Columbia Sportswear 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

One year ago on these pages, following a

record-setting warm winter and with Europe in

economic quicksand, I wrote that 2012 would

be a difficult year for top-line growth.

That turned out to be an accurate prediction, as a second

consecutive mild winter in North America and continued macro-

economic struggles across Europe offset 11 percent growth in the

Latin America/Asia Pacific (LAAP) region and held our 2012 net sales

to $1.67 billion, down 1 percent from 2011’s record $1.69 billion.

Our Columbia, Mountain Hardwear and Montrail brands each

generated 2012 sales equal to 2011; only our Sorel footwear

brand was unable to fend off the harsh effects of two mild winters,

falling 16% after growing nearly 70 percent in 2011. Disciplined

discretionary spending throughout the year enabled us to achieve

operating margins of 8.0 percent and diluted earnings per share of

$2.93, down 3 percent from $3.03 in 2011.

Despite this pause in our growth, we remain resolved to use our

powerful portfolio of outdoor brands to drive top-line growth and

improved profitability over the long term. Our primary focus is on

building the right product, positioned to appeal to a broad range of

consumers.

Dear Fellow Shareholders:

we repositioned and elevated the SOREL brand, capturing fashion-

forward female consumers and garnering distribution in premium

footwear boutiques around the world, benefiting from the brand’s

growing appeal among film and entertainment icons.

Our pace of innovation and change has been very rapid during the

past four years. We succeeded in innovating our technologies and

designs, and creating competitive advantages in the battle to offer

products that keep consumers warm, dry, cool and protected in the

outdoors – any time of year, anywhere in the world.

We believe there remains significant opportunity for growth.

Consumer adoption of our new products and brand messaging

is beginning to take hold, despite unseasonable weather that

temporarily muted demand for cold weather apparel and footwear,

and input cost pressures that worked their way through the supply

chain into retail prices, revealing additional areas of inelastic

consumer demand.

We remain committed to our strategies and intend to focus our

efforts for 2013 and beyond on a few primary initiatives:

1. Consolidate and expand our existing

innovation platforms –

The innovation platforms we’ve established help differentiate

our products from competitors’ and represent valuable growth

opportunities. Our product teams and sourcing partners are working

to engineer products that make these innovations accessible

to a broader base of consumers, while maintaining disciplined

distribution in brand-enhancing retail channels. At the same time, we

are continually refining our marketing messages and the channels

through which we communicate with consumers in order to create

awareness, demand and, ultimately, desire for our brands.

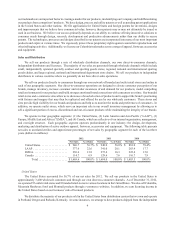

1500

2011 2012

1000

$ MILLIONS

NET SALES

500

0

$1,392 $1,391

150

2011 2012

100

$ MILLIONS

NET SALES

50

0

$142 $142

150

2011 2012

100

$ MILLIONS

NET SALES

50

0

$150 $127

9

12

2011 2012

6

$ MILLIONS

NET SALES

3

0

$10 $10

Over the past four years we’ve focused on reinforcing the Columbia,

Mountain Hardwear and Montrail brands as leading innovators in

the outdoor, alpine and running segments, respectively. We’ve

introduced numerous innovations, along with significant updates to

styling, fit, construction and marketing. Our products increasingly

target young, active core outdoor consumers who shop in leading

sporting goods, specialty outdoor, fish/hunt/camp, alpine and

running shops, and corresponding online channels. At the same time,

2. Grow our warm-weather business –

We currently generate nearly two-thirds of our annual net sales

during the second half of the year, relying heavily on winter weather

to drive consumer demand. Consumers know and trust our brands

to keep them warm and dry in winter, but less so as brands that

can keep them cool, dry and protected during their spring and

summer outdoor activities. We’re working to change that. We offer

a full assortment of lightweight layering styles that address outdoor

consumers’ needs year-round, and we are working closely with

our wholesale customers to flow those styles more consistently

throughout the year, especially during the “shoulder seasons”

of early fall and early spring. In addition, we have extended the

SOREL brand’s seasonal selling window with a strong assortment of

lightweight, less-insulated styles that address the shoulder seasons

and, over time, should help reduce reliance on winter weather. For

the spring and summer seasons, our Performance Fishing Gear (PFG)

sub-brand is our fastest growing product segment. Consumers in the