Columbia Sportswear 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

Business Outlook

The global business climate continues to present us with a great deal of uncertainty, making it more difficult to predict

future results. Factors that could significantly affect our full year 2013 outlook include:

• Unseasonable weather conditions or other unforeseen factors affecting consumer demand and the resulting effect

on order cancellations, sales returns, customer accommodations, reorders, direct-to-consumer sales and

suppressed demand in subsequent seasons;

• Changes in mix and volume of full price sales in contrast with closeout product sales and promotional sales

activity;

• Increased costs to support supply chain and information technology infrastructure investments and projects,

including our multi-year global enterprise resource planning ("ERP") system implementation;

• Our ability to implement and maintain effective cost containment measures in order to limit the growth of selling,

general and administrative (“SG&A”) expenses to a rate comparable to or lower than sales growth;

• Continued economic uncertainty, which is creating headwinds in key global markets, particularly Europe as it

relates to our EMEA direct business where we have ongoing efforts to elevate the Columbia brand;

• The rate of new store expansion in our direct-to-consumer operations;

• Changes in consumer spending activity, including consumer acceptance of increased prices of our products; and

• Fluctuating currency exchange rates.

Like other branded consumer product companies, our business is heavily dependent upon discretionary consumer

spending patterns. Continuing high levels of unemployment and concerns about potential consumer price increases in our

key markets continue to pose significant challenges and risks.

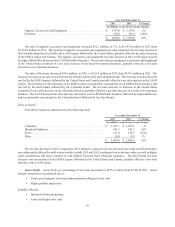

Our preliminary 2013 outlook assumes net sales comparable to 2012 net sales, including a decrease in sales in our

North American wholesale channels resulting from cautious wholesale customer purchases following back-to-back mild

winter weather in 2012 and 2011, largely offsetting anticipated expansion in our global direct-to-consumer channels and

increased sales in the LAAP region. The combination of these assumptions leads us to anticipate 2013 operating margin

ranging from 8.0 percent, comparable to the operating margin realized in 2012, to approximately 7.5 percent. We are

continuing our cost containment measures with the goal of limiting SG&A expense as a percentage of net sales.

Our previously announced joint venture in mainland China with Swire is expected to commence operations effective

January 1, 2014, subject to regulatory approval in the People's Republic of China and other conditions customary in

transactions of this size and type. During 2013, we will begin accounting for the transition to the joint venture from our

current third-party distributor relationship with Swire. We expect to fund our approximately $50 million share of joint

venture capitalization in 2013 and the early part of 2014. Our shipments of spring 2014 inventory for the China market,

anticipated to begin in the fourth quarter of 2013, will be sold directly to the joint venture entity. The related sales, gross

margin, and licensing income, which we would have recognized in the fourth quarter of 2013 under the distributor model,

will be deferred and recognized in future periods as the joint venture sells that inventory to wholesale customers and

consumers. Similarly, on or about December 31, 2013, Swire's inventory of fall 2013 and prior seasons will be transferred

to the joint venture. We will defer 2013 profits related to the inventory transferred to the joint venture and recognize those

profits as the inventory is sold by the joint venture in future periods. The actual amount of these profit eliminations and

deferrals into future periods will be dependent upon the volume of spring 2014 shipments that occur in the fourth quarter

of 2013 and the remaining balance of prior season inventory transferred to the joint venture. These adjustments are not

currently included in our preliminary 2013 outlook. As these amounts become more predictable, we will refine our 2013

outlook as part of our regular quarterly disclosures.

These factors and others may have a material effect on our financial condition, results of operations, or cash flows,

particularly with respect to quarterly comparisons.

We remain firmly committed to: