Columbia Sportswear 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

61

Service-based restricted stock units are granted at no cost to key employees, and shares granted prior to 2009 generally

vest over three years from the date of grant. Service-based restricted stock units granted after 2008 generally vest over a

period of four years. Performance-based restricted stock units are granted at no cost to certain members of the Company’s

senior executive team, excluding the Chairman and the President and Chief Executive Officer. Performance-based restricted

stock units granted prior to 2010 generally vest over a performance period of between two and one-half and three years

with an additional required service period of one year. Performance-based restricted stock units granted after 2009 generally

vest over a performance period of between two and one-half and three years. Restricted stock units vest in accordance with

the terms and conditions established by the Compensation Committee of the Board of Directors, and are based on continued

service and, in some instances, on individual performance and/or Company performance. For the majority of restricted

stock units granted, the number of shares issued on the date the restricted stock units vest is net of the minimum statutory

withholding requirements that the Company pays in cash to the appropriate taxing authorities on behalf of its employees.

For the years ended December 31, 2012, 2011 and 2010, the Company withheld 30,299, 48,059 and 18,721 shares,

respectively, to satisfy $1,486,000, $2,974,000 and $853,000 of employees’ tax obligations, respectively.

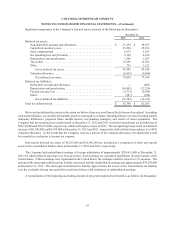

The fair value of service-based and performance-based restricted stock units is discounted by the present value of the

estimated future stream of dividends over the vesting period using the Black-Scholes model. The relevant inputs and

assumptions used in the Black-Scholes model to compute the discount are the vesting period, expected annual dividend

yield and closing price of the Company’s common stock on the date of grant.

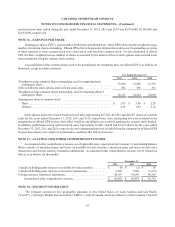

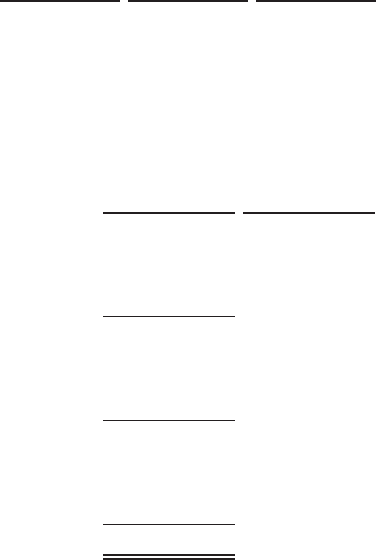

The following table presents the weighted average assumptions for the years ended December 31:

2012 2011 2010

Vesting period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.86 years 3.96 years 3.75 years

Expected dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.77% 1.33% 1.56%

Estimated average fair value per restricted stock unit granted . $46.57 $58.37 $43.95

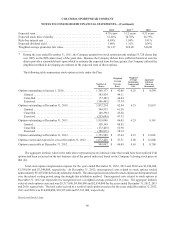

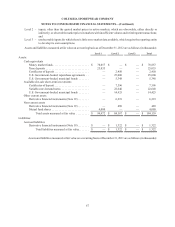

The following table summarizes the restricted stock unit activity under the Plan:

Number of

Shares

Weighted Average

Grant Date Fair

Value Per Share

Restricted stock units outstanding at January 1, 2010. . . . . . . . . . . . . . . . . . 286,520 $36.35

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 128,525 43.95

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (62,417) 42.95

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (23,833) 42.44

Restricted stock units outstanding at December 31, 2010. . . . . . . . . . . . . . . 328,795 37.63

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145,768 58.37

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (146,951) 38.01

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30,860) 41.79

Restricted stock units outstanding at December 31, 2011. . . . . . . . . . . . . . . 296,752 47.19

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 185,303 46.57

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (91,383) 42.39

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (70,114) 46.26

Restricted stock units outstanding at December 31, 2012. . . . . . . . . . . . . . . 320,558 $48.31

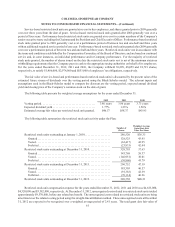

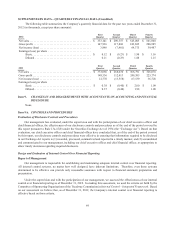

Restricted stock unit compensation expense for the years ended December 31, 2012, 2011 and 2010 was $4,653,000,

$4,320,000 and $3,382,000, respectively. At December 31, 2012, unrecognized costs related to restricted stock units totaled

approximately $9,570,000, before any related tax benefit. The unrecognized costs related to restricted stock units are being

amortized over the related vesting period using the straight-line attribution method. These unrecognized costs at December

31, 2012 are expected to be recognized over a weighted average period of 2.41 years. The total grant date fair value of