Columbia Sportswear 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

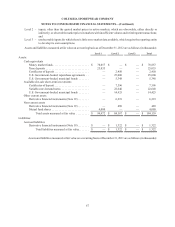

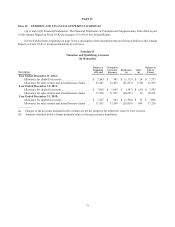

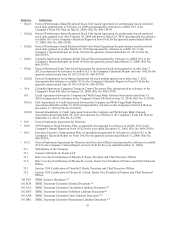

SUPPLEMENTARY DATA—QUARTERLY FINANCIAL DATA (Unaudited)

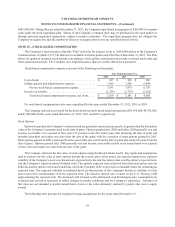

The following table summarizes the Company’s quarterly financial data for the past two years ended December 31,

2012 (in thousands, except per share amounts):

2012 First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 333,141 $ 290,357 $ 545,005 $ 501,060

Gross profit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147,936 117,868 243,685 206,905

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,898 (7,901) 64,375 39,487

Earnings (loss) per share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.12 $ (0.23) $ 1.90 $ 1.16

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.11 (0.23) 1.88 1.15

2011 First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 333,086 $ 268,030 $ 566,791 $ 526,078

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149,536 112,413 249,585 223,774

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,770 (13,558) 67,539 36,728

Earnings (loss) per share

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.38 $ (0.40) $ 2.00 $ 1.09

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.37 (0.40) 1.98 1.08

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.

Item 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Our management has evaluated, under the supervision and with the participation of our chief executive officer and

chief financial officer, the effectiveness of our disclosure controls and procedures as of the end of the period covered by

this report pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (the “Exchange Act”). Based on that

evaluation, our chief executive officer and chief financial officer have concluded that, as of the end of the period covered

by this report, our disclosure controls and procedures were effective in ensuring that information required to be disclosed

in our Exchange Act reports is (1) recorded, processed, summarized and reported in a timely manner, and (2) accumulated

and communicated to our management, including our chief executive officer and chief financial officer, as appropriate to

allow timely decisions regarding required disclosure.

Design and Evaluation of Internal Control Over Financial Reporting

Report of Management

Our management is responsible for establishing and maintaining adequate internal control over financial reporting.

All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems

determined to be effective can provide only reasonable assurance with respect to financial statement preparation and

presentation.

Under the supervision and with the participation of our management, we assessed the effectiveness of our internal

control over financial reporting as of December 31, 2012. In making this assessment, we used the criteria set forth by the

Committee of Sponsoring Organizations of the Treadway Commission in Internal Control – Integrated Framework. Based

on our assessment we believe that, as of December 31, 2012, the Company’s internal control over financial reporting is

effective based on those criteria.