Columbia Sportswear 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Earnings per share and weighted average shares outstanding above have been restated to reflect the three-

for-two stock split that was distributed on June 4, 2001, to all shareholders of record at the close of business on

May 17, 2001.

Options to purchase an additional 8,000, 839,000 and 34,000 shares of common stock were outstanding at

December 31, 2003, 2002 and 2001, respectively, but were not included in the computation of diluted earnings

per share because their effect would be anti-dilutive.

In June 2003, the Company repurchased 234,831 unvested shares of its common stock awarded to a former

key employee under a Deferred Compensation Conversion Agreement (the “Agreement”). The repurchase cost

was approximately $498,000 and was accounted for as a reduction to shareholders’ equity. As provided in the

Agreement and because the executive’s employment terminated January 3, 2003, the unvested shares would vest

automatically unless the executive was compensated by the Company within 180 days from termination date.

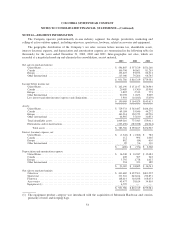

NOTE 15—COMPREHENSIVE INCOME

Accumulated other comprehensive income (loss) reported on the Company’s consolidated balance sheets

consists of foreign currency translation adjustments and the unrealized gains and losses, net of applicable taxes,

on derivative transactions. Comprehensive income, net of related tax effects, for the years ended December 31,

2003, 2002 and 2001 is as follows (in thousands):

2003 2002 2001

Netincome ...................................................... $120,121 $102,518 $88,824

Unrealized derivative holding losses arising during period (net of tax

(benefit)/expense of ($584), ($288) and $41 in 2003, 2002 and 2001,

respectively) ............................................... (2,464) (2,362) (147)

Reclassification adjustment for losses included in net income (net of tax

(benefit)/expense of ($288), $41 and ($592) in 2003, 2002 and 2001,

respectively) ............................................... 2,362 147 950

Net unrealized gains (losses) on derivative transactions ................... (102) (2,215) 803

Foreign currency translation adjustments .............................. 24,535 7,822 (1,646)

Totalcomprehensiveincome ........................................ $144,554 $108,125 $87,981

52