Columbia Sportswear 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

49

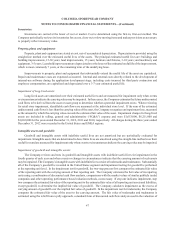

Foreign currency translation:

The assets and liabilities of the Company’s foreign subsidiaries have been translated into U.S. dollars using the exchange

rates in effect at period end, and the net sales and expenses have been translated into U.S. dollars using average exchange

rates in effect during the period. The foreign currency translation adjustments are included as a separate component of

accumulated other comprehensive income in shareholders’ equity and are not currently adjusted for income taxes when

they relate to indefinite net investments in non-U.S. operations.

Revenue recognition:

The Company records wholesale, distributor, e-commerce and licensed product revenues when title passes and the

risks and rewards of ownership have passed to the customer. Title generally passes upon shipment to, or upon receipt by,

the customer depending on the terms of sale with the customer. Retail store revenues are recorded at the time of sale.

In some countries outside of the United States where title passes upon receipt by the customer, predominantly in the

Company’s Western European wholesale business, precise information regarding the date of receipt by the customer is not

readily available. In these cases, the Company estimates the date of receipt by the customer based on historical and expected

delivery times by geographic location. The Company periodically tests the accuracy of these estimates based on actual

transactions. Delivery times vary by geographic location, generally from one to five days. To date, the Company has found

these estimates to be materially accurate.

At the time of revenue recognition, the Company also provides for estimated sales returns and miscellaneous claims

from customers as reductions to revenues. The estimates are based on historical rates of product returns and claims as well

as events and circumstances that indicate changes to historical rates of returns and claims. However, actual returns and

claims in any future period are inherently uncertain and thus may differ from the estimates. If actual or expected future

returns and claims are significantly greater or lower than the reserves that have been established, the Company would record

a reduction or increase to net revenues in the period in which it made such determination.

Cost of sales:

The expenses that are included in cost of sales include all direct product and conversion-related costs, and costs related

to shipping, duties and importation. Specific provisions for excess, close-out or slow moving inventory are also included

in cost of sales. In addition, some of the Company’s products carry limited warranty provisions for defects in quality and

workmanship. A warranty reserve is established at the time of sale to cover estimated costs based on the Company’s history

of warranty repairs and replacements and is recorded in cost of sales.

Selling, general and administrative expense:

SG&A expense consists of personnel-related costs, advertising, depreciation and other selling and general operating

expenses related to the Company’s business functions, including planning, receiving finished goods, warehousing,

distribution, retail operations and information technology.

Shipping and handling costs:

Shipping and handling fees billed to customers are recorded as revenue. The direct costs associated with shipping

goods to customers are recorded as cost of sales. Inventory planning, receiving and handling costs are recorded as a component

of SG&A expenses and were $59,212,000, $65,290,000 and $57,901,000 for the years ended December 31, 2012, 2011 and

2010, respectively.

Stock-based compensation:

Stock-based compensation cost is estimated at the grant date based on the award’s fair value and is recognized as

expense over the requisite service period using the straight-line attribution method. The Company estimates stock-based

compensation for stock options granted using the Black-Scholes option pricing model, which requires various highly