ 197,869

Expected long-term rate of return on plan assets (11,629) 11,629 – –

Rate of future compensation increase 461 (442) 2,504 (2,417)

Post-retirement Benefi ts:

Discount rate $ (64) $ 5,035 $ (33,462) $ 40,619

Health care cost trend rate 1,749 (1,451) 38,194 (31,112)

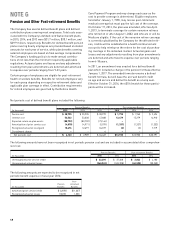

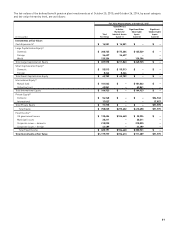

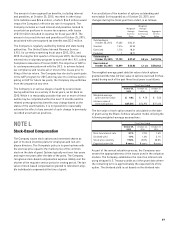

The actual and target weighted-average asset allocations for the Company’s pension plan assets as of the plan measurement

date are as follows:

2015 2014

Asset Category Actual Target Range Actual Target Range

Large Capitalization Equity 38.8% 15-35% 33.0% 15-35%

Small Capitalization Equity 5.4% 5-15% 6.0% 5-15%

International Equity 14.0% 15-25% 20.8% 15-25%

Private Equity 6.1% 0-15% 5.0% 0-15%

Total Equity Securities 64.3% 50-75% 64.8% 55-75%

Fixed Income 34.3% 25-45% 34.0% 25-45%

Real Estate – 0-10% – –

Cash and Cash Equivalents 1.4% – 1.2% –