Columbia Sportswear 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

51

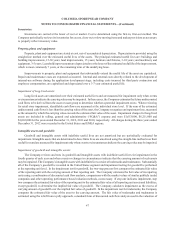

is effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012, although

early adoption is permitted. The Company does not expect the adoption of this standard to have a material effect on the

Company's financial position, results of operations or cash flows.

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts

Reclassified Out of Accumulated Other Comprehensive Income. This ASU requires an entity to disclose additional

information with respect to changes in accumulated other comprehensive income (AOCI) balances by component. In

addition, an entity is required to present, either on the face of the financial statements or in the notes, significant amounts

reclassified out of AOCI by the respective line items of net income, but only if the amount reclassified is required to be

reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety

to net income, an entity is required to cross-reference to other disclosures that provide additional details about those amounts.

This ASU is effective for interim and annual periods beginning after December 15, 2012. The Company does not expect

the adoption of this standard to have a material effect on the Company's financial position, results of operations or cash

flows, but it will require additional disclosure.

NOTE 3—CONCENTRATIONS

Trade Receivables

No single customer accounted for 10% or more of consolidated accounts receivable at December 31, 2012 or 2011.

No single customer accounted for 10% or more of consolidated revenues for any of the years ended December 31, 2012,

2011 or 2010.

Derivatives

The Company uses derivative instruments to hedge the currency exchange rate risk of anticipated transactions

denominated in non-functional currencies that are designated and qualify as cash flow hedges. The Company also uses

derivative instruments to economically hedge the currency exchange rate risk of certain investment positions, to hedge

balance sheet re-measurement risk and to hedge other anticipated transactions that do not qualify as cash flow hedges. At

December 31, 2012, the Company’s derivative contracts had a remaining maturity of approximately one year or less. The

maximum net exposure to any single counterparty, which is generally limited to the aggregate unrealized gain of all contracts

with that counterparty, was less than $4,000,000 at December 31, 2012. All of the Company’s derivative counterparties

have investment grade credit ratings and as a result, the Company does not require collateral to facilitate transactions. See

Note 19 for further disclosures concerning derivatives.

Country and supplier concentrations

The Company’s products are produced by independent factories located outside the United States, principally in

Southeast Asia. Apparel is manufactured in approximately 20 countries, with Vietnam and China accounting for

approximately 67% of 2012 global apparel production. Footwear is manufactured in three countries, with China and Vietnam

accounting for approximately 93% of 2012 global footwear production. The five largest apparel factory groups accounted

for approximately 25% of 2012 global apparel production, with the largest factory group accounting for 9% of 2012 global

apparel production. The five largest footwear factory groups accounted for approximately 79% of 2012 global footwear

production, with the largest factory group accounting for 34% of 2012 global footwear production. In addition, a single

vendor supplies the majority of the zippers used in the Company’s products. These companies, however, have multiple

factory locations, many of which are in different countries, thus reducing the risk that unfavorable conditions at a single

factory or location will have a material adverse effect on the Company.

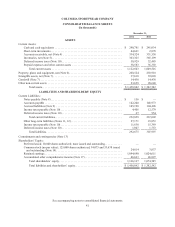

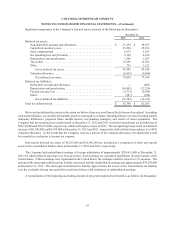

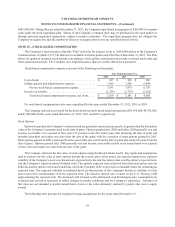

NOTE 4—ACCOUNTS RECEIVABLE, NET

Accounts receivable, net, is as follows (in thousands):