Columbia Sportswear 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

• Information technology initiatives, including our ERP implementation; and

• The unfavorable effect of foreign currency translation.

Depreciation and amortization included in SG&A expense totaled $42.9 million in 2011, compared to $37.8 million

in 2010.

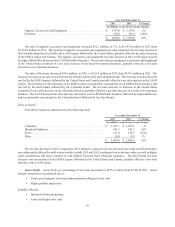

Net Licensing Income: Net licensing income increased $7.8 million, or 98%, to $15.8 million in 2011 from $8.0

million in 2010. The increase in net licensing income was primarily due to increased apparel and footwear licensing in the

LAAP region, where a third party distributor is licensed to locally manufacture Columbia brand apparel and footwear for

sale in local markets.

Interest Income, Net: Net interest income was $1.3 million in 2011, compared to $1.6 million in 2010. The decrease

in interest income was primarily driven by lower average cash and investment balances and lower interest rates in 2011

compared to 2010. Interest expense was nominal in both 2011 and 2010.

Income Tax Expense: Income tax expense increased to $34.2 million in 2011 from $27.9 million in 2010. Our

effective income tax rate decreased to 24.8% from 26.6% in 2010, primarily because we earned a higher proportion of our

income from foreign jurisdictions with tax rates that are generally lower than the U.S. tax rate.

Net Income: Net income increased $26.4 million, or 34%, to $103.5 million in 2011 from $77.0 million in 2010.

Diluted earnings per share was $3.03 in 2011 compared to $2.26 in 2010.

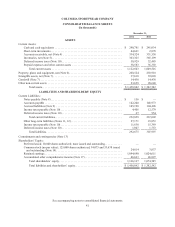

Liquidity and Capital Resources

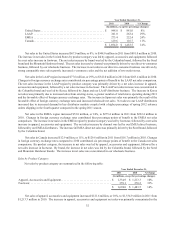

Our primary ongoing funding requirements are for working capital, investing activities associated with the expansion

of our global operations and general corporate needs. At December 31, 2012, we had total cash and cash equivalents of

$290.8 million compared to $241.0 million at December 31, 2011. In addition, we had short-term investments of $44.7

million at December 31, 2012 compared to $2.9 million at December 31, 2011. At December 31, 2012, approximately 30%

of our cash and short-term investments were held by our foreign subsidiaries where a repatriation of those funds to the

United States would likely result in a significant tax expense to the Company. However, based on the capital and liquidity

needs of our foreign operations, as well as the status of current tax law, it is our intent to indefinitely reinvest these funds

outside the United States. In addition, our United States operations do not require the repatriation of these funds to meet

our currently projected liquidity needs.

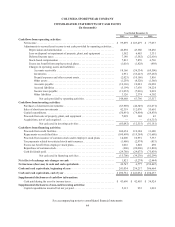

2012 compared to 2011

Net cash provided by operating activities was $148.7 million in 2012 compared to $63.8 million in 2011. The increase

in cash provided by operating activities was primarily due to decreases in accounts receivable and inventory for the year

ended December 31, 2012, compared to increases in the prior year; partially offset by a decrease in accounts payable and

accrued liabilities for the year ended December 31, 2012 compared to an increase in 2011.

Net cash used in investing activities was $85.0 million in 2012 compared to $12.5 million in 2011. For 2012, net

cash used in investing activities primarily consisted of $50.5 million for capital expenditures and $41.7 million for net

purchases of short-term investments. For 2011, net cash used in investing activities primarily consisted of $78.4 million

for capital expenditures, including the acquisition of a new distribution center and headquarters facility in Canada, partially

offset by $65.7 million for net sales of short-term investments.

Net cash used in financing activities was $15.7 million in 2012 compared to $39.2 million in 2011. For 2012, net

cash used in financing activities primarily consisted of dividend payments of $29.8 million, partially offset by net proceeds

of $13.1 million from the issuance of common stock. For 2011, net cash used in financing activities primarily consisted of

dividend payments of $29.1 million and the repurchase of common stock at an aggregate price of $20.0 million, partially

offset by net proceeds of $8.0 million from the issuance of common stock.

2011 compared to 2010