Columbia Sportswear 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This letter contains forward-looking statements. Actual results may differ materially from those projected in these forward-looking statements as a result of a number of risks

and uncertainties, including those described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, under the heading “Risk Factors.”

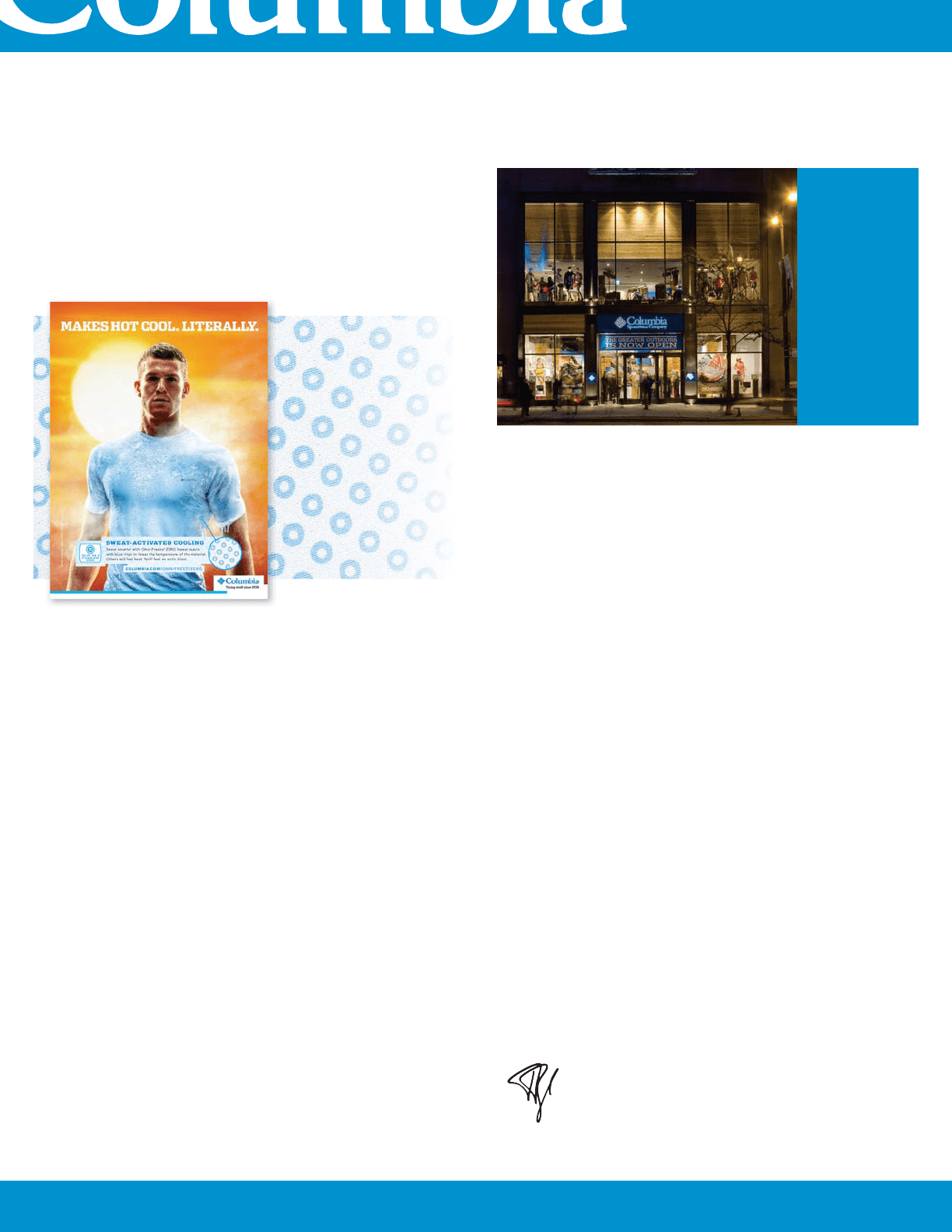

U.S. Gulf states, and in Central and South America, have embraced

PFG apparel as a leading performance and lifestyle icon. We are

very excited about the Spring 2013 global launch of our innovative,

sweat-activated, visible cooling technology - Columbia’s Omni-

Freeze® ZERO and Mountain Hardwear’s Cool.QTM ZERO. This launch

is being supported by the largest Spring advertising campaign in our

history, featuring integrated in-store, print, digital, grassroots guerilla

and broadcast elements. Omni-Freeze® ZERO and Cool.QTM ZERO

give outdoor and athletic consumers a powerful reason to seek out

our brands year-round for all of their warm climate and/or high-

intensity activities.

3. Capitalize on growth opportunities

in the LAAP region –

Sales in the LAAP region grew 11 percent in 2012, led by our

Japanese and Korean subsidiaries, as well as the efforts of our

independent distributors in Latin America and China. We expect

this region to be a continued source of growth over the next several

years. To drive growth in China, we are laying the groundwork for

a new 60/40 joint venture with our current independent distributor,

Swire Resources, Ltd., expected to commence January 1, 2014,

subject to customary regulatory approvals in China. Swire’s efforts

as our exclusive distributor over the past decade have already

positioned Columbia as a leading premium outdoor brand in this

large, growing market. As China’s economy and standard of living

have increased, so has interest in outdoor activities of all kinds. This

joint venture represents an opportunity to add another profitable

growth engine to our global business.

4. Continue to build a brand-enhancing

direct-to-consumer business –

Direct-to-consumer (DTC) sales represented approximately 29

percent of our global sales in 2012, up from 25 percent in 2011.

This part of our business comprises a growing base of branded stores

in the U.S., Korea and Japan; outlet stores, primarily in the U.S., that

help protect our brands during periods of inventory liquidation; and

localized branded ecommerce sites in 12 countries. In 2013, we plan

to add outlet stores in the U.S. and more branded stores in Japan

and Korea. Plus, the commencement of our China joint venture

in 2014 will bring almost 80 additional company-owned branded

stores into our global DTC platform. Creating pure online and brick-

and-mortar brand environments allows us to engage directly with

consumers and tell our innovation, performance and style stories,

helping to drive demand across all channels and geographies.

5. Transform our global business processes to

drive and support growth –

For us, the word “innovation” refers not only to our product and

marketing, but also to how we conduct our business, which has been

evolving rapidly as we have invested in long-term growth platforms

that are increasingly multi-channel, multi-brand and multi-national.

We continue to invest in a multi-year implementation of a new

global ERP platform, while simultaneously transforming many of

the global processes that support our business. We are investing

significant resources in this effort in order to become more nimble in

responding to market opportunities, improve delivery and customer

service, and drive profitability through better inventory management

and operating efficiencies.

We currently expect 2013 net sales to be comparable to 2012,

following two consecutive warm winters in North America and with

continued macro-economic weakness in Europe. The leadership

team remains committed to diligently managing operating expenses

while we evolve our brands, the organization and our operations to

position us for renewed growth.

However, we know that we cannot cost-cut our way to prosperity and

market leadership. We will continue to pursue growth catalysts by

investing in our brands, our products, our people and the initiatives

that we believe can grow Columbia Sportswear Company into a

much larger and more profitable business over time.

We have many tools at our disposal, starting with our brand portfolio

and our innovation platforms, all backed by a very strong balance

sheet that enables us to stay on offense through periods of slow

growth. As we approach Columbia’s 75th anniversary in 2013, we are

also mindful of the great strength of our heritage as an authentic,

innovative, outdoor company.

Thank you for your continued support.

Sincerely,

Timothy P. Boyle

President and Chief Executive Officer

Michigan Ave.

Chicago, IL

USA