Columbia Sportswear 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

60

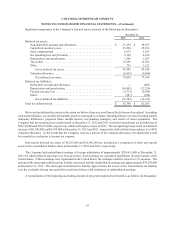

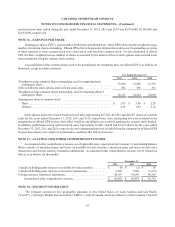

2012 2011 (1) 2010

Expected term . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.78 years 5.12 years 4.53 years

Expected stock price volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.20% 30.76% 28.79%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.88% 1.84% 1.91%

Expected dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.80% 1.31% 1.64%

Weighted average grant date fair value. . . . . . . . . . . . . . . . . . . . . . . . . . . $11.57 $16.09 $10.08

—————

(1) During the year ended December 31, 2011, the Company granted two stock option awards totaling 53,720 shares that

vest 100% on the fifth anniversary of the grant date. Because the Company did not have sufficient historical exercise

data to provide a reasonable basis upon which to estimate the expected term for these grants, the Company utilized the

simplified method in developing an estimate of the expected term of these options.

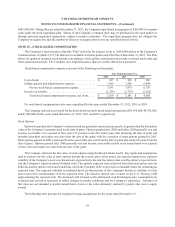

The following table summarizes stock option activity under the Plan:

Number of

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value (in

thousands)

Options outstanding at January 1, 2010 . . . . . . . . . . . . . . . . . . . . 1,760,173 $ 42.08 6.25 $ 4,599

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 385,924 44.11

Cancelled. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (77,481) 46.04

Exercised. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (196,402) 37.34

Options outstanding at December 31, 2010 . . . . . . . . . . . . . . . . . 1,872,214 42.84 6.33 33,057

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 340,973 61.38

Cancelled. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (40,396) 43.68

Exercised. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (253,695) 43.32

Options outstanding at December 31, 2011 . . . . . . . . . . . . . . . . . 1,919,096 46.05 6.25 9,141

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 358,169 48.82

Cancelled. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (172,465) 52.90

Exercised. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (380,811) 38.34

Options outstanding at December 31, 2012 . . . . . . . . . . . . . . . . . 1,723,989 $ 47.64 6.15 $ 13,001

Options vested and expected to vest at December 31, 2012 . . . . 1,672,468 $ 47.51 6.08 $ 12,808

Options exercisable at December 31, 2012 . . . . . . . . . . . . . . . . . 989,092 $ 46.09 4.63 $ 8,708

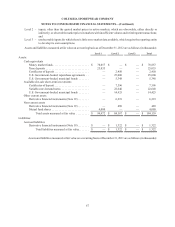

The aggregate intrinsic value in the table above represents pre-tax intrinsic value that would have been realized if all

options had been exercised on the last business day of the period indicated, based on the Company’s closing stock price on

that day.

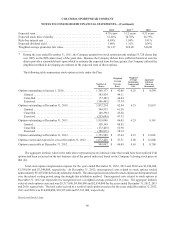

Total stock option compensation expense for the years ended December 31, 2012, 2011 and 2010 was $3,180,000,

$3,550,000 and $3,348,000, respectively. At December 31, 2012, unrecognized costs related to stock options totaled

approximately $5,407,000, before any related tax benefit. The unrecognized costs related to stock options are being amortized

over the related vesting period using the straight-line attribution method. Unrecognized costs related to stock options at

December 31, 2012 are expected to be recognized over a weighted average period of 2.16 years. The aggregate intrinsic

value of stock options exercised was $5,517,000, $4,906,000 and $2,854,000 for the years ended December 31, 2012, 2011

and 2010, respectively. The total cash received as a result of stock option exercises for the years ended December 31, 2012,

2011 and 2010 was $14,600,000, $10,991,000 and $7,333,000, respectively.

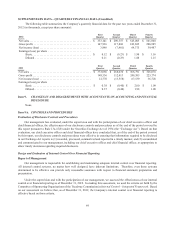

Restricted Stock Units