Columbia Sportswear 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

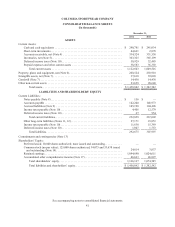

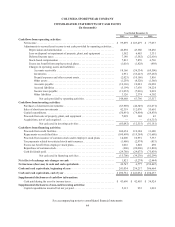

COLUMBIA SPORTSWEAR COMPANY

46

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—BASIS OF PRESENTATION AND ORGANIZATION

Nature of the business:

Columbia Sportswear Company is a global leader in the design, sourcing, marketing and distribution of active outdoor

apparel, footwear, accessories and equipment.

Principles of consolidation:

The consolidated financial statements include the accounts of Columbia Sportswear Company and its wholly owned

subsidiaries (the “Company”). All significant intercompany balances and transactions have been eliminated in consolidation.

Estimates and assumptions:

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements

and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from these estimates

and assumptions. Some of these more significant estimates relate to revenue recognition, including sales returns and claims

from customers, allowance for doubtful accounts, excess, slow-moving and close-out inventories, product warranty, long-

lived and intangible assets, income taxes and stock-based compensation.

NOTE 2—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

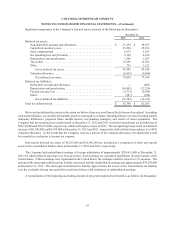

Cash and cash equivalents:

Cash and cash equivalents are stated at fair value or at cost, which approximates fair value, and include investments

with original maturities of 90 days or less at the date of acquisition. At December 31, 2012, cash and cash equivalents

consisted of cash, money market funds, time deposits, certificates of deposit, repurchase agreements and municipal bonds

with original maturities ranging from overnight to less than 90 days. At December 31, 2011, cash and cash equivalents

consisted of cash, money market funds and time deposits with original maturities ranging from overnight to less than 90

days.

Investments:

At December 31, 2012, short-term investments consisted of certificates of deposit and municipal bonds with original

maturities greater than 90 days, and variable-rate demand notes that generally mature up to approximately 35 years from

the purchase date. Investments with maturities beyond one year may be classified as short-term based on their highly liquid

nature and because such marketable securities represent the investment of cash that is available for current operations. At

December 31, 2011, short-term investments consisted of time deposits with original maturities greater than 90 days. These

investments are considered available for use in current operations. All short-term investments are classified as available-

for-sale securities and are recorded at fair value with any unrealized gains and losses reported, net of tax, in other

comprehensive income. Realized gains or losses are determined based on the specific identification method.

At December 31, 2012 and 2011, long-term investments included in other non-current assets consisted of mutual fund

shares held to offset liabilities to participants in the Company’s deferred compensation plan. The investments are classified

as long-term because the related deferred compensation liabilities are not expected to be paid within the next year. These

investments are classified as trading securities and are recorded at fair value with unrealized gains and losses reported in

operating expenses, which are offset against gains and losses resulting from changes in corresponding deferred compensation

liabilities to participants.

Accounts receivable:

Accounts receivable have been reduced by an allowance for doubtful accounts. The Company makes ongoing estimates

of the collectability of accounts receivable and maintains an allowance for estimated losses resulting from the inability of

the Company’s customers to make required payments.