Columbia Sportswear 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Recent Accounting Pronouncements:

In November 2002, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No.

45, “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Others” (“FIN 45”). This interpretation elaborates on the disclosures to be made by a guarantor

in its interim and annual financial statements about its obligations under specified guarantees that it has issued. It

also clarifies that a guarantor is required to recognize, at the inception of a guarantee, a liability for the fair value

of the obligation undertaken in issuing the guarantee. The disclosure requirements in this interpretation are

effective for financial statements of interim or annual periods ending after December 15, 2002. Additionally, the

recognition of a guarantor’s obligation should be applied on a prospective basis to guarantees issued after

December 31, 2002. The adoption of this statement did not have a material effect on the Company’s financial

position, results of operations or cash flows.

In January 2003, the FASB issued FASB Interpretation No. 46 “Consolidation of Variable Interest Entities”

(“FIN 46”). This interpretation explains how to identify variable interest entities and how an enterprise assesses

its interest in a variable interest entity to decide whether to consolidate that entity. This interpretation requires

existing unconsolidated variable interest entities to be consolidated by their primary beneficiaries if the entities

do not effectively disperse risks among parties involved. Variable interest entities that effectively disperse risks

will not be consolidated unless a single party holds an interest or combination of interest that effectively

recombines risks that were previously dispersed. This interpretation applies immediately to variable interest

entities created after January 31, 2003, and to variable interest entities in which an enterprise obtains an interest

after that date. It applies in the first fiscal year or interim period beginning after December 15, 2003, to variable

interest entities in which an enterprise holds a variable interest that it acquired before February 1, 2003. The

adoption of this statement did not have a material effect on the Company’s financial position, results of

operations or cash flows.

In April 2003, the FASB issued SFAS No. 149, “Amendments of Statement No. 133 on Derivative

Instruments and Hedging Activities,” which amends and clarifies financial accounting and reporting for

derivative instruments, including certain derivative instruments embedded in other contracts (collectively

referred to as derivatives) and for hedging activities under SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities.” SFAS No. 149 is effective for contracts and hedging transactions executed

or modified after June 30, 2003. The adoption of this statement has not had a material effect on the Company’s

financial position, results of operations or cash flows.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity,” which establishes standards for how an issuer classifies and

measures certain financial instruments with characteristics of both liabilities and equity. It requires that an issuer

classify a financial instrument that is within its scope as a liability (or an asset in some circumstances). Many of

those instruments were previously classified as equity. This statement is effective for financial instruments

entered into or modified after May 31, 2003, and otherwise is effective at the beginning of the first interim period

beginning after June 15, 2003, except for mandatorily redeemable financial instruments of nonpublic entities.

The adoption of this statement has not had a material effect on the Company’s financial position, results of

operations or cash flows.

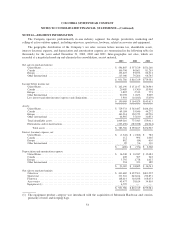

NOTE 3—ACQUISITION

On March 31, 2003, the Company acquired Mountain Hardwear, Inc. (“Mountain Hardwear”) for aggregate

consideration of approximately $36 million, including approximately $30 million in cash and $6 million of debt

assumption. Mountain Hardwear, which is based in Richmond, California, designs, develops and markets

43